by Gary Alexander

July 8, 2025

On July 6, 1785 – 240 years ago this week – the Continental Congress authorized the issuance of the first U.S. dollar, to replace the Spanish “pieces of 8” then in circulation. Why call it a dollar? That word comes from the German, a sort of slang version of the High German term Thaler, which effectively means “a valley person” (a “Thal” is a valley). The Joachimsthaler was a large silver coin first minted in the town of Joachimsthal, Bohemia, in 1519. These “dollars” were traded by many Germanic immigrants.

The U.S. dollar was not intended to be printed, but to be minted, as the silver dollar was officially defined as 371-1/4 grains of pure silver, based on the average weight of the old and worn Spanish ‘dollars’ (pieces of eight). America had learned its lesson with inflated paper, so the Constitution decreed that nothing but gold or silver should be used as a tender of exchange by States or the nation as a whole.

This system was instituted in detail in the 1792 Coinage Act, crafted by Alexander Hamilton, our first Treasury Secretary. The Act also called for the first Mint in Philadelphia, the U.S. Capitol in the 1790s.

Gold dollar coins were first denominated as Eagles—an Eagle being $10, containing 247-1/2 grains of pure gold, or 270 grains of standard 22-carat gold (0.9167 purity). Half-Eagles cut those numbers in half and were worth $5. Quarter-Eagles—worth $2.50 – cut the $10 gold content by 75%. Double Eagles ($20 coins) were launched in 1849, in response to the rapid inflow of gold bullion during the 1849 Gold Rush.

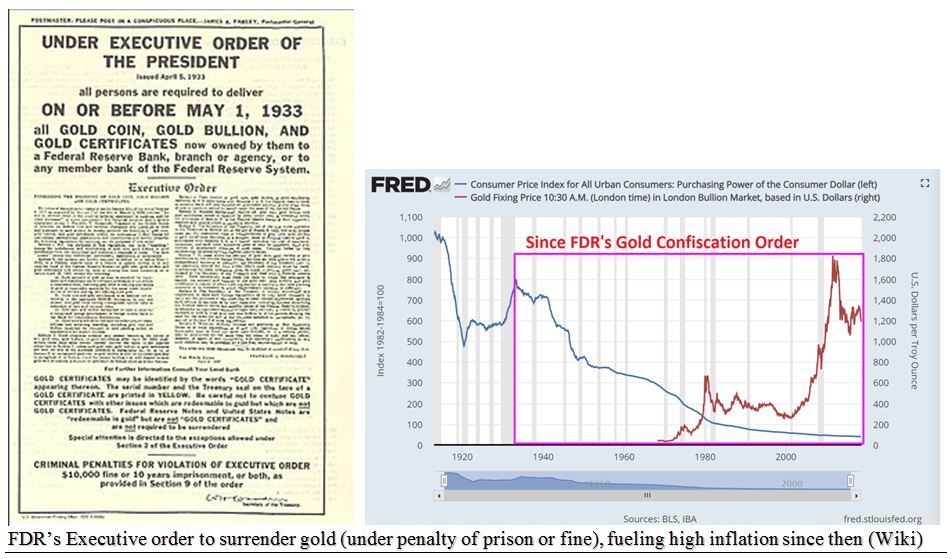

There was little peacetime inflation during the 120 years from the 1792 Coinage Act to the birth of the Federal Reserve in 1913, and no net inflation for another 20 years to 1933, when new President Franklin D. Roosevelt first launched a bank holiday and then an Executive Order to surrender all gold by May 1, at the price fixed in 1785 and 1792, equivalent to $20.67 per ounce. He then revalued gold to $35 per ounce.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

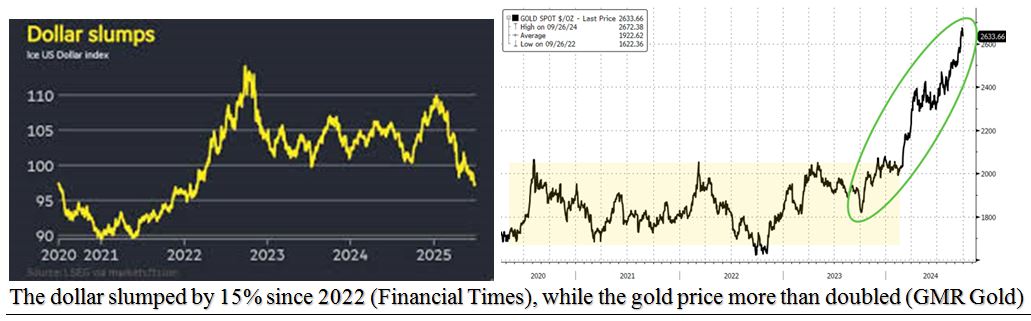

Moving up to modern times, most investors and pundits compare the Dollar to other currencies, not gold. In that “race to the bottom,” the Dollar celebrated its 240th birthday by losing 12% in the last six months.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

