by Bryan Perry

November 5, 2024

This week’s historic election is finally here, and the polls seem to be about as undecided as ever, with allegations of manipulation, targeted selection of those being surveyed by irresponsible pollsters herding their numbers, or recycling past results to affect current results in order to make it seem like the two presidential candidates are always within a point or two margin. The idea that nearly every swing state is always plus-one or plus-two does not jibe with history and, thus, in the view of many, cannot be trusted.

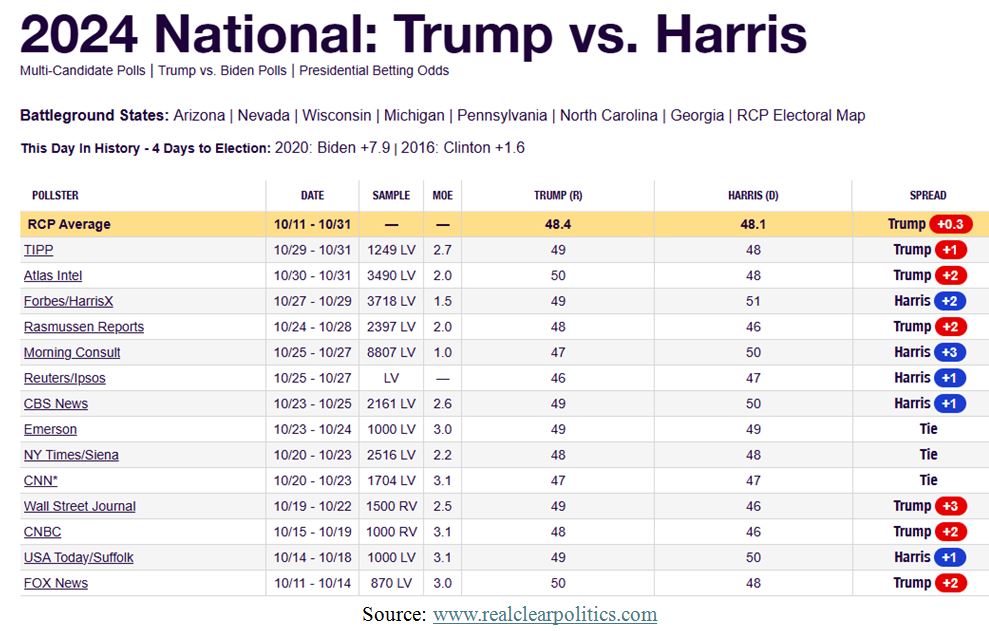

Here’s a chronicle of 14 polls in the seven battleground states during the last three weeks of October:

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

If the outcome of the election is as super close as this in seven states, then it could be weeks before a clear winner is determined in the White House, the House of Representatives and in the Senate, as the results will surely be contested at several levels. This would leave the future of the government in limbo, but the current Congress won’t turn over control to the new Congress until January 3rd, and the swearing in of the new President and Vice President takes place January 20th, when the transfer of power is complete.

To say that after the elections we will revert to “business as usual” may be true if the election results are clear, but I think it is likely that the social atmosphere will be unsettling no matter who wins, and whether that sentiment negatively impacts market sentiment. For the time being, however, a healthy earnings season, led by big cap tech, consumer discretionary, communication services, and the financial sector, has kept investors engaged in staying long the market, even in the historically weak pre-election months.

So, what if the outcome of the balance of power is unfavorable to the near-term whims of Wall Street? There could be more volatility in some sub-sectors that are exposed to more tariff pressure, regulatory pressure, inflationary pressure, budget pressure and tax pressure. Once the power structure is finally clear and in place on Capitol Hill, the market will certainly experience sector rotation at an elevated level.

It will be important for investors not to be complacent during this period, which will define the market’s leadership going forward. Some things will stay the same, and some likely will not, but no matter what happens to the political landscape over the next few months, there are some all-weather, election-proof themes that should thrive in 2025 and produce potentially portfolio-enriching profits for investors.

Profit From the “Pick and Shovel” Stocks of the AI Buildout

The build-out of AI is for real and will be as transformational as when the Internet began and went global. If the long-shoremen’s strike did not raise a red flag as to how AI is going to impact most every labor-intensive industry, then investors are just not paying attention. AI makes most companies leaner, meaner and more profitable. Leading corporations need AI, or they are liable to lose market share.

Although the hyper-scalers get most of the attention, the biggest money in any high-tech gold rush is by owning the picks and shovels of the boom – those companies that build out the infrastructure.

