by Ivan Martchev

November 5, 2024

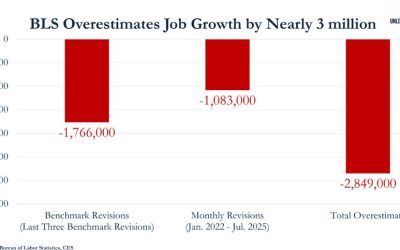

By the time most of you read this – Tuesday morning most likely – we still won’t know who will be the next president, which will have implications for both stocks and bonds and financial markets in general. The latest spike in Treasury yields surely anticipates a Trump victory, which implies rising Treasury issues as he plans to cut taxes and raise tariffs, which introduces higher volatility in government revenues.

Unless we have a hung election, meaning it is so close that neither side is willing to concede, I would not be surprised if a post-election market rally revives. It is also possible that the market starts rallying before we know who is president and only erases the gains in the case of a hung election (a 20%-30% chance).

In any case, the market probably goes up if either candidate clearly wins; it is just that different sectors tend to lead. The S&P 500 has been trending gently lower for two weeks, a bit like a compressed spring, with the lower probability event of the spring releasing to the downside in a hung election scenario.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

The NASDAQ 100 Index, representing the high-beta, high-growth part of the market, is coiling similarly to the way it did in July-October of last year before the big rally started. The all-time high was set in the third week of July. We came down hard when the yen carry trade was unwound, and now we have recovered all the losses. If there is no hung election, we probably rally strongly in the next two months.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

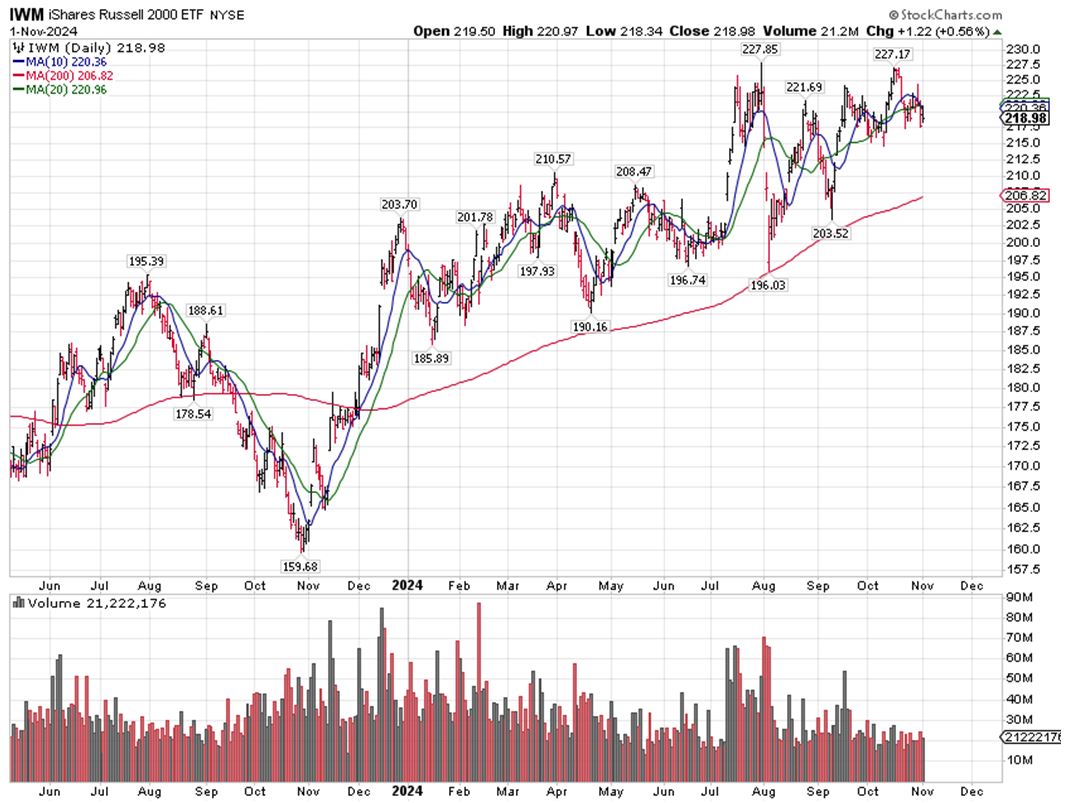

Ironically, the index that started the big rotation into the value part of the market has not made any progress either. The Russell 2000 index now needs to play catch up, with more Fed rate cuts coming (including this week, most likely), but I suppose the recent spike in Treasury yields has not been helping.

I think that both the Russell 2000 and NASDAQ 100 will rally after the election, if it is not “hung” in limbo, as the Russell 2000 is merely a rounding error. The whole of the Russell 2000 is smaller than Nvidia stock alone, which now is the largest company in the U.S. stock market. So yes, the Russell may outperform going into the end of the year, but the dollar value of any gains will be much bigger with the NASDAQ 100.

If Trump wins, I look forward to seeing what plan he has for ending the war in Ukraine. He has said multiple times that he can end the war quickly, which the Russians have responded to with skepticism. I don’t believe Putin will withdraw from Ukraine. He just got North Korean reinforcements, which will likely fight in Russia only, since Ukraine made an incursion there. There is no third country in Ukraine but a third country entering the conflict is clearly broadening the conflict rather than bringing it to an end.

An end to the Ukraine war would be bullish for Europe, although Europeans have shot themselves in the foot when it comes to energy prices. Not only did they botch de-carbonization, as in Germany, but the blown-up natural gas pipelines expose them to much more expensive LNG (3-5 X pipeline gas), which is a long-term negative for Germany and other nations. While one of the pipelines is still intact and may become operational soon, I doubt they will turn it on soon, prolonging the agony of German industry.

Navellier & Associates owns Nvidia Corp (NVDA), in managed accounts. Ivan Martchev does not own Nvidia Corp (NVDA), personally.

The post 11-5-24: The Big Election Week is Finally Here appeared first on Navellier.