by Ivan Martchev

October 14, 2025

For most of the last six-months, it was kind of nice to not see aggressive presidential tweets in the middle of the trading day, but the trade war is not over yet, and (as I have written here before), I never thought the Chinese were negotiating in good faith. All we need to do is look at the deals China made in the first Trump administration to see that they hardly ever keep their promises. So, when President Trump threatened to slap 100% tariffs on China for their choke-hold on rare-earth metals, all I can say is that the Chinese probably expected a response like this, and they will now likely have an escalation of their own.

This puts us back into a cycle of acrimonious recriminations, where national leaders keep slapping each other with astronomical tariffs. Until that cycle runs out and there is some rapprochement between the U.S. and China – most likely, another Scott Bessent meeting, similar to what we saw in May in Geneva – it is highly unlikely that the S&P 500 will make any significant gains. Since I don’t think this tariff situation will be resolved quickly, this likely means a real correction, and not just a sharp pullback.

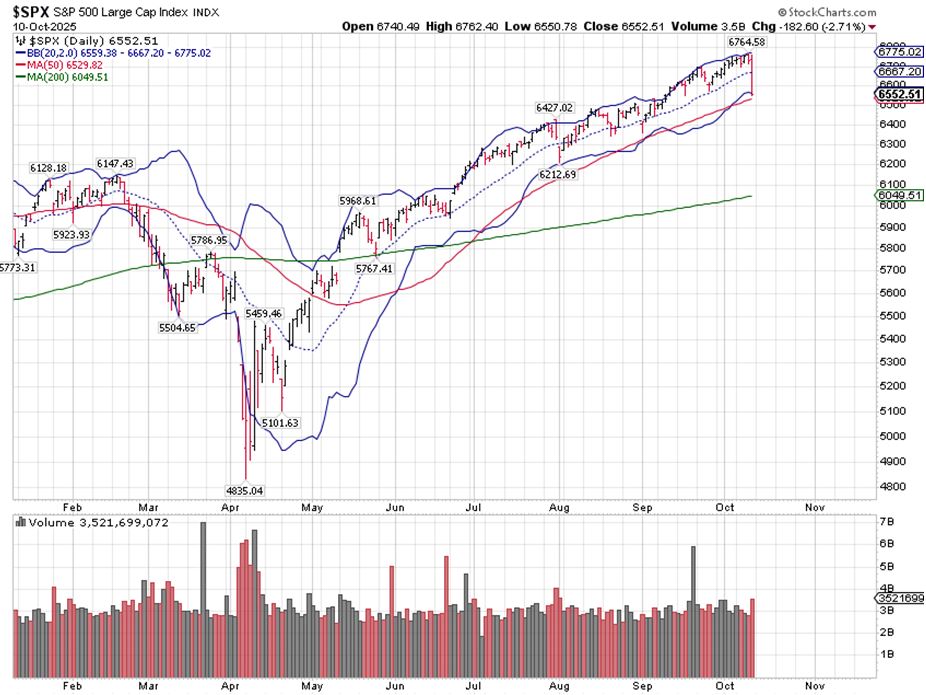

How big can a “real correction” be? Nobody knows for sure ahead of time, as it depends on events that haven’t happened yet, but based on the S&P Futures, Friday’s decline was almost as large as any pullback since late April (but in one day). If the Chinese situation is not resolved this week – and I don’t think it will – the S&P 500 is likely headed to the vicinity of its 200-day moving average which is near 6,000 (in the green line, below). That would be about the size of a normal correction, not the start of a bear market.

I don’t believe this correction will turn out to be a real bear market, as China has always been a potential problem, and the Trump administration has already made plenty of big trade deals.

Turning to the technical side, the S&P 500 rallied about 40% (low to high) without ever touching its lower Bollinger band, which is set at two standard deviations below a 20-day moving average – the same as the upper band, which is two standard deviations above that average (see blue bands, below).

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

Friday’s move is extraordinary. The S&P came close to that lower Bollinger band on the first trading day in August but never touched it. Last Friday, we actually closed below that level. Technically, this one day of trading was a five-standard deviation move – the width of the two bands – plus what we saw after the cash market closed at 4.50 pm: The S&P futures declined significantly more when the actual 100% tariff rate was announced “starting November 1st, 2025 (or sooner, depending on any further actions or changes taken by China),” as the President wrote in a tweet. One could read this as the U.S. trying to resolve the situation by November 1st without actually slapping the new tariff, which would be a best-case scenario

The decline in S&P 500 Index (which everyone sees) was 182-points, but the decline in the S&P 500 futures – which few individual investors see – was 227-points. If we take the futures decline in points and take the value of one S&P 500 Index point as worth $8.45-billion, the decline was 227-times $8.45- billion = $1.918-trillion. That comes close to a $2-trillion market value decline, based on two presidential tweets.

I don’t know why the Chinese have decided to handle trade with America this way, but since they are the original disciples of General Sun Tzu (544 – 496 BC), we know that Sun Tzu said, “All battles are won before they have been fought.” Clearly, Xi Jinping thinks China can win that way. I do not believe the Trump administration has any illusion that the Chinese will be as easy to make a deal with, as the EU was, so this could be a fascinating sword fight, metaphorically speaking, with China’s Sun Tzu disciples.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

From a weekly perspective, we see what the Japanese call a “bearish engulfing pattern.” The high of the week is above last week’s high and so is the open. The low of the week is way below last week’s low, and so is the close. The last time we had a bearish engulfing pattern on a weekly basis was on August 1st, but nothing came of it. We saw a sharp pullback, but not a correction. The last time we had a bearish engulfing pattern on a weekly basis that led to a correction was mid-July 2024, which did lead to a decline in the vicinity of the 200-day moving average. That was part of the infamous “yen carry trade unwind.”

We don’t have a yen carry trade now, but we do have a trade war. The reason why I think this will be a correction, not a pullback, is that the Chinese have planned their strategy and that strategy is not to fold immediately when President Trump hits them with a 100% tariff threat. There will be some response from the Chinese, and it won’t be nice, most likely coming in November, if the new tariff goes into effect.

Luckily, we have a very smart top trade negotiator in Scott Bessent, who strikes me as one familiar with the wisdom of general Sun Tzu, who also said, “If you know the enemy and know yourself, you need not fear the result of a hundred battles. If you know yourself but not the enemy, for every victory gained, you will also suffer a defeat. If you know neither the enemy nor yourself, you will succumb in every battle.”

I can see the stock market rebounding after such fierce selling, but I cannot see this market holding on to its gains unless the Chinese trade situation is resolved, which, based on their trade negotiations in the first Trump administration and since April of this year, is unlikely to be quick.

The post 10-14-25: Two Tweets Totaling $2-Trillion (aka, “the Sun Tzu Sell-Off”) appeared first on Navellier.