by Bryan Perry

December 2, 2025

The Trump administration has stated that its economic agenda is designed to address the debt crisis by focusing on pro-growth policies that it expects will generate enough revenue to reduce the debt burden.

The “One Big Beautiful Bill” created the cornerstone of the plan, as it involves significant tax cuts, which the administration argues will unleash rapid economic growth. The belief is that this accelerated growth will generate a larger tax base, ultimately leading to greater tax revenues that help pay down the debt.

Critics, including the Congressional Budget Office (CBO) and other analysts, have estimated that the net effect of the plan will likely add several trillion dollars to the national debt over the next decade.

To boost revenues, the administration’s trade strategy includes imposing new tariffs on imported goods, to generate “trillions of dollars” for the federal government, providing a new source of revenue to offset the deficit. However, based on recent estimates from nonpartisan economic think tanks, the new tariffs are generally projected to generate lower revenue, in the range of $200-billion to $240-billion in 2026.

The final official figure for the Fiscal Year 2025 federal budget deficit was about $1.8-trillion, according to the Congressional Budget Office and U.S. Treasury Department, so for the first time, net interest payments on the national debt surpassed $1-trillion, due to both high debt levels and higher interest rates.

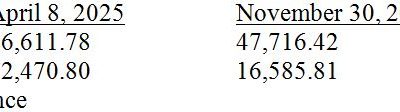

We haven’t balanced a budget in 25-years, and the six-deficits since 2020 have all surpassed $1-trillion:

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

Spending on major entitlement programs like Social Security, Medicare, and Medicaid continued to rise by about 8%, collectively. While revenues increased overall, due to individual income and payroll taxes, this was partially offset by a decline in corporate tax receipts, potentially due to new tax deductions.

For attacking the $38-trillion federal debt, a genuine game changer would be the speed and magnitude of the re-shoring plan for foreign manufacturing to move to the U.S. Calculating the potential future revenue streams, aside from raising taxes to offset deficit spending, generating up to a million new manufacturing jobs that work in tandem with AI would be a viable option – including large tax revenue implications.

As this chart shows, our manufacturing jobs have been trending down since 1980, and sharply since 2000:

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

There are no specific estimates of future tax revenue from the re-shoring of manufacturing, but re-shoring generates tax revenue through two primary mechanisms: (1) the largest being increased payroll and income taxes, and corporate and investment taxes, providing significant tax revenue. Also, (2) revenue will accrue from profits from any new or expanded U.S. based manufacturing companies as well as revenue from taxes on capital investment, new construction, and local property taxes on new facilities.

Re-shoring is heavily incentivized by federal acts, like the CHIPS Act, Inflation Reduction Act, and state programs. These incentives include refundable tax credits, 100% bonus depreciation, and exemptions that reduce immediate taxable income, lowering initial tax revenues, but exact revenue estimates are elusive.

The potential numbers look promising. According to the National Association of Manufacturers, for every $1 spent in manufacturing, there is a total impact of $2.65 to the overall U.S. economy. In addition, for every worker in manufacturing, 4.8-workers are added to the U.S. economy. This is one of the largest job multipliers in the economy. In 2024, manufacturing workers in the U.S. earned $106,691 on average, including pay and benefits. For all categories of manufacturing workers, hourly earnings averaged $35.50.

We could see 3.8 new manufacturing jobs in the next decade, due to organic growth and re-shoring alone, and these aren’t the old “assembly line” jobs. America leads the world in innovation, and manufacturers in the U.S. perform 53% of all private-sector R&D in the nation, driving more innovation than any other sector. Manufacturing R&D has more than tripled from $132.5-billion in 2000 to $404.7-billion in 2023.

At a time when there is growing concern about AI-related job destruction in several service sectors of economy, the ramping up re-shoring and expansion of domestic manufacturing is timely. With retirements rising and digital fluency growing, manufacturers are capturing institutional knowledge, redesigning roles for human-machine collaboration, and up-skilling at scale.

Based on what we know about the fragility of global supply chains during the pandemic, it is in our national and economic interest to “Build, Baby, Build” factories as far as the eye can see.

The post 12-2-25: Moving Toward More Domestic Manufacturing is Now a Must appeared first on Navellier.