The long wait is over. The Federal Reserve lowered interest rates. Here’s how to make the most of it…get bullish on technology. When the Fed cuts rates, buy semiconductor stocks. It’s an amazing time to be an investor. Markets are at all-time highs, interest rates are...

Market Podcast: September 17, 2025

9/17/2025 Navellier & Associates owns Nvidia (NVDA), in managed accounts. Louis Navellier and his family own NVidia (NVDA) via a Navellier managed account and in a personal account. Watch the Podcast on VIMEO ► Or Listen Here ► IMPORTANT DISCLOSURES This...

Market Podcast: September 16, 2025

9/16/2025 Navellier & Associates owns Hesai Group Sponsored ADR (HSAI), and a few accounts own Alphabet Inc. Class A & C (GOOGL), in managed accounts. Louis Navellier and his family own Hesai Group Sponsored ADR (HSAI), via a Navellier managed account. They...

Money Flows and Market Rallies

MoneyFlows co-founder, Lucas Downey, joins Diane King Hall on Schwab Network comparing the post-tariff rally to the post-Covid rally and highlights factors that can support the markets climb even higher. Watching Money Flows to Find Market Winners: STX, HUM & More...

9-16-25: A Widening Bifurcation of Spending Trends

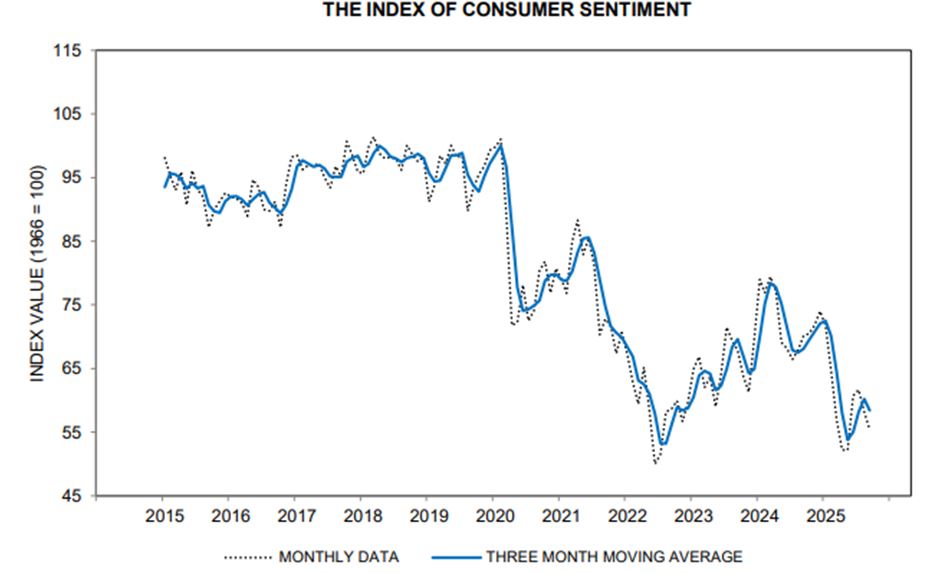

by Bryan Perry September 16, 2025 There is a classic bifurcation in market dynamics underway: a divergence between capital-intensive tech optimism and consumer-driven economic fatigue. This split is becoming more pronounced of late, and it is reshaping sector...

