by Gary Alexander

September 30, 2025

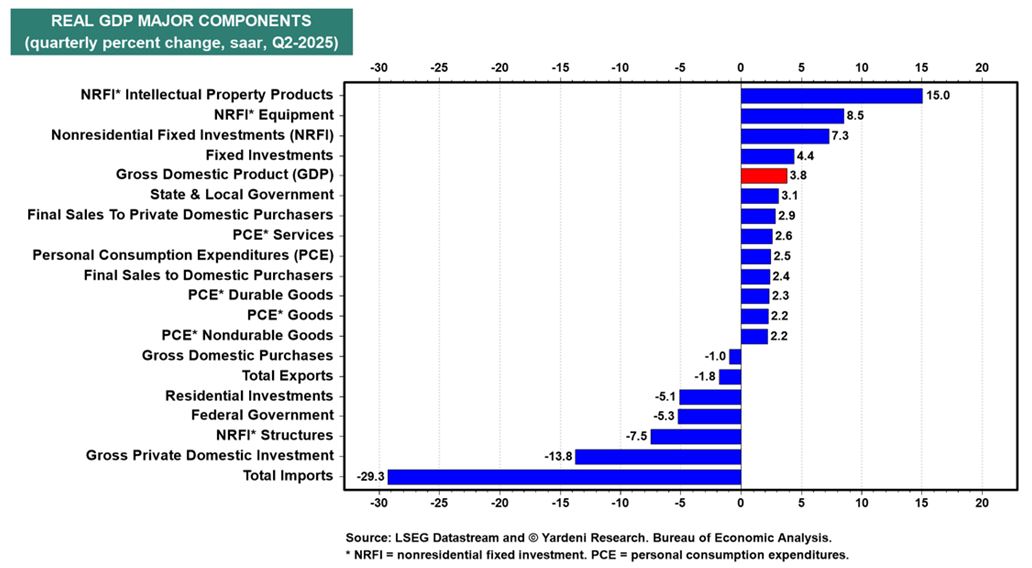

Last week’s third and final estimate of the second-quarter real GDP growth rate rose fairly dramatically, from 3.3% to 3.8%, confirming that the economy is in good-to-great condition. Most notably, I’d say, the consumer is still shopping, big-time, as real consumer spending was revised up from 1.6% to 2.5%.

Here are some of the major winning (and some losing) components of 2Q GDP, thanks to Ed Yardeni.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

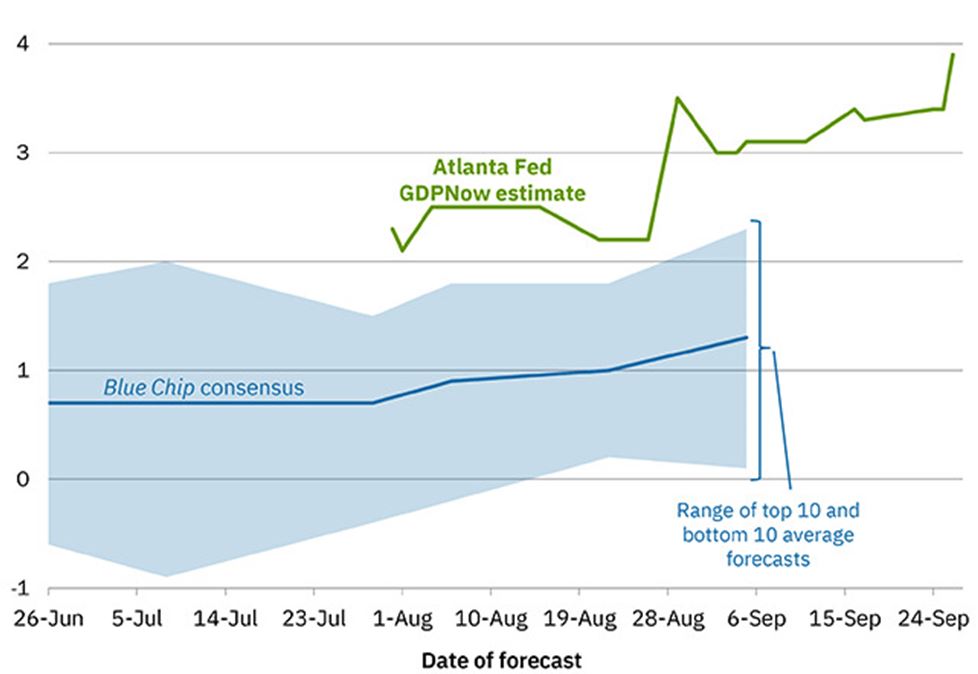

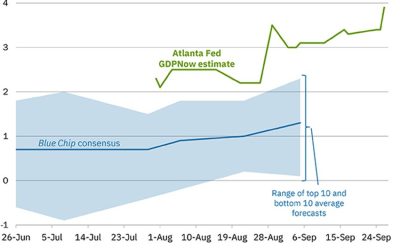

Fixed investments in intellectual property (IP) were up the most (+15%) while imports were down the most (-29%), partly due to the imposition of higher (but temporary) tariffs on some trading partners,Moving ahead to the current (third) quarter, ending today, the Atlanta Fed’s model, GDPNow, estimates a continuation of the second quarter’s torrid pace, at +3.9%, up from a 3.3% estimate earlier last week.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

