by Louis Navellier

November 4, 2025

Last week was a big week for technology earnings reports, specifically for Amazon, Apple, Google, Meta and Microsoft. First, on Tuesday, before earnings came out, Amazon announced 14,000-job cuts because it says it needs to better prepare for the impact of AI. Amazon senior vice president Beth Galetti said, “Some may ask why we’re reducing roles when the company is performing well,” and then elaborated: “What we need to remember is that the world is changing quickly…. AI is the most transformative technology we’ve seen since the Internet, and it’s enabling companies to innovate much faster than ever before (in existing market segments and altogether new ones).” Amazon also warned of additional layoffs in the future – more evidence that AI is eliminating jobs, in what many now call a “job apocalypse.”

I should add that Amazon is also aggressively automating its warehouses with robots to reduce even more jobs. Amazon has 350,000-corporate jobs, plus 1.2-million warehouse workers, for a total of 1.55-million, and Amazon recently hired 250,000-seasonal workers, so the company’s workforce has seasonal swings.

In related news, UPS has reduced its management workforce by about 14,000-positions so far this year, as well as cutting another 34,000 operational positions. The company said it is well positioned to navigate the upcoming holiday season and added that its restructuring efforts have resulted in cost savings of about $2.2-billion so far this year. Obviously, an AI-driven economy that promotes more on-line shopping has caused delivery companies to boost their efficiency, which may show up in U.S. productivity calculations.

The New York Times reported that General Motors is laying off 1,750-workers indefinitely and 1,670 more workers temporarily at its EV manufacturing plants due to the expiration of the $7,500 federal tax credit. In a statement, GM said, “In response to slower near-term EV adoption and an evolving regulatory environment, General Motors is realigning EV capacity,” adding, “Despite these changes, GM remains committed to our U.S. manufacturing footprint.” GM is second in U.S. EV sales after Tesla and actually offers the lowest priced EV in the U.S., namely the Chevrolet Bolt. Interestingly, GM also largely solved any “range anxiety” due to a double battery pack on its SUVs and pickup trucks, but this massive battery pack also makes these EVs extremely heavy and less efficient that some other EVs.

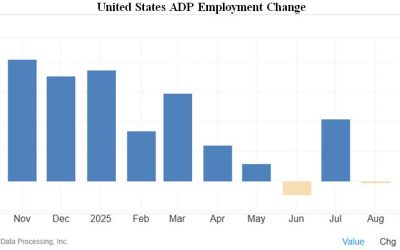

Outplacement firm Challenger Gray announced 54,064 job cuts by companies nationwide in September. This is the fifth highest monthly job cuts that Challenger Gray has monitored in the past 36 years. Since October totals will be even higher, the Fed must continue to cut key interest rates to stimulate job growth.

Turning to the big tech earnings reports, on Wednesday, Google posted the biggest surprise as its cloud sales rose 34% and Microsoft’s Azure cloud service also rose by an impressive 39%. Then, on Thursday, Amazon and Apple followed through with better-than-expected sales, earnings and positive guidance.

Even before announcing earnings, Nvidia became the first $5 trillion company after it announced a deal with Nokia, which helped Nvidia surge 12% in the past 10 days! Also, we may soon see expanded AI access within China due to President Trump’s meeting with President Xi. Trump said that he would discuss Nvidia’s Blackwell chip with President Xi, since that chip is currently not available in China due to export controls. Nvidia is now larger than the stock markets of France, Germany and Italy combined!

In addition to cutting key rates 0.25% last week, the Fed also announced on Wednesday they will wind down a three-and-a-half-year campaign to shrink its $6.6 trillion balance sheet as of December 1st. As for their interest rate statement and press conference, we learned that a minority of FOMC officials want the Fed to cut key rates at its December FOMC meeting, while a majority would opt to stand pat.

New FOMC member Stephen Miran voted to ease rates by 0.5%, while FOMC member Jeffrey Schmid voted for no rate cut. As a result, Fed Chairman Jerome Powell said that there were “strongly differing views” on what to do at the next FOMC meeting. Specifically, Powell said, “In the committee’s discussions at this meeting, there were strongly differing views about how to proceed in December,” adding, “A further reduction in the policy rate at the December meeting is not a foregone conclusion. Far from it.” Since the Fed is “flying blind” with a lack of key economic data, the FOMC is just being cautious. Treasury yields rose after what was perceived to be a hawkish FOMC stance, but I expect market rates to resume declining in December.

The Wall Street Journal reported that BlackRock is now trying to recover hundreds of millions of dollars after falling victim to what they called a “breathtaking” fraud. Specifically, lenders accused Bankim Brahmbhatt, owner of little-known telecom-service companies Broadband Telecom and Bridgevoice, of fabricating accounts receivable that were supposed to be used as loan collateral. Lenders filed a lawsuit in August claiming Brahmbhatt’s companies owe them over $500 million. Between a default rate of over 9%, the Tricolor and First Brand bankruptcy liquidations, and now this latest lending fiasco, private credit may stop expanding, since there are an increasing number of these credit fiascos disrupting the industry.

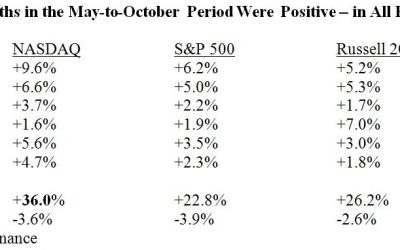

Finally, we’re entering the two strongest months of the year, and an early “January effect” appears to be already underway. There is no doubt that the breadth and power of the market is improving, since we are now in the midst of the strongest earnings announcement season in four years, according to Bloomberg. (Barron’s also has an article entitled “Stocks Are Set to Sizzle After a Weekend of Trade Moves.”) Despite the bad news that dominates the press, this is the best time of year to be invested in strong stocks.

Navellier & Associates; own Nvidia (NVDA), Apple Inc, (AAPL), Alphabet Inc. Class A (GOOGL), Amazon.com, Inc. (AMZN), Microsoft Corporation (MSFT), and Meta Platforms Inc Class A (META), in managed accounts. A few accounts own Tesla (TSLA), per client request. Navellier does not own General Motors (GM), or Nokia (NOK). Louis Navellier and his family own Nvidia (NVDA), via a Navellier managed account, and Nvidia (NVDA), Apple Inc, (AAPL), and Amazon.com, Inc. (AMZN), in a personal account. They do not own Alphabet Inc. Class A (GOOGL), Microsoft Corporation (MSFT), Meta Platforms Inc Class A (META), Tesla (TSLA), General Motors (GM), or Nokia (NOK), personally.

The post 11-4-25: Companies Boost Earnings…and Cut Jobs appeared first on Navellier.