by Bryan Perry

October 28, 2025

Investor stock portfolios are enjoying the best of times, fueled by some bullish current developments that are drawing money off the sidelines and into risk assets. As of Sunday night, a constructive trade deal with China from the Trump advance team looks positive, as a proposed 100% tariff on Chinese imports would be curtailed in exchange for a reduction of restrictions in rare earth metals and other concessions.

Also, the delayed CPI inflation report released Friday paves the way for the Fed to lower short-term rates by a quarter-point this week and lay the groundwork for another quarter point cut in December. The bull market in AI mega tech is now broadening out to include most of the other 10-sectors of the S&P 500 – and it is exciting to see the mid-cap, small-cap, and micro-cap stocks not only participate, but play serious catch up ball on the conviction of the lower future borrowing rates that they so heavily depend on.

President Trump and President Xi are planning to meet to formalize a trade deal this week, just in time for China shipping goods to fuel a holiday shopping season that is being touted as incredibly important to China’s export market, being that the U.S. remains China’s largest single export market.

If the U.S. had imposed 100% tariffs on Chinese exports to America as of November 1, the impact on China’s economy would have been significant but not catastrophic, likely shaving 1%-2% off its GDP growth rate while accelerating a shift in China’s export strategy to compensate for the huge new tariffs.

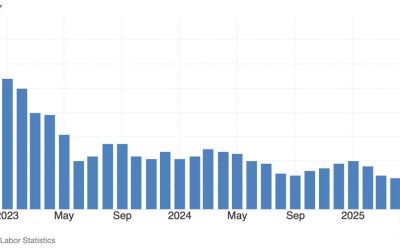

To put this trade relationship into perspective, China’s exports to the U.S. account for roughly 2.9% of its GDP, down from a peak of 7.5% in 2006 (source: chinafocus.. The dependence of the Chinese economy on exports, and in particular on its exports to the U.S., has been declining significantly. The fear has been that China’s economy would suffer badly in a tariff war, but the data actually shows otherwise.

The chart below, produced by China’s Bureau of Statistics, casts some light on the notion that this week’s meeting doesn’t offer much in the way of major economic impact but is just a high-profile glad-handing between the two superpowers to feel each other out in the long game of global power domination. The trade deal makes for impressive headlines, but it doesn’t even begin to address China’s long-term goals.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

It seems to me that this meeting is more about Trump trying to keep close to Xi as China’s rapid growth in military assets and its Belt and Road Initiative signal a formidable dual-track strategy to project power globally, both militarily and economically, threatening U.S. influence and favor in multiple markets and nations. Longer-term, it is my contention that Xi wants to outlast Trump’s final four-year tenure in office, and Trump wants to solidify his goals when he takes that last helicopter ride off the White House lawn.

Defense spending in China is surging. Official figures put China’s 2025 defense budget at $247-billion, but independent estimates suggest their actual military spending could be as high as $471-billion, making it the second largest global military power after the U.S. China now has the world’s largest navy by number of battle force ships. It is evolving into a blue-water navy, capable of operating far beyond its shores. While it still trails the U.S. in tonnage and missile capacity, its reach is expanding.

China’s Belt and Road Initiative (BRI) is at record investment levels. In the first half of 2025, China signed $66.2 billion in construction contracts and $57.1-billion in direct investments, nearly double the previous year’s pace (greenfdc). Projects include ports in Sri Lanka, railways in Africa, and energy pipelines across Central Asia. These assets often come with both commercial and military functions.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

Critics argue that China’s lending practices trap countries in unsustainable debt, giving Beijing leverage over strategic assets like ports and telecom infrastructure. Together, China’s military buildup and BRI reflect a coordinated strategy to reshape global power dynamics. The military secures China’s interests abroad, while the BRI builds economic dependencies and influence. This dual approach is challenging U.S. dominance and reshaping alliances across the Global South, which is 50% of the planet. The threat is the U.S. must pay extreme fees to ship goods to half the world, those controlled by Chinese port facilities.

Donald Trump has brought a greater challenge to China than any preceding president and, in doing so, he has resolved to work with China on a peaceful basis. For Xi, this week’s trade deal is more about tactical de-escalation and not resolution. The threat of 100% tariffs, a delay in rare-earth export controls, promises of soybean purchases, and fentanyl drug enforcement are largely Xi’s reversible, tactical concessions.

A Change in Trade Strategy Between Trump’s First and Second Terms

There’s little evidence of structural changes to industrial subsidies, IP protections, or state-owned enterprise reform – core U.S. demands since 2018, as championed by U.S. Trade Representative Robert Lighthizer, architect of Trump’s first-term trade war strategy. He isn’t working for Trump now because he was passed over for a Cabinet role and has declined to accept a lesser position in the administration.

Lighthizer’s zero-sum view of trade, coined in his litany of China’s “Seven Deadly Sins,” avers that foreign investment is a form of economic conquest. Lighthizer clashed with the more pro-market voices in Trump’s current team. His advocacy for taxing capital inflows and restricting foreign ownership of U.S. assets was seen as too extreme, even within Trump’s inner circle of second-term negotiators.

Lighthizer’s absence marks a pivot away from hard-line protectionism toward a more investment-friendly approach. While Trump still touts aggressive tariffs, his personnel choices suggest a balancing act between populist rhetoric and Wall Street interests. And by all measures, right or wrong, the market is “all in” on this line of thinking, now spearheaded by Treasury Secretary Scott Bessent and Commerce Secretary Howard Lutnick. The current narrative is what the market wants to hear, and so … up we go.

This week’s meeting suggests China is offering just enough to defuse immediate escalation and live out the Trump era, while preserving long-term leverage. Many analysts argue that the Trump-Xi trade deal is a tactical win for Trump’s optics during the 2026 midterms. Trump may have won the news cycle, but Xi is playing a long game, preserving China’s strategic position while giving just enough to avoid escalation.

Donald Trump’s final term will end in January 2029. Xi removed term limits in 2018, allowing him to remain in power indefinitely. China’s ruling party employs strategic patience to outlast strong leaders like Trump. While Trump may win this month’s battle, Lighthizer’s framework offers a more coherent and enforceable doctrine for the U.S. to continue its dominance of an ideologically comprehensive adversary.

The post 10-28-25: The Dangerous Long Game Dilemma with China appeared first on Navellier.