by Gary Alexander

September 23, 2025

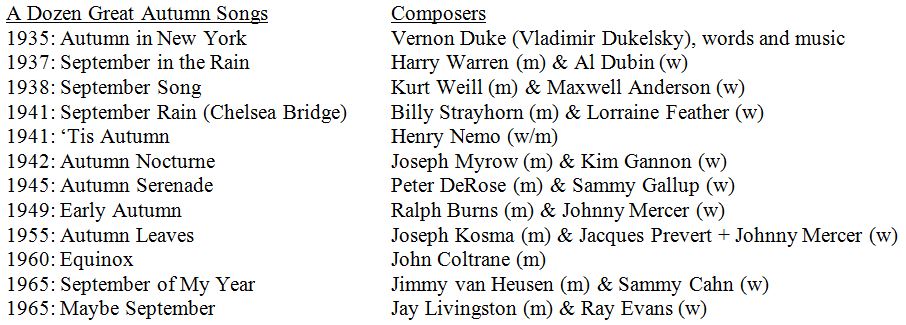

A new season began yesterday, at 2:19 pm Eastern time, so today marks the autumnal equinox and the first full day of fall. In my weekly radio music history program yesterday, I honored that fact with about a dozen songs, six of them bearing Autumn in the title, five with September in the title, and one called Equinox by a man born near the equinox, John Coltrane. All these songs were written in the middle of the 20th century (1935 to 1965), my favorite era of great American music, but not all of these songs were born in America. Last year, I played 30 to 40 great versions of “Autumn Leaves” over a two-month span, and that is a French tune whose original lyrics were dismal in the extreme, about dead (not falling) leaves:

“Les feuilles mortes se ramassent à la pelle” is translated as “Dead leaves are collected with a shovel.”

That’s not my idea of a romantic tune, and not Johnny Mercer’s, either, so he changed the opening to “Fallings leaves drift by the window, the autumn leaves of red and gold. I see your lips, the summer kisses, the sun-burned hands I used to hold.” Ah, now we’re talking love, not a dead pile of leaves.

A proudly French jazz historian, Philippe Baudoin, has called Autumn Leaves, “The most important non-American standard” in our canon of great songs, further noting that, “It has been recorded about 1,400 times by mainstream and modern jazz musicians alone, and is the eighth most-recorded tune by jazzmen,” but “dead leaves” would not have generated that tsunami of cover versions without Mercer’s new words.

Other autumn songs are more wistful than sad, starting with “Autumn in New York” (1935) by Russian immigrant Vladimir Dukelsky, who took the name Vernon Duke. Then came “September in the Rain” by Harry Warren and Al Dubin, and a wistful “September Song” by Kurt Weill and Maxwell Anderson,” all about how “the days dwindle down to a precious few: September… November.” Later on, Frank Sinatra’s “September of My Year” was written especially for his 50th birthday by his best composing friends, as Old Blue Eyes entered the last third of life (September to December on a calendar of mortality). Sad stuff.

If you’re not a fan of old songs, I apologize for spending so much time on songs this week, but we just returned from the Journey of Jazz cruise (Vancouver BC to Los Angeles), so I’m still saturated in songs.

The Largest Market Rises Usually Fall in the Fall

Turning to markets, fall is the time for new life, a resurrection of hope for the new year, a time of family gatherings, feasting and football games, with two major holidays, Thanksgiving and Christmas, most years leavened with rising paper profits generated during the market’s fattest feasts in most years.