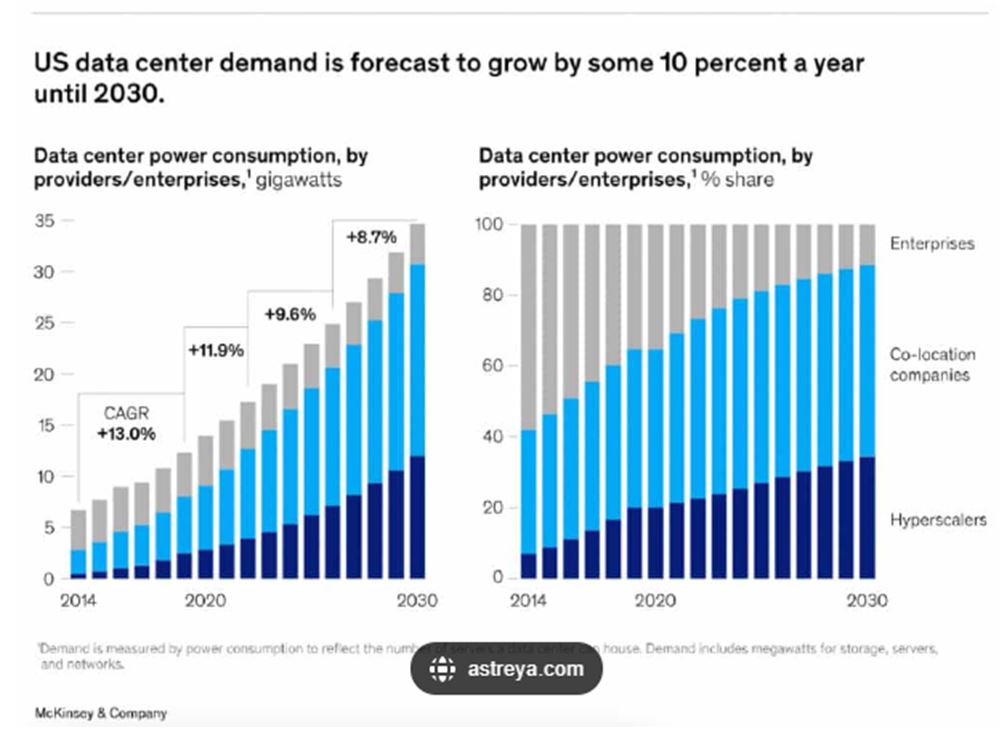

While NVIDIA (NVDA) is the most substantial name in AI, providing the leading chip/software stacks to the data centers, investors can also own the engineering construction companies that build data centers. According to ABI Research, by the end of 2024, there will be 5,709 public data centers worldwide – 5,186 colocation sites and 523 hyper-scaler sites. ABI anticipates 8,378 data centers will operate by 2030.

There are several stocks to choose from in this data center buildout sub-sector that have a five-year runway of robust growth ahead. Data centers will consume 8% of U.S. power by 2030, compared with 3% in 2022. U.S. utilities need to invest around $50 billion in new generation capacity just to support data centers alone. Companies that specialize in assisting utility operators expand their grids and capacity are another excellent example of picks and shovels plays that are devoid of Washington politics.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

For all the amazing attributes and progress AI promises to bring, the dark web and the global cyber-crime community will become that much more lethal in its operations as well. To this point, it is natural that cyber security companies that have the innovative technology to fend off AI-enabled attacks will see their sales flourish. And the U.S. government and other global governments will be some of the largest customers of the leading cyber security companies as spending on cyber-crime and intrusion accelerates.

Lastly, the hurricanes that pummeled Florida, Georgia and the Carolinas will fuel a multi-year rebuilding process from the devastation incurred by Hurricanes Debbie, Helene, and Milton. The latest total estimated economic damage from the 2024 hurricane season has soared to approach $130 billion. (source: USA Today) By comparison, Hurricane Katrina in 2005 caused an estimated $125 billion in damage.

Aside from the two most well-known big box home building supply store chains, there are publicly traded companies that rebuild roads, bridges, waterways, sewers, harbors, seawalls and are major suppliers to the big-box retailers of products that will experience huge sales increases: Flooring, roofing, sheet-rock, cement, aggregates, asphalt, lumber, steel, and all manner of custom items to reinforce infrastructure.

These are just a few of the areas for guaranteed capital investment, regardless of how the elections play out. If the market undergoes some volatility, where some of the premium comes out of these “pick-and-shovel” stocks, investors will have an opportunity invest in these bullish trends at attractive entry points.

Navellier & Associates owns Nvidia Corp (NVDA), in managed accounts. Bryan Perry does not own Nvidia Corp (NVDA), personally.

The post 11-5-24: Investing In Election-Proof Themes For 2025 appeared first on Navellier.