by Ivan Martchev

October 28, 2025

I’ve been writing about the power of presidential tweets over the last two weeks. While technically not a tweet, there was a move similar in magnitude to a Wednesday “tweet storm” that moved the S&P 500 36-points down in one-minute. It had to do with a news release discussing plans by the Trump administration to withhold critical software for numerous Chinese products, without which they would be unable to operate. This was apparently the Trump team’s response to China’s rare earth metals restrictions.

Note that the Trump administration has not actually issued any ban – which is, in effect, negotiating on live TV in the middle of a market trading day – but by the next day, Thursday, it became clear that the Xi Jinping meeting was still on for Thursday this week, which provided a small boost to stock prices.

One would think that, until that meeting actually happens on Thursday, there would be no escalation on trade issues. If the news after the meeting with the Chinese is “we resolved our differences,” the stock market would likely rise. If the trade war escalates, it is likely the stock market will come under pressure.

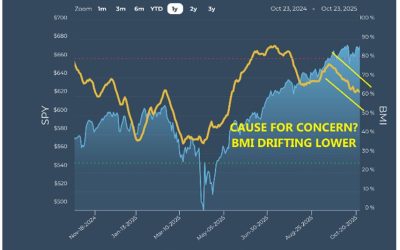

If it were not for this sort of trade war noise going on, share prices would likely be rising further, as we are entering the seasonally strongest part of the year. With plenty of big technology companies reporting this week – and those reports expected to be positive – further gains are likely. The VIX intermediate term buy signal I discussed last week delivered on its promise and further gains are likely.

Primarily, there are two main policy decisions that can push the stock market in one direction or the other. One comes from Jerome Powell, and the other comes from Donald Trump – but Fed Chair Powell does not tweet in the middle of the trading day, while President Trump does, so perhaps all our commentary from now on must include the caveat: “If President Trump does not override this situation with a tweet,”

The Rate of U.S. Inflation is Gradually Rising Again

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

The news that pushed the S&P 500 to a fresh all-time high is that inflation rose by 3% year-over-year. As this chart shows, the inflation rate has been steadily climbing since April, when it was 2.3%. The latest inflation rate was higher, but not high enough to stop the Fed from cutting rates this week. Still, some forecasters think the inflation rate is headed to 3.5% by the end of the year as tariffs begin to slowly creep into prices. If that happens, it would be much harder for the Fed to keep on cutting rates in 2026.

The Fed is also flying blind on the job front, as the government shutdown has delayed any new job numbers. Since we know the Fed is worried about the job market, as per their statements of late, I think they may cut the Fed funds rate tomorrow, but they may wait to check the data that comes out after the government shutdown ends before deciding to make another rate cut this year. If the Fed cuts rates this week and the Chinese trade meeting goes without negative headlines, we are likely to see further gains, as October ends this week, which is a catalyst for fund managers to mark up prices at the end of the month.

Paul Tudor Jones: A Blast from the Past

I saw Paul Tudor Jones (PTJ) on TV a couple of weeks ago, and he made the point repeatedly that the market feels like October 1999, drawing parallels between the dot-com mania and the current AI boom.

True, the NASDAQ 100 Index does trade with a persistent upside bias: Every sharp sell-off has been met with aggressive buying – which we experienced on October 10, a one-day wonder similar to what we experienced at the end of July and the first day of August, which was more like a two-day wonder.

In both cases, the sharper the sell-off the faster traders bought into it. (Also, we see that President Trump is trying to help the market recover with his tweets – both on the way down and the way up.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

Regarding the Paul Tudor Jones interview and 1999, if late 2025 is to be like October 1999, the NASDAQ 100 needs to double by March (as NASDAQ did in just five-months: See chart above). Also, there is a big difference in the nature of the rising stocks now and then. While there are extreme levels of spending on AI data centers, much of it is financed by surging cash flows at major tech companies (mainly the Mag 7).

A lot of the spending in 1999-2000 used borrowed money to build out fiber-optic networks and buy telecom equipment. That, in and of itself, is a major difference, but I have to say that it does bother me to see the circularity of OpenAI’s recent deals. First, Nvidia will invest $100-billion in OpenAI in tranches, so that OpenAI can have money to buy huge amounts of GPUs from Nvidia for data centers. Then AMD gives OpenAI a massive amount of warrants. Ultimately OpenAI can own up to 10% of AMD, so that OpenAI also uses large amounts of AMD GPUs. OpenAI is also doing large deals with Broadcom for custom made GPUs as well as huge contracts with data center providers like Oracle.

It is understandable that OpenAI wants to diversify its suppliers and fund its explosive growth. It is a software company with a maximum of $15-billion in forecasted revenues at the end of 2025, while private market cap value is $500 billion and rising. Basically, they are spending money they don’t have, other people’s money, in order to fund the growth of what is the fastest growing software company of all time.

I like their products, and I think they will succeed, but I sure hope PTJ is wrong and the NASDAQ 100 does not double in the next five-months, as it did after October 1999, since the consequences would be nasty.

Navellier & Associates; own Nvidia Corp (NVDA), Broadcom Inc. and Oracle (ORCL), in managed accounts. A few accounts own Advanced Micro Devices, Inc. (AMD) per client request. Ivan Martchev does not personally own Nvidia Corp (NVDA), Broadcom Inc. Oracle (ORCL), or Advanced Micro Devices, Inc. (AMD).

The post 10-28-25: Market Sets New Highs, After No “Trillion Dollar Tweets” appeared first on Navellier.