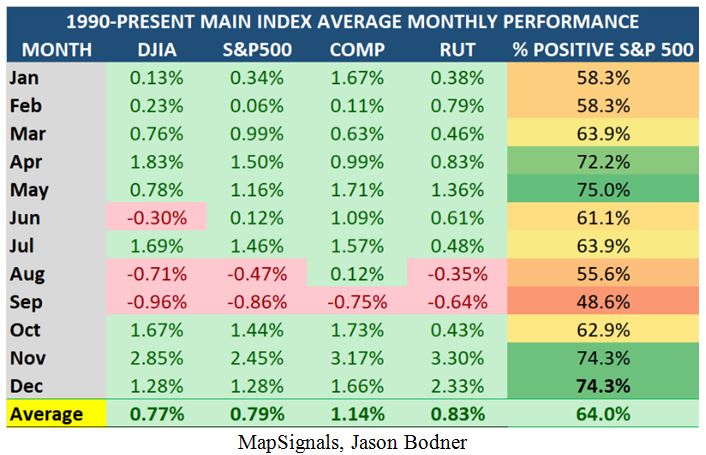

As our compatriot Jason Bodner has shown, the largest annual market increases since 1990 have come in the last three calendar months. October’s average returns are solid (+1.3% on average), December is even better (+1.6%) and November is the Gold Medal market month, with the highest average gains (+2.95%).

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

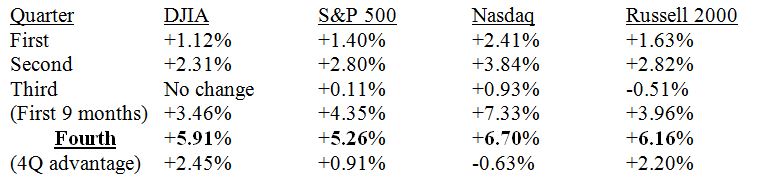

Breaking the averages down by quarters, Jason’s 35-year totals are astonishingly one-sided, with the final quarter beating the other three quarters combined, in most cases (all except the NASDAQ Composite).

As you can see, the Dow and Russell 2000 perform over 2% better in the fourth quarter than the previous three quarters combined, while the S&P 500 is up nearly 1% over the previous three quarters, combined.

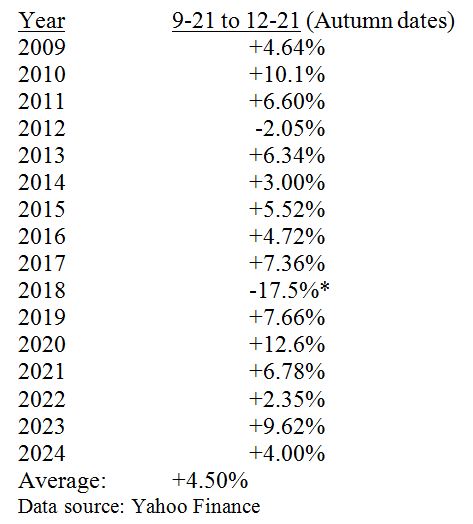

Next, let’s focus on recent fall seasons – September 21 to December 21 in most years – in the S&P 500.

Since 2008’s Great Recession, the only big downdraft was 2018, when the new Fed Chair Jerome Powell endured President Trump’s Twitter war over Powell’s stubborn interest rate increases in the fall of 2018.

Including the dismal 2018, 14 of 16 recent autumns have risen by an average 4.5%. Barring another war of words between Chairman Powell and President Trump, we could see another 4+% rise next quarter.

Going back further in history, the fourth quarter has risen 80% of the time and by an average of over 4%.

Why such consistently strong markets in the fourth quarter? Louis Navellier has mentioned the cheery holiday season – with family, feasting and football lifting our spirits – plus the technical market forces of year-end tax selling and buying, creating more breadth in the market and better-balanced portfolios. There is also the usual late-year Santa Claus Rally and an early January Effect, often focusing on smaller stocks.

Basically, the end of the year is a time to anticipate positive returns in the following year – the opposite of the sad serenades so prevalent in our best September-and-Autumn oriented historical Hit Parade. If you are interested in music, here are the 12 wistful Autumn songs I played in my last two radio shows:

The post 9-23-25: In Market Lingo, a “Fall” (Season) Means a Rise (in Stocks) appeared first on Navellier.