by Jason Bodner

July 8, 2025

“We suffer more in imagination than in reality.” – Seneca, the Roman Philosopher

This insight rings true across the centuries, and it continues to resonate today. People, as a rule, tend to worry about things that never actually happen. Our imaginations are powerful—sometimes too powerful. They can often create elaborate scenarios filled with fear, anxiety, or doubt. These scenarios rarely come to fruition, yet they shape our actions, mood, and decision-making in very real and sometimes costly ways.

That same lens of psychological insight applies to investing. I just heard from my dad, an accomplished investor. Calling him accomplished would be an understatement. Last week, I told you about our first meeting with Louis Navellier in his Reno corporate offices in the early 1990s, since dad wanted to see his operation up close and ask the team about their investing discipline before investing there. As a result of dad’s skills and Louie’s team, he has been living off his investment successes and skills for more than 20 years, managing his nest egg with consistency and focus. His investment accounts have continued to grow and compound handsomely. He’s seen market crashes come and go – booms, bubbles, and bear markets.

With that background, when he asked me a particular question last week, I knew it wasn’t rooted in fear or panic—it came from a place of genuine curiosity, seasoned experience, and rational analysis. He asked:

Dad’s question was simple but profound. Perhaps he was also asking, When is the next shoe going to drop?

It’s a fair question. A lot of people are asking questions like that about now. With markets at all-time highs, geopolitical tensions rising and inflation still being debated, many are nervously watching the skies for signs of storm clouds. My initial short answer to dad’s question was: The shoe will drop when it drops.

The longer answer is more interesting. Basically, while a correction is inevitable at some point, we are not there yet, and it may take some time to get there. All the available data suggest that we are in the midst of a strong bull market. And in times like these, it’s far more dangerous to jump out of the way of a bus that may be 25 miles down the road, just because you fear an accident like one read about in today’s news.

So, let’s examine the data.

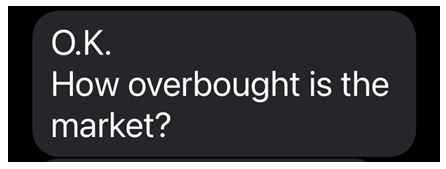

To begin with, the Big Money Index (BMI) is still sitting in overbought territory. This indicator measures large institutional buying versus selling and is often a powerful signal of the market’s direction. A rising BMI, even in overbought conditions, suggests sustained interest from big players.

Recently, the BMI drifted down slightly, but last week it began to rise again.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

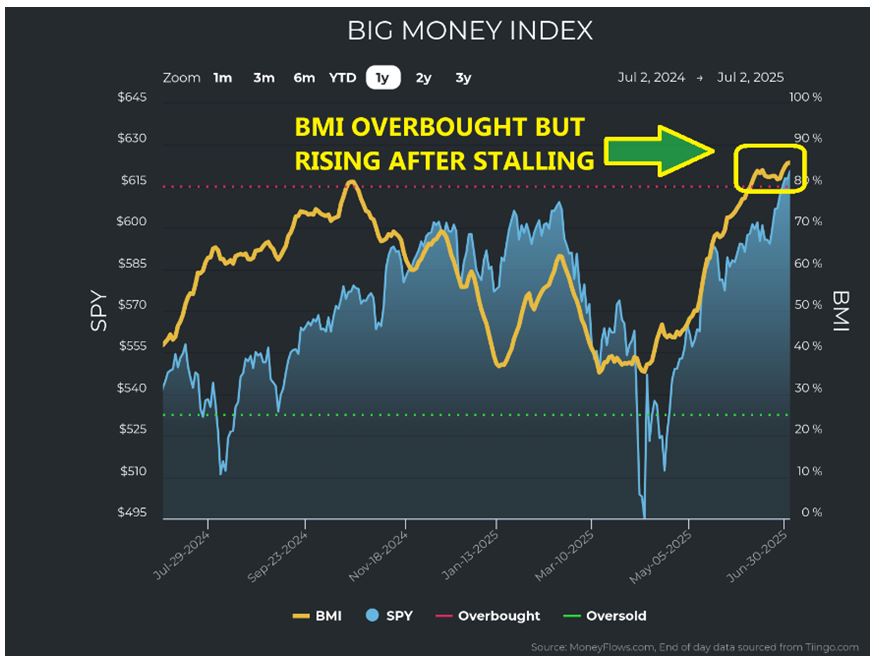

Even more telling, we are witnessing increasing equity inflows—a positive sign that institutional and retail investors alike are putting fresh capital into the market.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

The post 7-8-25: How Overbought is this Market? (And Does it Matter?) appeared first on Navellier.