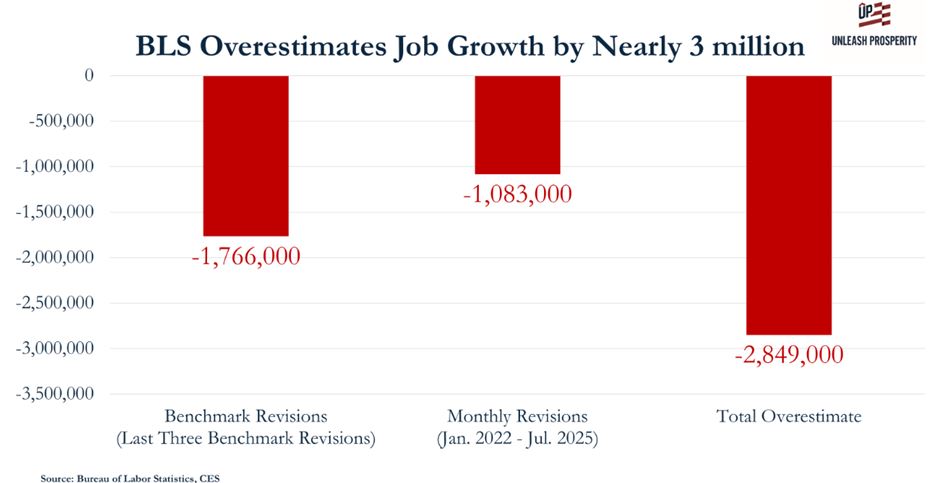

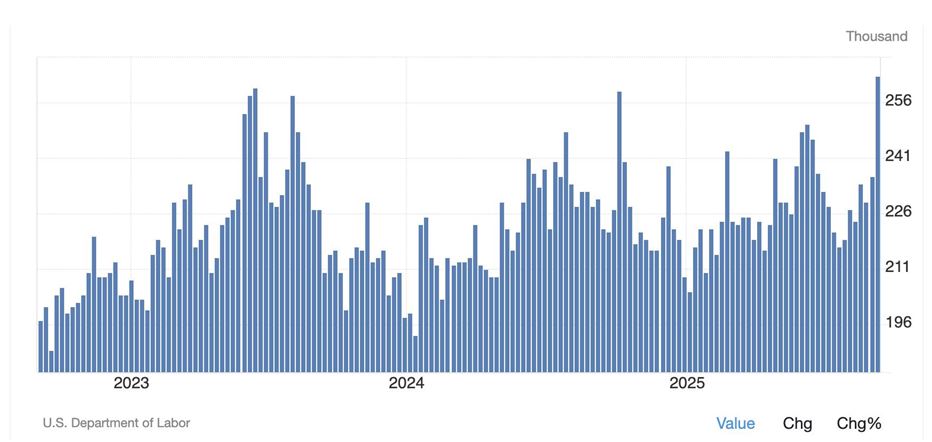

9-16-25: Why Does the Market Rely So Much on Bogus BLS Job Counts?

by Gary Alexander September 16, 2025 On Friday, September 5th, the market soared to all-time highs based on a low job count, which indicates a greater likelihood of rate cuts this week. But my question has always been: Why does the market usually make such profound...

9-16-25: Honey Thoughts

by Jason Bodner September 16, 2025 Did you know that honey never spoils? Archaeologists found honeypots in Egyptian tombs, perfectly edible after 3,000-years. Its chemistry makes it naturally un-spoilable, preserving sweetness through centuries. Markets, too, preserve...

9-16-25: S&P 6600.21

by Ivan Martchev September 16, 2025 Another all-time high a fraction of a point above 6600 and another weak Friday close for the S&P 500. Last Friday it was only marginally negative, but we have had a string of three-negative Fridays, some of them big. It used to...

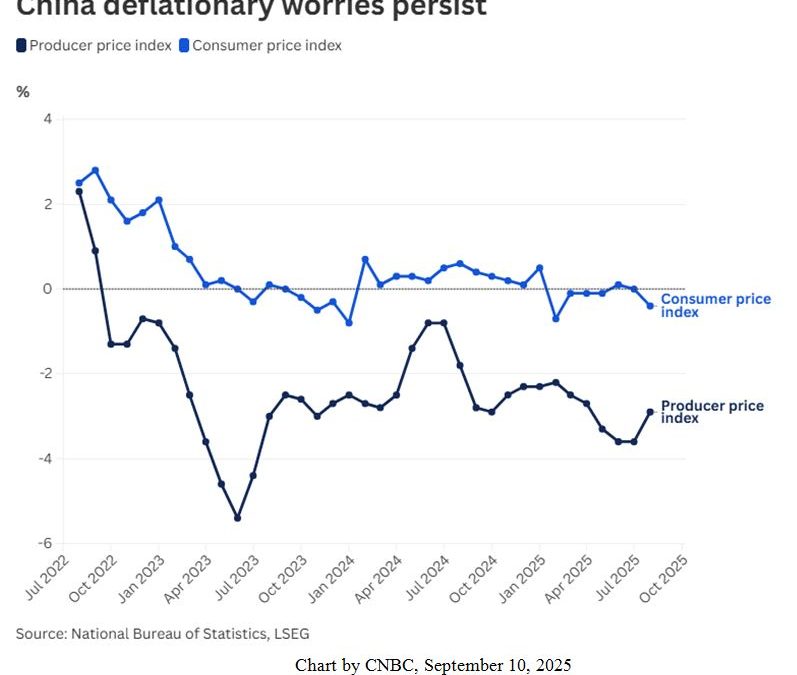

9-16-25: Continuing Deflation Could Fuel a 0.5% Fed Rate Cut Tomorrow

by Louis Navellier September 16, 2025 Producer prices in America are flat to down. That’s largely because China’s National Bureau of Statistics announced last Wednesday that its producer price index declined 2.9% in August compared to the same month a year ago, and we...