by Ivan Martchev

December 3, 2024

The best way to describe the huge swing in Treasury yields last week was a sigh of relief. The decline in long-term Treasury rates was mostly in response to the Scott Bessent nomination for Treasury Secretary. I expected the market would like it when I wrote my commentary on the Sunday before trading opened last week. What I didn’t know is how much the bond market would like it. We went from a 10-year bond yield just above 4.50% in mid-November all the way down to a few ticks above 4.17% at last week’s lows.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

Most investors don’t follow the bond market that closely, as it is more of a professional market, but the overall bond market is bigger (in market value) than the stock market, and Treasuries are the largest part of the bond market. What Treasures did last week is like the Dow surging by 2,000 to 3,000 points. Such a drop in yields helps the stock market, too, although I doubt it can continue at the same breakneck pace.

I think President-Elect Trump will act more decisively, even abrasively, compared to his first term, and that could clearly impact the volatility of both stocks and bonds. Why? First, he won’t have to run for office again, although if he is successful, I would expect J. D. Vance to run in 2028. Second, I feel Trump thinks he has some unfinished business from his first administration, which was hamstrung by COVID in 2020, and he would like to finish strong on the trade front. Third, what he is trying to achieve on both the trade and fiscal fronts is gargantuan, if it can be done in four years, which suggests his administration will move into overdrive. I know he can be a divisive figure, particularly in the eyes of his opponents, but the consolation is that his fiscal and trade agendas are highly necessary and, if he succeeds, we will all win.

My Year-End Target for the S&P 500 is 6,300 (If….)

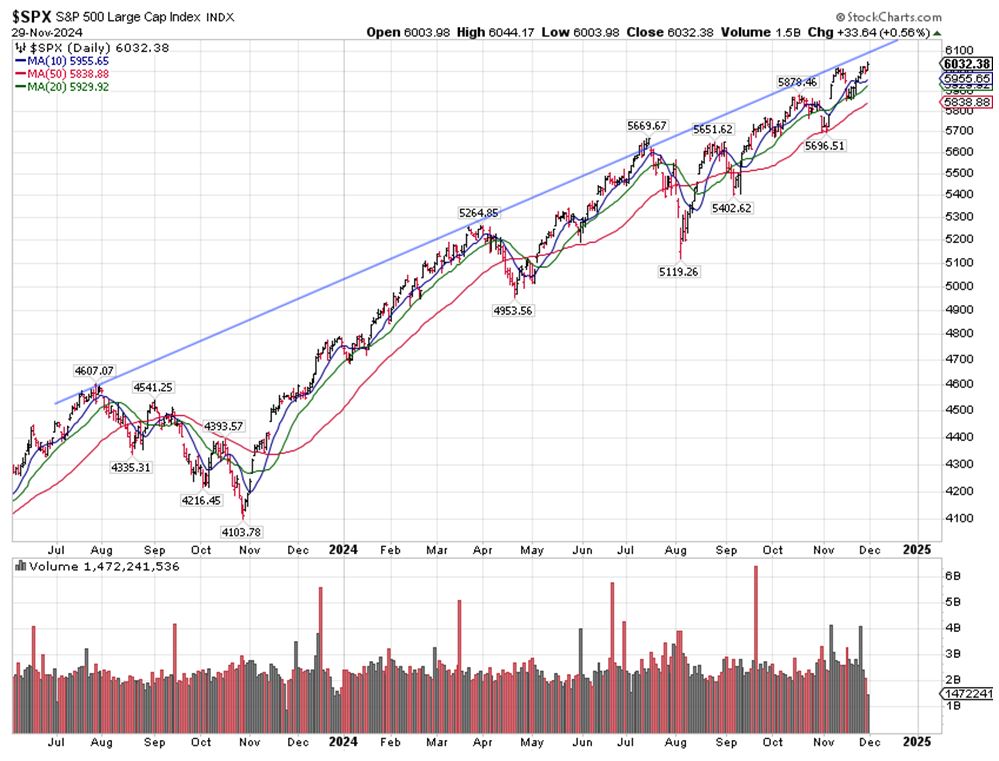

What about the stock market? December is seasonally one of the most positive months, and it tends to be even more positive when the year has been up more than 20%. The Fed will likely cut rates in the middle of the month, and bond yield should keep declining. If we don’t have geopolitical blowups, which are impossible to predict, we could be up 2-3% in December, or more with positive geopolitical surprises.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

In the short-term, 6,100 on the S&P 500 strikes me as an area where we could see some choppy waters, or back and fill but, other than that, the glass seems to be half full. During a strong November, there were quite a few rotations out of technology into the value part of the market, but keep in mind that rotations don’t move in linear fashion. Technology can pick up again, so don’t extrapolate daily moves into trends.

I would expect December to start strong and have quite the flips on the November employment report on Friday. I don’t know which way it will go, but based on recent trends it might be fairly positive. A good S&P target for the end of the year is 6,300. We can overshoot with positive surprises on the political front or undershoot if the surprises are negative, but if life is close to being normal, I think 6,300 is achievable.

The post 12-3-24: The Biggest Move Last Week Was in Bonds appeared first on Navellier.