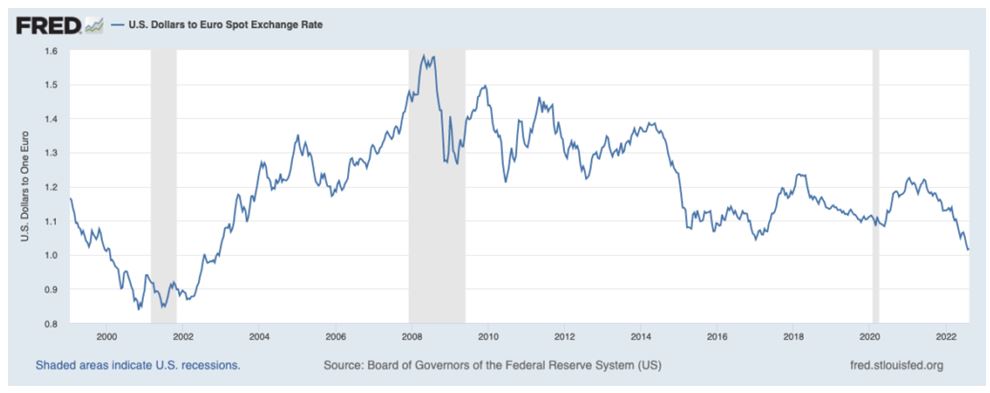

The U.S. Dollar Index (DXY) fell from a peak of 110 on January 13, 2025, to under 97 last week. The U.S. Dollar is heavily weighted (57%) in the euro, so let’s see how the dollar has fared in euro terms.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

The euro was born on January 1, 1999, at a set price (like an IPO, or initial public offering) of $1.18. The investment world did not take kindly to this IPO, as the euro sank to $0.85 (-28%) by year-end 2000. However, the euro then soared to $1.60 during the 2008 Financial Crisis, a gain of 88%. After 2009, it soon became clear that Europe was hit harder by that 2008 financial crisis than the U.S. – with continuing funding crises in their Mediterranean PIGS (Portugal, Italy, Greece and Spain), so the euro began sinking.

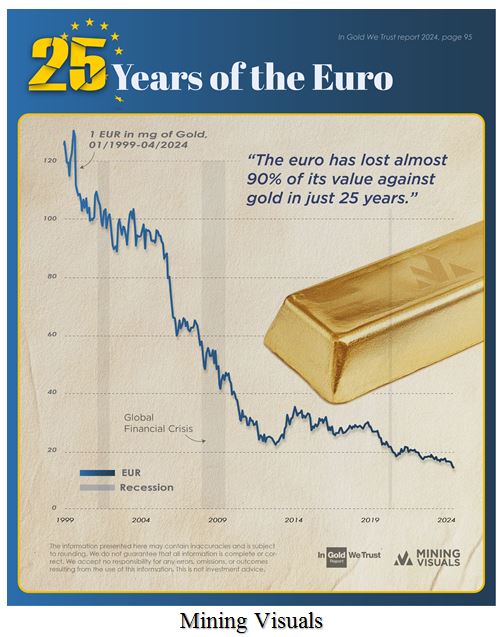

During those same years in which the euro and the dollar were fighting to a virtual tie, the price of gold increased about 14-fold, from barely $250 per ounce in 1999 through 2001, to nearly $3,500 now. The same has happened in euro terms, since paper follows paper, and gold crushes all paper in time.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

In the last six months, a fear of tariffs and other major policy shifts has pushed the euro back up to its IPO rate of $1.18. (The euro has risen from $1.02 on January 13, 2025, to its current $1.18, up nearly 16%.) Going back further, the euro traded below the dollar ($0.96 in late 2022), so it is up 23% in 33 months.

Does it matter? That is the $64 trillion question. In comparing paper to paper, it doesn’t matter much. The euro and dollar will continue this waltz around zero net change, but gold tells us that failing paper of all colors is concerning. That’s why the 1787 Constitution and 1792 Coinage Act mandated gold and silver.

Want More History? Conflicting Edicts (An Olive Branch and a Call to Arms)

Were Issued on Successive Days 250 years ago This Week

A quarter millennium ago*, after the 13 Colonies started fighting their British overlords, the ever-waffling Continental Congress got cold feet one day (July 5, 1775), sending an Olive Branch across the pond to King George III, then (in a 180-degree turn) they drafted a resolution titled “the Declaration of the Causes and Necessity of Taking Up Arms” on the very next day. That treatise was sort of a “rough draft” of the 1776 Declaration, which consisted mostly of a list of reasons why we should have “No King” here.

*A centennial is 100 years, a sesquicentennial is 150 years, and our nation’s 200th birthday was a glorious bicentennial in 1976. So, what do you call a 250% birthday? According to the savants who draft “AI” responses, the proper word is semi-quincentennial, or “half of 500” (quin=5) years. That’s not going to gain traction, my fellow Americans. It fails to trip off the tongue. How ‘bout a “Quarter-Millennial” gala?

This 1775 Declaration, like the one to come, was written primarily by Thomas Jefferson. Meanwhile, the Olive Branch was ignored by the Crown, so the colonies continued to take up arms in battle during 1775.

The July call to arms was the sort of red meat the street protestors ate up, so why did Congress also send King George an Olive Branch Petition, which restated our loyalty to Britain and wished King George III a long reign and healthy life? It sounds more like a desperate “Hail Mary pass” to avoid losing a costly war.

The musical version of “Hamilton” explains some of the understandable fear of losing to mighty Britain:

How does a ragtag volunteer army in need of a shower

Somehow defeat a global superpower?

How do we emerge victorious from the quagmire?

Leave the battlefield, waving Betsy Ross’ flag higher?

–Lin-Manuel Miranda, in “Hamilton”

Long after “Hamilton” celebrated the Betsy Ross flag (below), that flag became controversial. In 2019, the Nike shoe company canceled the release of a sneaker featuring the Betsy Ross flag after former NFL player Colin Kaepernick raised concerns about its 13 stars representing a time of slavery. But such critics may need to crack a book. Betsy Ross was a Quaker who opposed slavery, so let’s celebrate her flag!

Navellier & Associates; do not own Nike Inc (NKE). Gary Alexander does not personally own Nike Inc (NKE).

The post 7-8-25: Where is the U.S. Dollar Headed? – And Does it Matter? appeared first on Navellier.