by Ivan Martchev

November 11, 2025

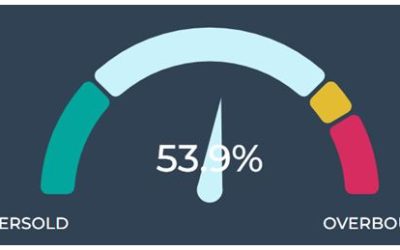

The S&P’s recent 4.2% decline was the kind of pullback I expected, a little larger than any pullback since late April, when the market began to recover in earnest, post-tariff tantrum. It is entirely possible that the selling is over, given that we tagged the 50-day moving average on the S&P 500 for the first time since April and then recovered impressively on Friday. The decline was over 100 points (in S&P futures, high to low) and a similar over-100-point recovery (low to high) to finish in the green. At $8.5-billion per S&P 500 point, these broad swings in the S&P 500 again came close to $2-trillion, as there were also some impressive swings, smaller in magnitude on Thursday night, after the futures market opens at 6:00 pm.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

I must emphasize again the difference between a correction – of generally 5% to 10% for the S&P 500, and a pullback. We did not get a correction during September or October, as is typically the case, so it would be ironic if we get one now, given that it is the strongest seasonal time of the year. This is not my base case, but stranger things have happened, as we learned in 2018, when the S&P 500 declined 19% between September and December – all without a recession – simply because of the Fed’s QT mistake.

This recent pullback is likely over if the U.S. government reopens soon and there are no serious complications on the geopolitical front, invading Venezuela, which now seems unlikely in the short-term.

First, why do I say the U.S. government reopening would be bullish for stocks?

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

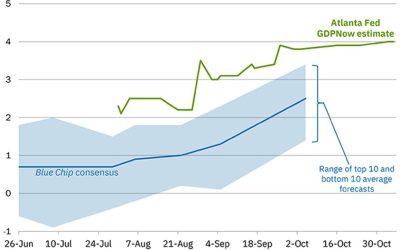

This chart covers the U.S. Treasury General Account at the Fed, which is like a checking account for the federal government. Many factors affect it, like a government shutdown, which causes it to surge as the government can’t spend the money. During the Biden administration there was a fight over the debt ceiling, which caused the balance to decline dramatically as the government had to spend every penny authorized, even while it could not issue more debt for as long as the debt ceiling fight was going on.

Both political parties have used government shutdowns as ammunition against each other. The current shutdown is the longest (not included in table, as it is not over). Here are the other five, ranked by length:

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

For reference purposes, the current government shutdown is a record 41 days as we go to press.

An investor asked me recently: “Can a government shutdown cause a recession?”

My answer is “No,” if the shutdown ends fairly soon, but if it lasts for six months, which I don’t believe will be the case, my answer will have to change to “Yes.” Security people at the airports need to get paid, as they have families to feed. The U.S. government is already restricting the number of flights, due to lack of air traffic controllers, and the list of critical services the U.S. government provides is long.

As the U.S, government account at the Fed suggests, this is money that is not entering the banking system. It is like quantitative tightening, but this time done by the U.S. Senate to the tune of $500-600 billion so far. It is not hard to imagine that people not getting paid spend less money. That limit to spending would reverse the minute the federal government reopens, but that date is still uncertain. A government reopening would be like a burst of quantitative easing – bullish for stocks, all other things being equal.

The Ukrainian Situation is Not Affecting the U.S. Market

In another week, if that long, Pokrovsk will fall and the encirclement strategy that the Russian army has deployed – at great cost of human life – will be completed. At that point, the best course of action is for the Ukrainians to surrender, as there is no winning when surrounded on all sides. Below is an updated map from a U.S. source that I posted a week ago. The encirclement is almost complete. There is fighting inside Pokrovsk, which in medieval terms is the equivalent of the fortress walls having been breached.

The Russians seem to think that taking Pokrovsk is key to capturing all of Donbass, as the Donetsk and Luhansk provinces are known. I think the fighting will stop when they annex all four provinces they claim, which would happen sometime in 2026, at the current pace, if the Trump administration does not manage to intervene. It is also possible that the front line will crumble, and it would happen a lot faster.

Regrettably, I do not believe it is possible for Ukraine to win this war, as they are outnumbered and outgunned, despite the fact that they have defended themselves brilliantly. Ukraine is victim to an East versus West proxy war, which Russia is winning, and for them it is about a lot more than just capturing territory.

I think we have the making of a new Iron Curtain, a new version of the East versus West division in Soviet-controlled Europe that collapsed in 1989. This time, the border states will run alongside the Russian Federation’s external borders, with Belarus, the four annexed Ukrainian provinces and Crimea.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

This new East-West division is not good for long-term economic development for the West, as the access to cheap Russian energy has been affected. Ukraine will flourish and be rebuilt after the war. It may end up in the European Union, but I seriously doubt it will join NATO, as they will not recognize the annexation and will be technically in a permanent truce, and therefore technically at war, with Russia.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

For comparison purposes, Cyprus joined the EU, even though part of that divided island is still occupied by Turkey and its proxies. I think the same sort of division will happen to Ukraine. I don’t like it, and you don’t have to like it, but that is the realpolitik situation at present. Incidentally, I don’t think Turkey can ever join the EU if it is helping the occupation of part of a country like Cyprus that is an EU member.

The post 11-11-25: The Pullback is Over, If…. appeared first on Navellier.