by Ivan Martchev

March 18, 2025

I think the recent decline in the stock market is primarily rotational in nature, and the tariff threats by the Trump administration are mostly just an excuse for this rotation. However, President Trump would be well served to learn a phrase from one of his famous predecessors: “Speak softly and carry a big stick.”

Theodore Roosevelt used that foreign policy approach, and President Trump might achieve more by adopting it and not by scaring investors while shooting himself in the foot. I have my doubts as to whether he can change, given his behavior in his first term as president, but toning it down just a little may help. The minute he gets some wins in his drug-and-trade war, people might view tariffs differently.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

As for the recent stock rotation, the most important stock market in the EU is Germany, and that market is benefitting from a potential end of the war in Ukraine and a new German government that will soon take over, led by the CDU (a more competent political party, in my view) with a huge stimulus spending plan in the works. We will all be very happy if the German economy improves, but they have more to lose in a trade war than the U.S., as it is an export-driven country, and the U.S. is its largest export destination.

I think the U.S. market got extended to an all-time high relative to the rest of the world in terms of market capitalization and the violent rotation into Europe and many emerging markets caused this sharp sell-off.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

From a statistical perspective, this type of selling right after an all-time high is rare. Every single day for three weeks (except last Friday), the daily range of the S&P 500 touched or went outside the lower Bollinger band, which is set at two standard deviations away from the 20-day moving average (the dotted middle band, above). That’s 14 trading days – regardless of Presidential tweets, good economic statistics or any other kind of news. I suspect computerized trading – as computers don’t care about any of that.

Statistically, this type of action is extreme and typically comes at the end of a bear market in a waterfall sell-off and not right after an all-time high. A simple reflexive rebound to the 20-day moving average would wipe out half the decline. I think the chances that we get this rebound in the next two weeks are much better than 75%. I would say even higher, but I cannot predict Presidential tweets and geopolitical events that can come out of left field. In fact, 5800-5850 by the end of March would be a good target, or even higher based on Trump’s tweets (lower if he starts tweeting aggressively in the middle of the night).

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

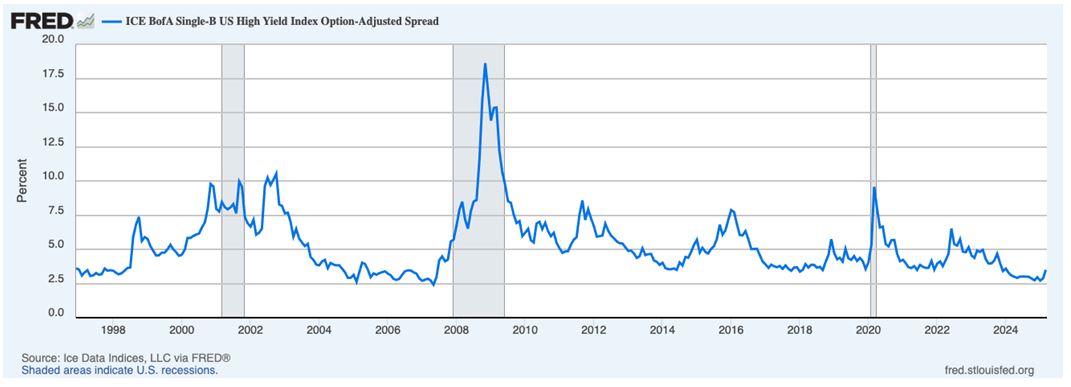

Furthermore, risky bonds or junk bonds are going well. There is some weakening in the junk bond market, but nothing like the weakening before a recession. Note: COVID was a government-mandated shutdown because of a pandemic and not a normal recession. We have had junk bond spreads at much higher levels in 2012, 2016 and 2022 without a recession, and their recent reading at 350 basis points over Treasuries is “inside 400,” which is a bond trader’s term for a relatively strong junk bond market.

Junk bonds are correlated with stocks, and right now junk bonds do not see what the stock market is seeing. Could it be that the stock market is hallucinating? It sure could.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

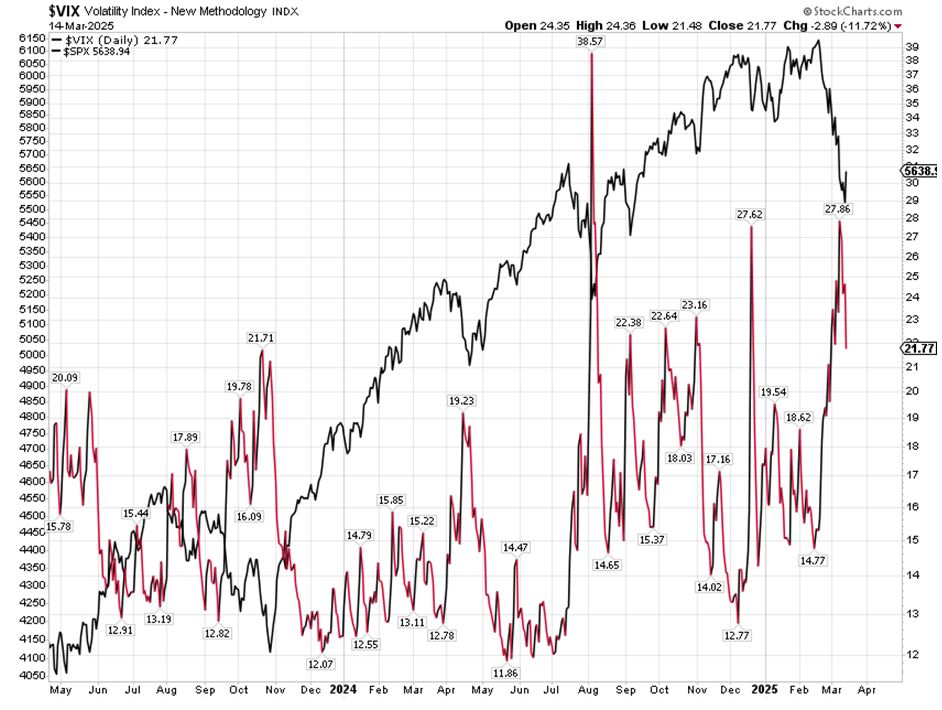

In addition to the extreme nature of the sell-off, we have an intermediate-term buy signal from the fear gauge index called the VIX, which measures implied volatility in index options. The VIX had not one but two double-digit percentage declines last week – one was -9.99% (in my book that counts as double-digit) earlier and one of -11.72% on Friday. These types of declines in the VIX after this type of sell-off would easily signify a 5% up-move in the S&P 500 in 2-4 weeks (it could be bigger). In fact, the chances that the S&P 500 makes an all-time high in the second quarter are better than ever, in my view, but I would caution that this is contingent on some wins in President Trump’s trade war, which I expect to see.

P.S., A closing note to Mr. Trump: Please read up on Teddy Roosevelt. It is in everyone’s best interest.

The post 3-18-25: The VIX Says Buy Stocks appeared first on Navellier.