by Gary Alexander

October 28, 2025

Last week, I reviewed Andrew Ross Sorkin’s fine history of 1929. The core of his book is the drama that unfolded during the last week of October that year. Sorkin crafts about 50-captivating pages of war-like attacks on stock values from October 24 to 30, 1929. First, on Black Thursday (the 24th), the Dow was down 11% in early trading. In the weekend Saturday Evening Post, Edwin Lefevre wrote that Wall Street housed “dying men counting their own last pulse beats.” There were no bids – until a miracle happened:

In a classic deux ex machina finale to the day, a leading icon of Wall Street traders, Richard Whitney, Vice President of NYSE and a key J.P. Morgan broker, shouted, “10,000 shares of Steel at $205” ($10 a share above the last bid), and the market recovered, many thinking the worst was over. There was some hope over the weekend, but Monday opened in a bloodbath and Tuesday fell without end. By November 13, the market was off 48% in two-months, causing $50-billion in losses, equivalent to half 1929’s GDP.

Once again, it’s Halloween Week in the haunted halls of Wall Street. Today’s date, October 28, 1929, was actually the worst day in market history – until 1987 – but it didn’t even earn a “Black” nickname in its day, since it was trapped between the more famous Black Thursday (October 24) and Black Tuesday, October 29, but Monday that week was the worst day ever in the Dow index – until the Black Monday many of us endured struck in 1987. That was the worst-ever one-day Dow drop (-22.6%), but back-to-back Black days in the 1929 crash totaled a 23% loss, with the Dow dropping from 299 to 230 in two-days. Here is a list of the four worst Dow Days ever recorded:

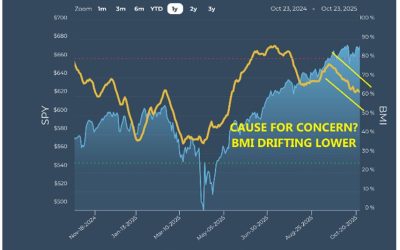

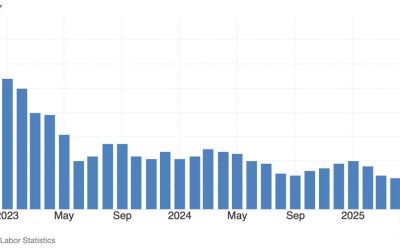

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

There was a recovery after Black Tuesday, as in most other panics. The day after Black Tuesday, the Dow rose 12.34%, its best one-day percentage gain ever, making up for nearly all the Black Tuesday losses, and by April 17, 1930, the Dow was back to 294, a whisker below its high before Black Thursday.

That’s a 48% gain in five months, but then a much bigger crash came in the 26-months ending mid-1932, after which the positive spirit of FDR’s first term made 1933 the best market year of the last century, and fueled a remarkable Dow rise of 372% from the week of FDR’s nomination to the end of his first term.

The Fed and Politicians (Not Stock Speculators) Created The Great Depression

“Regarding the Great Depression. You’re right, we did it. We’re very sorry. But thanks to you, we won’t do it again.” – Ben Bernanke in a tribute to Milton Friedman on his 90th birthday in 2002

There is virtually no link between the Crash of 1929 and the Great Depression of the 1930s. Twice in the previous generation (and twice recently) we’ve seen near-50% market declines with no long depression in its wake. This includes the Panic of 1907 (after a 48.5% Dow drop) and the sharp depression of 1920-21 (after a 46.6% Dow drop). More recently, we saw a 49% drop in the S&P 500 from 2000 to 2002 and a 57% drop in the S&P 500 from 2007 to 2009, but a strong five-year bull market in between, and a record-long 11-year bull market after 2009, interrupted only by the short, sharp 34% CoVID crash in early 2020.

History shows that most market panics last a short time before the next boom begins, but not so in 1930. Why not? Basically, the Fed was young and untested and, at times, clueless about how to end a panic.

The Fed was only 15 years old in 1929. In 1920, the Fed’s first (and some say best) Governor, Benjamin Strong (serving from 1914 to 1928) helped turn a similar crash into a short, cleansing process, leading into the Roaring 20s, but Strong died in 1928 and his successors made all the wrong moves, fueling the mania at first, then throttling the early 1930s recovery by sharply reducing money supply. In short, the main cause of the Depression was a huge decrease in money supply by the Fed, plus politically motivated tariffs in mid-1930, which exported our crash overseas, primarily to Europe, causing the rise of Hitler and other despots. Apparently, the Fed wanted to cut off market speculation by sopping up excess liquidity.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

In their 1962 book, “A Monetary History of the United States,” Milton Friedman and Anna Schwartz argued that U.S. money supply plummeted by a third between 1929 and 1933, creating a “Great Contraction,” leading directly to widespread bank failures. This misguided Fed policy led to deflation, increased debt burdens and reduced economic activity, turning a market correction into a Depression.

Specifically, Friedman and Schwartz documented the U.S. money supply fell by more than one-third, from billion in June 1930 to $29-billion in March of 1933. The Federal Reserve’s web page on “Federal Reserve History” agrees: “From the fall of 1930 through the winter of 1933, the money supply fell by nearly 30 percent. The declining supply of funds reduced average prices by an equivalent amount. This deflation increased debt burdens; distorted economic decision-making; reduced consumption; increased unemployment; and forced banks, firms, and individuals into bankruptcy.”

In 2002, the Fed honored Friedman on his 90th birthday with a tribute to his historical analysis. At the University of Chicago, future Fed Chair Ben Bernanke, then a Fed Governor, paid Friedman this tribute at the end of his talk: “Let me end my talk by abusing slightly my status as an official representative of the Federal Reserve. I would like to say to Milton and Anna: Regarding the Great Depression. You’re right, we did it. We’re very sorry. But thanks to you, we won’t do it again. Best wishes for your next 90-years.”

Sorkin’s “1929” book does not address this link. In his book, Sorkin devotes over 30-pages to an Epilogue and Aftermath of the Crash, without making these links to the Fed’s role in the crash and Depression. The Fed could have prevented deflation and massive bank failures by keeping liquidity level or gently rising.

Milton Friedman once suggested that the Fed could be replaced with a computer program that maintains a predictable amount of money, steady and reliable. Today, that could be done by “AI.” It’s worth a try.

The post 10-28-25: Happy 96th Birthday, “Black Tuesday” – Please Don’t Come Back! appeared first on Navellier.