by Bryan Perry

October 21, 2025

Last Monday, October 13, Bloomberg reported that China instituted sanctions against U.S. units of a South Korean shipping giant and then threatened further retaliatory measures on U.S. trade. While China had earlier signaled it was keeping its communications channels open, this marks the latest in a series of tit-for-tat moves between China and the U.S., as Beijing and Washington jockey for leverage before expected trade talks.

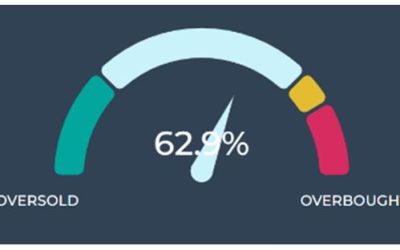

Third-quarter earnings season kicked off as the big money center banks delivered strong top- and bottom-line results, paving the way for what should be a solidly bullish reporting season. Investors are buying on dips, a strong indicator. This buying continues even as there are some disconcerting issues overhanging the market.

Selling pressure hit the big private equity firms, business development companies (BDCs) and regional bank stocks, stemming from private credit and loan write-offs that stoked fears of systemic trouble in the private credit space, recalling the 2023 regional bank crisis when Silicon Valley Bank collapsed on March 10, 2023, triggering a broader crisis.,

Market participants fear that “Where there is smoke, there is fire.” The pattern is always the same. The early signs – unusual losses, deposit flight and panic – are the smoke. The fire? A full-blown banking crisis that takes down multiple institutions that require emergency action by the Federal Reserve and the Treasury Department.

Jamie Dimon recently warned that credit risks are like cockroaches: “If you see one, there are probably more.” He said this after JPMorgan took a $170 million hit from the bankruptcy of subprime auto lender Tricolor.

The private credit market is valued at $3 trillion, or roughly 10% of annual U.S. GDP, so it is a very big deal if this sector starts moving in the wrong direction. As of Friday, several “experts” in the space stated that the past two weeks’ problems were isolated incidents rather than the beginning of a trend. Only time will tell, but it won’t take many more credit collapses to trigger a “sell first, ask questions later” investor reaction.

Another nagging and growing concern is the length of the U.S. federal government shutdown, which has been in effect since October 1, 2025, and is now the third-longest shutdown in modern history. Congress remains deadlocked, with no resolution in sight, or expected in the near term. Congress failed to pass appropriations for the 2026 fiscal year due to partisan disputes over health insurance subsidies, foreign aid and spending levels.

Many Republicans call it the “Schumer Shutdown,” accusing him of prioritizing politics over governance.

Democrats demand permanent extension of Affordable Care Act tax credits, while Republicans want to separate health care from 2026 budget negotiations. For his part, President Trump has used executive orders to keep paying military personnel, but most federal workers remain unpaid in last week’s mid-October pay cycle.

The shutdown impacts about 900,000 furloughed workers, of which 700,000 are working without pay. Essential services, like the military, TSA and law enforcement, are still operating, while suspended agencies include NIH, CDC, WIC, and parts of the Army Corps of Engineers. Social Security, Medicare and Medicaid are also active.

Odds of resolution are low in the short term, suggesting the shutdown may extend into mid-November. From a historical context, if it lasts until November 5, it will become the longest government shutdown in U.S. history (surpassing the 35-day shutdown of 2018–2019), but at present the market does not care about the shutdown.

Most investors are more concerned about the market’s anxiety regarding the “debasement trade,” which is rooted in the fear that the federal government’s continuing fiscal irresponsibility will erode the value of traditional currencies, especially the U.S. dollar, over the long term. This “debasement trade” is an investment strategy in which investors move capital out of assets tied to government promises (like fiat currencies and sovereign debt) and into hard assets, like gold, which have a finite supply to protect their purchasing power.

Key concerns driving this trade and its impact on markets include excessive government debt and deficits. Persistent, high levels of government borrowing are leading investors to believe that policymakers will eventually choose to let their currency’s value decline to reduce the real burden of the debt service.

The core belief is that ongoing government borrowing, and money creation will undermine the long-term value of the dollar and other major currencies, leading investors to seek alternative stores of value.

While gold, silver and Bitcoin are clear beneficiaries, the U.S. stock market has also seen long-term buying, with some analysts arguing that the record-setting asset prices are as much a byproduct of a weakening dollar as they are of genuine value creation. While there might be some credence to this line of thinking, the stock market is more focused on two major catalysts – the next Fed rate cuts and AI Capex spending by S&P 500 companies.

Given the new sources of “noise” from some failing private credit, the government shutdown and stalled trade deals with China, India, and Brazil, bullish market momentum is being broadened-out to include other sectors, outside of mega-tech. Traders are laser-focused on the next three weeks of third-quarter reporting season from America’s premier corporations. The financial media will stoke as much fear as possible, but there is a higher probability of a market melt-up going into year-end, based on strong corporate guidance and lower interest rates.

“Stay low and keep moving” is a widely used military phrase that emphasizes tactical survival techniques: You minimize exposure and maintain momentum under threat. The battle plan for investors should be similar: Stick with stocks where institutional fund flows are prominent. Pay attention to technical analysis, cut losses on any real bad news but let your profits run in winning stocks. In “interesting times,” be proactive and not passive.

Navellier & Associates; own JPMorgan Chase & Co. (JPM), in some managed accounts. Navellier does not own Tricon Capital (TCN). Bryan Perry does not personally own JPMorgan Chase & Co. (JPM), or Tricon Capital (TCN).

The post 10-21-25: Measuring the Market’s Pros and Cons on the Anniversary of the 1987 Crash appeared first on Navellier.