by Gary Alexander

June 17, 2025

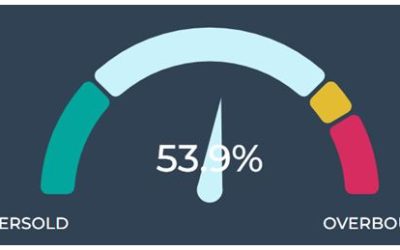

The Consumer Price Index (CPI) came out last Wednesday, rising only 0.1% in both the headline number and the core number (minus food and energy), and it is up 2.4% over the last 12 months, its lowest rate since February of 2021. The Producer Price Index (PPI), released the next day, came in similarly low.

But that doesn’t matter. The Federal Reserve Board keeps expecting “sticker shock” to return, via high tariffs hitting consumers. Most consumers also expect high inflation (6.6%) over the next year, and now gold has set another new high above $3,450, with silver and the Platinum Group metals forming an Amen Chorus behind gold, leaping up by double digits in early June, partially on fears of higher inflation ahead.

Despite the fifth straight month of low inflation in 2025, last Monday’s Wall Street Journal published two cautionary articles in advance of last week’s inflation reports: The first article was perched on the top of Page 1 of the Business & Finance section, titled: “Inflation Casts Shadow on the Markets,” quoting the University of Michigan’s May consumer sentiment survey, which found that average Americans expect their prices to surge by 6.6% over the next year, up from 6.5% in April. Both numbers are the highest on record since 1981, when inflation was 10.32%. So…U.S. consumers clearly do not believe the CPI data.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

Even though these lofty 6.6% consumer inflation expectations fly in the face of year-over-year inflation of just 2.4% – the lowest rate since Biden’s first month in office – these expectations can become self-fulfilling if workers begin to demand higher wages, or if businesses raise prices to protect their profits.

The second Journal article from last Monday, June 9 (from their “Investing Monthly” section) profiled a newly retired couple discussing their concerns about inflation, with the husband (Steve) being concerned, and the wife (Karen) was not so worried about rising prices, thinking they can rely on their Cost of Living Allowance (COLA) in Social Security and rising stock markets and lower tax rates, but now they must be concerned about whether these monthly inflation numbers are accurate – due to another Journal article:

On June 4, 2025, the Wall Street Journal produced an article questioning the accuracy of the inflation data (“Economists Raise Questions About Quality of U.S. Inflation Data: Labor Department says staffing shortages reduced its ability to conduct its massive monthly survey”), which says that staffing shortages have handcuffed the Bureau of Labor Statistics (BLS) from making a full survey of nationwide prices each month. In the last inflation report (for April), they said, government statisticians said they had to use a less precise method for guessing price changes than they have in the past, so many economists now say these staffing shortages raise questions about the quality of recent and all upcoming inflation reports.

When asked about this problem, the BLS said, “The CPI temporarily reduced the number of outlets and quotes it attempted to collect, due to a staffing shortage in certain CPI cities” in April. “These procedures will be kept in place until the hiring freeze is lifted, and additional staff can be hired and trained.”

Most people don’t realize that BLS price checkers mostly look at price labels for the same products each month. They don’t monitor “sales” or replacement items, but the same products. So, if they don’t see the brand of jeans they saw last month, they might substitute cargo pants. They basically don’t live in the real world of a family trying to stretch their money by substituting bargain items for overpriced items.

The BLS reports low inflation, but is it accurate? I think so, since we have choices, but most Americans seem to doubt the validity of these numbers, so the market just might soar if we believe the numbers.

The Precious Metals Also Discount Low Inflation Data

In the first half of June, we’ve seen double-digit gains in silver and platinum, with a 5% leap in gold to new record highs, even though the commodity complex, as a whole, has been flat during most of 2025.