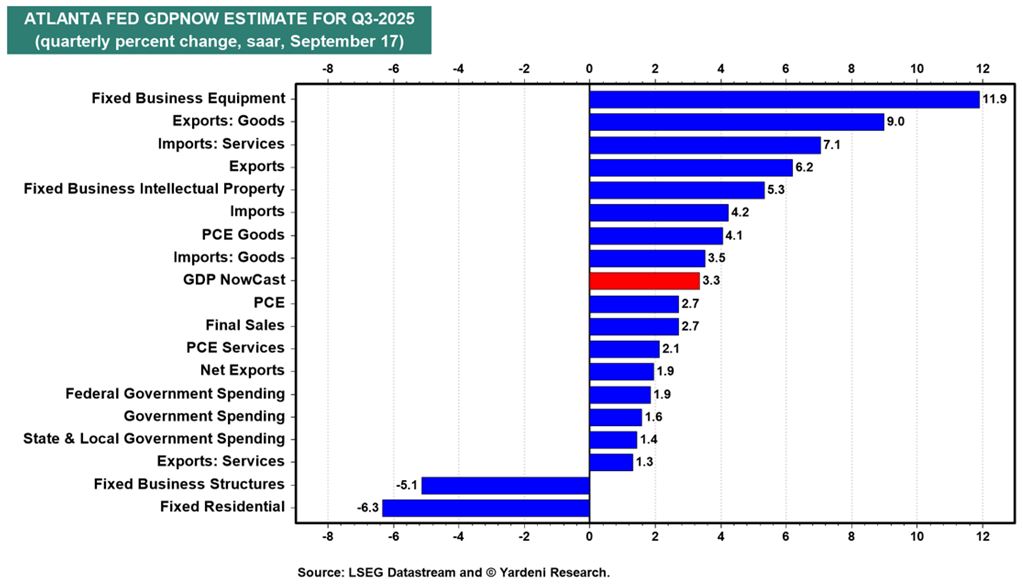

Looking at the leading component from the Atlanta Fed, we see fixed business equipment rising the most (nearly 12%), while fixed residential and business structures were the main drag, down 5% to 6%.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

This sudden upward revision in real GDP growth in two consecutive quarters – combined with the recent downward revisions in employment – implies that productivity growth is fueling this surge. The Fed cut rates due to a weakness in the labor market rather than high growth or high inflation, but this latest wave of decline in new jobs seems to stem mostly from productivity growth – replacing humans with bots.

Bottom line, the Fed’s easing can’t “save” the jobs market, but it could fuel a stock market melt-up.

