by Ivan Martchev

December 2, 2025

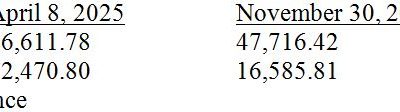

There was a pretty good run-up of over 325 S&P points in the last five-trading days of November, and suddenly we have a positive month. Just like that – all of the previous shrieking losses disappeared.

Why did we see this V-shaped bottom in late November?

First, there was a very large options expiration day two Fridays ago, the day we bottomed, to the tune of $3.1-trillion in notional value (you can look up “notional value for options” on ChatGPT). I have noticed many times that the bigger the notional value on the date the options expire, the weirder trading becomes, give or take a day or two. I would not put it past the option dealers’ algorithms that the sharp decline in the stock market the day before (November 20) may have something to do with this OPEX date.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

I did mention last week that I thought we were looking at a false breakdown and a likely bottom, given an intermediate-term buy signal from the VIX’s double-digit percentage decline, and neither the stock market nor the VIX disappointed on that front. The stock market ramped higher, while the VIX had three double-digit declines in a row, if you round the numbers, which is as big a buy signal as you can get.

Typically, after a bottom the sharpest gains are in the days right after, which is what we got last week.

Double-digit percentage declines in the VIX mean that large hedges taken against the S&P 500 Index are being liquidated and, instead of buying put options (the VIX going up), institutional players are selling options (the VIX going down), in some cases shorting them. That is all very bullish after a big VIX spike.

Below, you can see the buy signals (blue arrow), which I mentioned last week, with an updated VIX chart which is very similar to what we got on October 10 and the days following it (red-arrow), which at the time culminated with an all-time high. I think the same will happen here.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

Why do I think – and not know – that the same will happen here? Of course, I can’t know the future, and neither can anyone else. The president can override any convincing buy signals with a tweet, oversized tariff announcements – as he did on April 2 – or by ordering a missile strike from the largest aircraft carrier the world has ever seen – now in firing range off the coast of Venezuela. (There was a notice over the weekend that airspace over Venezuela should be considered closed. That implies imminent action).

Striking cartel targets is one issue, but getting bogged down in another long Iraqi-style war is another, but I do not believe the Trump administration is about to go down that road. The trouble is, we don’t know which route they are going to choose, so that raises the level of uncertainty somewhat.

Because of this very big rally in a short period of time – similar to what we saw at the end of October – it would be normal for the stock market to back and fill. Some minor pullback is likely, but I do not foresee retesting the November lows in any meaningful way, especially if missiles hit the right targets and the President’s Truth Social account stays relatively benign, but that is a nebulous concept for Donald Trump.

I still think the chances of the S&P 500 seeing the better side of 7,000 by the end of the year are better than 50-50. The Fed is giving the impression that they will cut interest rates, and Kevin Hassett looks like he is the favorite to replace Jerome Powell – and that would be a very good choice.

Sometime in early 2026 we will have to deal with the Supreme Court decision on tariffs. If ruled illegal, it upends a big part of the Trump economic policy, aimed at re-balancing unsustainable trade balances. They have said they have other options, but I am not sure the stock market would like an adverse ruling.

Even though the stock market hated the April 2 tariff announcement, there have been a number of pretty good trade deals which will be highly beneficial to the U.S. over the long-term. As we found out with the Chinese in the first Trump term, getting to a trade deal and holding them responsible to honor it are two very different things. I am not surprised that they are dragging their feet to get a trade deal done this time.

Despite the expected digestion of the rally coming this week – and military action in Venezuela seemingly imminent – I believe the glass is half full for investors and that the year-end rally has started.

The post 12-2-25: November Ends Positive – Like the Flip of a Switch appeared first on Navellier.