Platinum is up due to a projected supply deficit this year, and also due to threatened tariffs, which have resulted in some unusual advance trading and stockpiling of platinum before those expected tariffs take effect, but silver seems to have been catching up to gold in the “inflation hedge” department. Some analysts theorize that the sudden explosion of the “bromance” between the aggressive cost-cutting former DOGE director, Elon Musk, and the more pragmatic Trump team working with Congress on the “one beautiful bill” has sabotaged most of President Trump’s initial promise to cut high deficit spending in his first year. This rift, they theorize, insures high and rising deficits this year, and maybe next year. Such an outlook would virtually guarantee a decline in the dollar and higher inflation, helping gold and silver.

At the same time, this scenario would slow down the economy by keeping interest rates high, and service on the federal debt high, thereby crowding out free enterprise from access to that capital, limiting growth, and perhaps threatening a recession going into the mid-term elections. This opens up a scenario for a return to the “stagflation” of 50 years ago, when gold and silver soared. If so, the very public divorce between Musk and Trump may have sent silver soaring. But then, what if Trump and Musk make up….?

It’s clear that inflation is coming down, but the world (the Fed, the public and gold) don’t see it. So, we may see a major market surge, and perhaps a drop in gold, once the reality of low inflation sinks in.

A Trio Anniversaries in American History – 250, 140 and 95 Years Ago Today

Today marks the anniversary of three red-letter days in American history. Are they still relevant today?

- On June 17, 1775, the Battle of Bunker Hill was the first big battle of the Revolutionary War.

- On June 17, 1885, the Statue of Liberty arrived in New York harbor on a French ship, “Isere.”

- On June 17, 1930, President Herbert Hoover signed the Smoot-Hawley Tariff bill into law.

Before examining that last item in more detail, let me first clear up some myths about the first two:

#1: The Battle of Bunker Hill was mostly fought on Breed’s Hill, the closer of the two hills to the Charles River. Also, the famous patience of our defenders – “Don’t shoot until you see the whites of their eyes” – resulted in a slaughter of the British troops. It was attributed to Colonel William Prescott, but was more likely said by Israel Putnam and others – or not said at all, one of those many stirring post-war legends.

#2: The Statue of Liberty did not come with Emma Lazarus’ poem (“Give Me Your Tired, Your Poor…”) attached. That poem was affixed in bronze in 1903 and does not represent U.S. law, any more than the U.S. Postal Service bronze plaque does: “Neither snow nor rain nor heat nor gloom of night stays these couriers from the swift completion of their appointed rounds” is not an official motto or policy of the USPS. It is a quote from the Greek historian Herodotus describing an ancient Persian courier service.

With President Trump’s new offer of “Gold Card” U.S. residency visas last week for $5 million, entry into America is no longer favored for the “huddled masses yearning to breathe free, the wretched refuse.”

Now, let us examine the law which has given root to much of today’s Tariff Derangement Syndrome, the Smoot-Hawley law of June 17, 1930. A month before Hoover signed that Bill, over 1,000 economists signed a petition that protested the tariff. Their fears were well founded, as foreign nations retaliated by enacting their own tariffs or quotas on imports, and other measures that stifled global trade in the 1930s.

The Dow fell 11% that week, from 250 to 222. The Dow would not reach 250 again for over 20 years. But the tariff didn’t cause the big drop in the Dow over the next two years, as I’ve shown here before. The Federal Reserve caused that drop by cutting money supply (liquidity) by one-third from 1930 to 1932.

Last week, the Wall Street Journal commemorated the passage of this tariff law by reproducing one of their headlines from that week, 95 years ago, “Senate Passes Tariff Bill, 44-42” (June 14, 1930, below).

The Journal added (on June 9, 2025) that, “The administration expected the Smoot-Hawley tariffs to rake in $107 million a year, according to Journal coverage at the time, a big figure in a $92 billion GDP, but by 1933 the GDP sank to $57 billion.” In a companion piece to that historical survey on June 9, the Journal also wrote, “Stock funds Roared 6% in May 2025 as the ‘Tariff Panic eased for fund investors.’”

Who says we never learn from history? Nearly everyone quotes Smoot-Hawley as a warning these days!

And, in case you forget, the 1930s became a decade of deflation, not inflation, after these tariffs passed.

The post 6-17-25: “We Don’t Believe Your Low Inflation Numbers” appeared first on Navellier.