For a “Happy New (Fiscal) Year” in 2026,

Congress Needs to Grow a Spine over Spending Cuts

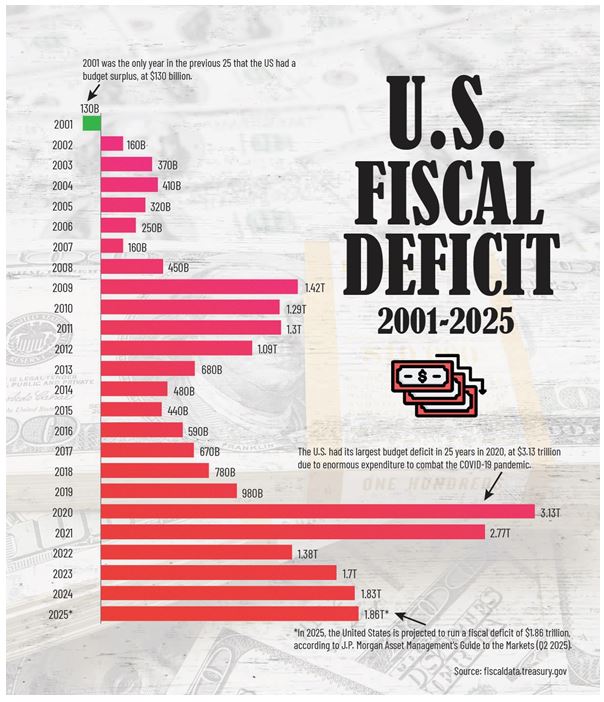

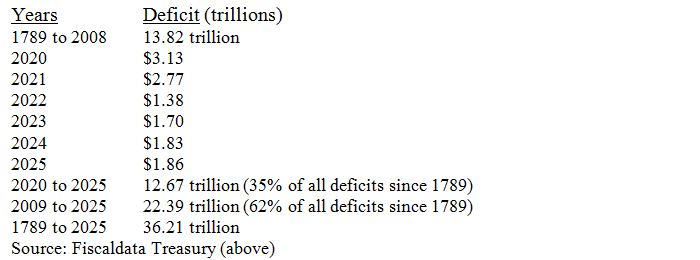

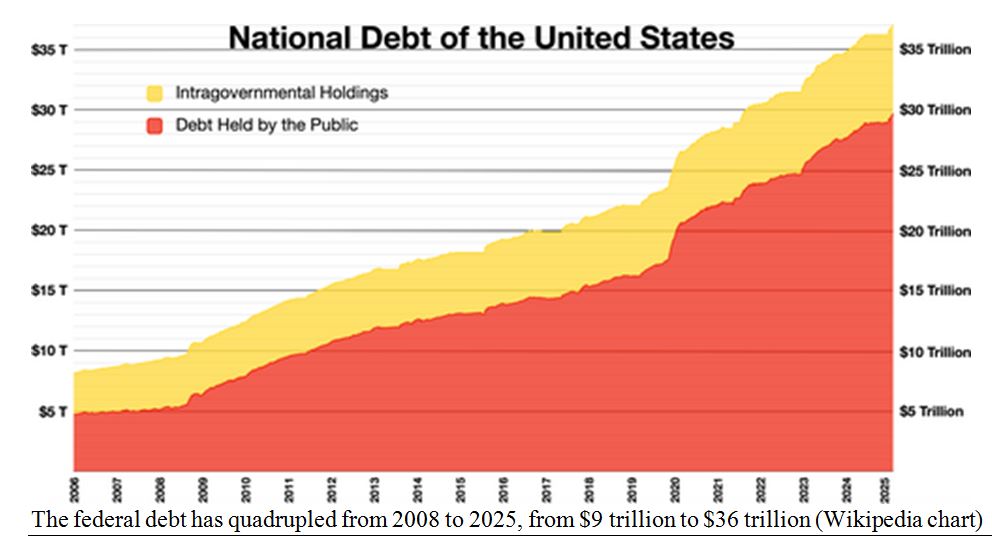

Today is not only the last day of the third quarter. It is also the final day of Federal Fiscal Year 2025, a year in which the annual deficit is likely to rise, not fall, despite all the controversial (and ham-handed) actions of the Department of Government Efficiency (DOGE) in the first half of the calendar year.

We won’t know the final deficit accounting for a couple of weeks, but it looks like the 2025 federal deficit will approach or surpass $1.9-trillion, the largest since 2021 and the third largest deficit ever.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

Deficits since 2008’s Great Recession account for 62% of the combined federal deficits in our first 235-years as a nation, and deficits since 2020 are more than half the deficits of all of the previous 230-years.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

Tax collections are not the problem. Income taxes (including Social Security) totaled $3.972-trillion in the 11-months through August 31, 2025, compared with $3,743 the previous year’s same 11-months. That means the IRS collected 6% more in 2025 from we Americans – but federal spending grew faster.

Total tax revenues (from all sources) through the first 11-months of FY25 were $300-billion above all the tax collections from a year ago – led by a $182-billion increase in individual income taxes. Due in part to rising tariffs, customs duties were $95-billion higher this year than in the same 11-months in 2024.

This won’t happen forever. Tax collections are up due to a booming economy, but what if we enter a recession or slowdown? The, tax collections will decrease while the demand for benefits will increase.

These facts don’t seem to penetrate the minds of most voters or politicians, so the Kids on the Potomac are threatening a government shutdown again, tonight at midnight as the new fiscal year begins, since they can’t figure out how to talk to each other and fashion a 2026 budget. This is vastly different than one of President Clinton’s finest moments, when he admitted that the 1994 mid-term elections signaled “the end of big government as we know it.” Clinton and the new Republican House engineered a huge set of budget surpluses by the end of the 1990s, capped by a $130-billion budget surplus in fiscal year 2001.

This year, a 6.1% increase in spending – in a 3% inflationary world – isn’t enough for the big spenders in both Parties, but the Democrats are particularly adamant about reversing the “Big Beautiful Bill’s” cuts in wasteful Medicaid spending, plus pet programs like PBS and NPR. They also insist on more protections for federal workers – after few were let go by DOGE – and over $1-trillion in new Medicaid spending.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

In a predictable war of words on the Potomac, President Trump’s OMB director Russ Vought said that if the Democrats force a shutdown, he will order “reduction in force” (RIF) notices for “all employees in programs, projects, or activities.” Once the shutdown ends, he added, federal agencies will be directed to retain only a “minimal number” of employees needed to function. Take time off, and you may be jobless.

We don’t want to get too mired in the political weeds of shutdowns, showdowns or suspensions, since this is primarily an investment column, and government shutdowns have little impact on the stock market.

Businesses live or die on their earnings. The less government intervention in businesses, the better (for them). History shows that the market has gained ground during most previous government shutdowns.

Most shutdowns lasted just a few days, but the three longest shutdowns didn’t spook the market. The first (1996) was over a balanced budget resolution and Medicare funding. The second (2013) began on Day 1 of the new budget year, all about a proposal to defund Obamacare. The third involved funding Trump’s border wall. In that third, longest shutdown – running five weeks, from December 21, 2018, to January 25, 2019 – the S&P 500 gained over 10% during the shutdown and another 10% in the next three-months.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

So, bring on the shutdown, Congress…. And then, start talking to each other about realistic spending cuts.

The post 9-30-25: Happy New Year! Growth Surges as we Enter Fiscal Year 2026 appeared first on Navellier.