by Jason Bodner

December 2, 2025

In the Arctic, scientists revived ancient viruses trapped in permafrost for tens of thousands of years. Amazingly, they reawakened instantly, once exposed to the right conditions.

Markets often behave the same way. Old fears can enter hibernation but they can thaw out in a heartbeat, and suddenly a calm environment becomes chaotic. This November was a textbook example.

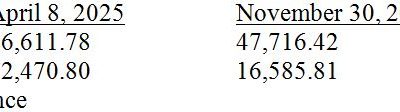

History says that November is the strongest month of the year for stocks. Since 1990, 74% of Novembers finished positive, with an average S&P 500 return of +2.54%. This year, the script flipped until the final week. The S&P fell 4.5% in the month, to November 20th, but then a normally thin holiday trading week saw the index spring back. By month-end, the Dow and S&P closed green, although NASDAQ fell 1.5%.

Growth stocks delivered outstanding 1-week returns. Growth-heavy sectors surged, with Discretionary, Tech, and Communications bouncing hard. The NASDAQ staged the biggest recovery, and small-cap growth ripped higher, as the Russell 2000 Growth index jumped +6.3%.

Semiconductors were the standout as the PHLX Semiconductor Index gained 9.66% in a single week.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

The post 12-2-25: Thanksgiving Week Pushes November into the Green appeared first on Navellier.