by Bryan Perry

November 11, 2025

The stock market’s price action last week was not well-defined enough to decipher what lies ahead. First, it had the makings of a tempest – headwinds, tailwinds, and heavy cross currents whipping leading names around like uprooted palm trees in a hurricane. The closing bell on Friday couldn’t come soon enough.

Let’s start with the AI trade, which talking heads love to critique, with unrelenting comparisons to the 1999 dot com bubble. From where I sit, however, the AI trade is far from over, with capex spending accelerating, not just on the data center and electric grid build-out. I see an AI rollout in its early days.

Jensen Huang, CEO of Nvidia, recently stated that China is “nanoseconds behind” the U.S. in the AI race, underscoring how narrow the technological gap has become. At the ‘Future of AI Summit’, Huang even said, “China is going to win the AI race,” sparking concern among U.S. policymakers and tech leaders.

Huang then clarified his remark, saying, “It’s vital that America wins by racing ahead and winning developers worldwide.” Huang emphasized that China’s looser AI regulations and lower energy costs are accelerating its progress, while the U.S. is constrained by fragmented regulations and export restrictions.

There is also a lot of AI-related debt being issued – about $1-trillion to date, if you count either issued or filed for issuance debt, that led to critics to call this a debt bubble that will not be able to be satisfied upon maturity dates. OpenAI issued $4-billion in conventional debt in October 2024, backed by major banks.

This latest debt round is part of a five-year strategy to fund over $1 trillion in AI infrastructure, including massive deals with Nvidia, Oracle and Broadcom. OpenAI’s debt issuance is not the largest in tech, but it is notable for its scale relative to its revenue and its role in financing long-term AI infrastructure.

OpenAI is leveraging debt alongside equity to fund massive commitments, including:

- $300-billion to Oracle for computing infrastructure

- $22-billion to CoreWeave for GPU access

- Undisclosed billions to Broadcom for custom chip-racks

These deals are part of the Stargate Project, a $500-billion data center backed by SoftBank and Oracle.

The AI race will define how global productivity is controlled and managed. The ban on exporting Nvidia’s advanced chips (like the Blackwell series) have led to a collapse in Nvidia’s market share in China, from 95% to near zero. China responded by banning foreign AI chips in government-funded data centers and ramping up domestic chip development. Nvidia’s Jensen Huang warned that losing access to Chinese developers, who represent nearly half of the global AI talent pool, could undermine America’s long-term position. AI critics do not seem to understand the immense urgency to harness and widen U.S. leadership in AI – akin to the forces of good versus evil in many aspects as to how this plays out.

The Sun.com

Wall Street will be laser-focused on Nvidia’s Data Center segment performance, Blackwell chip ramp guidance and margin sustainability in its upcoming Q3 2026 earnings report on November 19. Consensus estimates project $33-billion in total revenue, with $29-billion expected from the Data Center segment, up nearly 50% year-over-year. EPS is expected to be $1.17 per share, a 50% increase from the same quarter last year and, if history is any guide, the company will likely exceed expectations in both estimates.

The main takeaway in the AI explosion is that the moat for the biggest AI companies is getting wider, and the digestion of 2025 gains realized in the share prices of these companies is a healthy development.

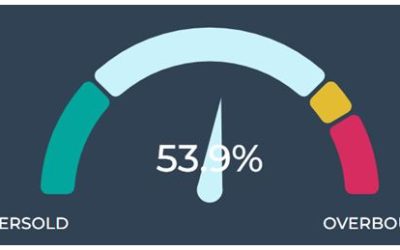

The 5.8% pullback for big tech last week took the NASDAQ 100 (QQQ) to its rising 50-day moving average on Friday. That’s when buyers and bargain hunters stepped in during Friday’s mid-afternoon to bid the mega-techs higher going into the close. If this week shows some evidence of follow-through buying pressure, last week will be looked on as a classic short-term pause that refreshes.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

The market’s correction and weaker private jobs data struck a blow to consumer sentiment. The University of Michigan Consumer Sentiment Survey for November came in at 50.3, the second lowest reading since 1978 and a 6.2% drop from October’s reading. Going back further, that’s a staggering 30% decline year-over-year. Clearly the advance of AI has stoked job security fears in many industries.

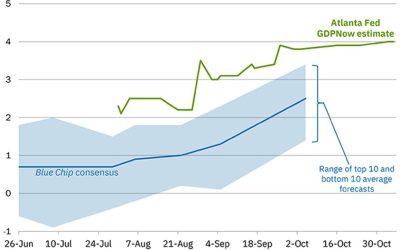

On the positive side, the ISM Services index for October came in strong, after a flat September. New orders and business activity surged, reinforcing the resiliency of the service sector, vital to GDP growth.

Bitcoin and other cryptocurrencies fell hard, along with NASDAQ, supporting the case that Bitcoin is not digital gold. Bitcoin fell from $125k to $100k in the last 30-days; it is seen as a risk-on asset and should be treated as such, even though stable-coins are making inroads into government and corporate finances.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

The U.S. Dollar Index (DXY) met resistance at 100.25 and retreated, putting a fresh bid under gold.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

The benchmark 10-year Treasury also ran into overhead resistance on the strong ISM Services data, with both manufacturing and services sectors expanding modestly. The J.P. Morgan Global Composite PMI held at 52.4, signaling continued global growth despite regional divergences and trade headwinds.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

Turning to earnings, FactSet Earnings Insight reported on Friday, November 7 that for Q3 2025 (with 91% of S&P 500 companies reporting actual results), 82% of S&P 500 companies reported a positive EPS surprise and 77% of S&P 500 companies reported a positive revenue surprise. FactSet further notes:

- Earnings Growth: For Q3 2025, the blended (year-over-year) earnings growth rate for the S&P 500 is 13.1%. If 13.1% is the actual growth rate for the quarter, it will mark the 4th consecutive quarter of double-digit earnings growth for the index.

- Earnings Revisions: On September 30, the estimated (year-over-year) earnings growth rate for the S&P 500 for Q3 2025 was 7.9%. Ten sectors are reporting higher earnings today (compared to September 30) due to positive EPS surprises.

This data is kind receiving an early Christmas gift, demonstrating how strong the third-quarter reporting season has been. And when the dust settled last Friday, most of the risk assets that investors were chasing during October have backed and filled most of the technical gaps while providing attractive entry points.

Strong earnings create a beautiful set up for the S&P to trade up to 7,000 before year-end.

It looks like “Jingle bells, Jingle bells, Jingle all the way.”

Navellier & Associates; own Nvidia (NVDA), Broadcom Inc. (AVGO) and Oracle (ORCL), in managed accounts. We do not own CoreWeave (CRWV). Bryan Perry owns personally.

The post 11-11-25: Musings from a Mixed-Up Early November Market appeared first on Navellier.