by Jason Bodner

October 28, 2025

Deep in the Chilean desert sits the Atacama Large Millimeter Array, 66-radio telescopes listening to space. What fascinates scientists most isn’t the noise; it’s the silences in between the noise.

In the same way, pauses in the market’s rhythm often reveal secrets. We’re in such a pause now.

The Big Money Index (BMI) is drifting lower. The BMI is our money flow index that measures all unusual inflows and outflows over a 25-day period. What we see looks suspiciously like deterioration.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

While the BMI is sensitive to big inflows or outflows, it is also sensitive to a lack of signals – the sound of silence. That’s why I’m not concerned: The action under the surface is strong. As the above chart shows, a recent wedge pattern reflects a spike in outflows and, since October 10, fewer inflows.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

If we start reaching more new highs, which I expect, we’ll see more inflows and a lifting BMI. While we are just entering Q3 earnings season, I suspect that earnings beats will continue propelling stocks higher.

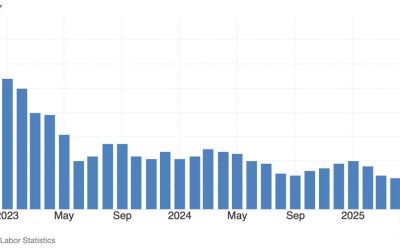

There’s more evidence of a solid base in ETF flows. Since May 12th, when President Trump paused the tariff deadlines, there have essentially been only inflows:

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

ETFs are a great measure of healthy fund flows, as ETFs give managers broad exposure to sectors and themes through baskets of related stocks and assets. The ETF takeaway is clear: It’s been one-way, toward risk on. Even in the recent air pocket, there weren’t many noteworthy outflows.

When we look at elevated trading volumes, we see that breadth is healthy and within normal ranges.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

With stocks near all-time highs, a risk-on attitude in the preferred instruments of retail managers, and very few outflows, the structure of the stock market is in great shape.

To continue our assessment of underlying market conditions, let’s look at how those flows have been distributed. Since October began, we’ve seen some distribution, but inflows still outnumber outflows, at 58%. Of those inflows, 83% are in small-cap and mid-cap stocks. These have been the dominant beneficiaries since May 12th. In fact, 83% of all inflows since then have been into stocks $50-billion and below.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

The distribution of flows by market cap confirms that the market’s underlying structure is very strong. Unusually large inflows into small-cap and mid-cap stocks doesn’t spell disaster – it spells growth.

Let’s take it further and look at how these flows have spread across sectors. Since October began, flows have gone into healthcare, technology, industrials, and financials.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

Financials have seen the highest outflows so far. Remember the credit scare from exposure to bad loans? That fear lasted only a few days. Compare the last month of sector behavior to the same post-tariff delay: Buying has been dominated by technology, healthcare, financials, industrials, and discretionary stocks.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

Since May, money has been gushing into strong growth sectors and particularly into small-cap and mid-caps. That’s bullish. October has given us a pause, but the underlying diagnostics show strength and structure.

Inflows over the last week reinforce that view. We’ve seen inflows into high-quality healthcare stocks, technology, and industrials — sectors packed with growth companies – and the quality of stocks is also high.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

Now, let’s look at the sectors themselves. Eight of the 11 S&P sectors are at or near highs. Utilities have gone parabolic, primarily due to the narrative of the AI revolution running out of power. That sector behavior is usually associated with defensive investor behavior, but that’s not the case here:

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

In sector rankings according to MoneyFlows, strong sectors dominate the top spots: technology, healthcare, and industrials. I’d love to see discretionary rise in the rankings, and I suspect we will, going into year-end.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

The spike in outflows hit financials, discretionary, energy, and industrials. They all occurred on October 10th and seem contained to that one day. That indicates a momentary fear-driven distribution, or perhaps a larger fund liquidation. Leave that day out and things look great. Leave it in, and we’re still doing well.

I would like to get back to earnings. I keep mentioning macro tailwinds, and earnings is one of them. Q2 earnings saw a record 81% of the S&P 500 beat sales and earnings – well above the 10-year average.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

We’re still in the early innings, but Q3 earnings are following suit. With 12% of S&P 500 companies reporting results, 86% beat EPS and 84% beat revenue. The blended year-over-year earnings growth rate for the S&P 500 is 8.5%. If it stays that way, it would be the ninth straight quarter of earnings growth.

The Big Beautiful Bill is providing lower taxes, and interest rates are falling. Companies don’t even need to beat sales to expand their bottom lines in those conditions – but they are.

The S&P 500 P/E ratio may seem elevated, but it can fall with lower prices or higher earnings. Add to all this a record, $7.5-trillion hiding in money markets in a falling rate environment, and this all seems like a setup for continued bullish conditions for stocks.

As physicist Richard Feynman once said, “Nature uses only the longest threads to weave her patterns, so each small piece reveals the organization of the whole tapestry.” Each signal, each pause, each October wobble, is a thread in the larger design – one that, over time, keeps weaving its way higher.

The post 10-28-25: Is This an “Ominous Silence – or “The Pause That Refreshes?” appeared first on Navellier.