by Ivan Martchev

October 21, 2025

Every day since that dreadful tweet on Friday October 10, which caused the S&P 500 to lose 182.60 points, we have seen huge daily ranges of over 100-points. That’s five trading days and on all days where the point gain or loss was “minimal” at the close, the swings were horrific (see hourly chart, below).

Thinkorswim.com

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

Last Friday, one week after the president’s 100% China tariff threat, the S&P 500 cash market gained 34.94 points at the close, or 0.53%. On the surface, this looks like a normal positive day, but that couldn’t be further from the truth. The S&P futures, open for trading on Thursday night at 6:00 pm and trading all the way till 5:00 pm on Friday, makes the Friday futures’ session 23-hours long, while the liquid cash trading pit is open 9.30 am to 4:00 pm (without counting the less liquid pre-market and after-market hours).

From the opening high of 6669.25 on Thursday night to the early morning low of 6571.25, S&P futures declined 98 points. Then, till the recovery highs of 6718 near the close on Friday, futures rallied 146.75 points. Similar moves, sometimes slightly smaller in both directions, happened every day last week.

Why this extreme volatility?

It seems to me that investors cannot make up their minds. Some of the upside moves are due to some presidential tweets aiming to calm down the market, while those to the downside are due to resurfacing problems in the regional banking sector, where customer bankruptcies are causing spiking losses in a couple of regional banks. Jamie Dimon, CEO of America’s largest bank, noted, regarding those losses: “When you see one cockroach, there are probably more, and so everyone should be forewarned….”

If there are no more regional banking “cockroaches,” and if we have no bad news on the Chinese trade front, then the S&P 500 can make fresh all-time highs. All it takes is one positive presidential tweet, but the opposite type of tweet could fuel more downside moves. Which of those two outcomes is more likely?

Due to the power of the president’s tweets, I believe the answer is a crap-shoot. How does one anticipate a presidential tweet? I don’t think it is possible, but what is possible is to recognize that the Chinese are not negotiating in good faith. They are smart enough that they would love to make some sort of deal, but they would also try to renege on it the minute President Trump leaves office. Then we would have to hope that whoever comes after him holds them responsible for their deal. That sounds like a reasonable estimation of the likely course of events as the deals they made in the first Trump administration they did not honor.

On the geopolitical front, we have another potential event that can move global markets. President Trump is meeting President Putin in two weeks, in Budapest, Hungary. He did not give Ukraine any Tomahawk missiles when he met with their president last week, even though he had suggested previously that he was considering it. Simply put, Tomahawk missiles mean an escalation of the war, and since President Trump does deserve credit for the barely-holding Gaza truce and hostage release that may end the war there, he surely would prefer to take his geopolitical momentum and try to settle the Ukrainian situation, too.

A truce in Ukraine that leads to talks aiming to settle this crisis would be a huge positive for Europe, as it takes a wider war off the table. If he can accomplish a Ukrainian truce, European markets are likely to go higher, and so will the U.S. stock market, particularly if there is no bad news on the Chinese trade front.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

After fueling some pretty extreme sell signals on October 10, President Trump has tried to de-escalate such threats by creating some large swings higher in stock prices. The president can push the stock market to fresh all-time highs with his Truth Social account, or he can create a further sell-off. I doubt his goal is to create a downside in the stock market he wants to get a trade deal done. That much he proved in April.

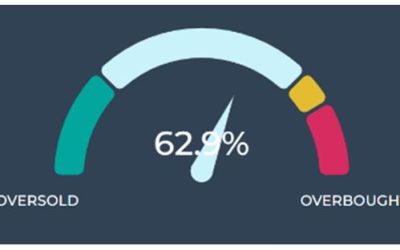

With all those caveats in mind, we have an intermediate term buy signal from the S&P 500 Volatility Index. Other than the extreme Japanese carry trade sell-off (in August 2024) and the Tariff Tantrum in April 2025, every time we have gotten near 30 on the VIX and reversed sharply lower – the VIX was down 18% on Friday – we have seen a substantial rebound in stock prices. In layman’s terms, that means the market has experienced some extreme selling, and the majority of those sellers may be done for now.

Be that as it may, watch out for any “trillion-dollar tweets.” They can be brutal.

Navellier & Associates; own JPMorgan Chase & Co. (JPM), in some managed accounts. Ivan Martchev does not personally own JPMorgan Chase & Co. (JPM).

The post 10-21-25: Will We See Any More “Trillion Dollar Tweets?” appeared first on Navellier.