by Bryan Perry

October 14, 2025

The current market flush, triggered by the Trump administration’s threat of additional 100% tariffs on China due to fresh export restrictions on rare earth metals – of which China controls 70% of the global supply – has provided a much-needed moment of consolidation in an overbought market, but I feel we remain in a long-term bull trend. This is a “pause that refreshes,” giving investors a chance to initiate (or add to) their slice of the pie in the top investment themes heading into year-end 2025, and then into 2026.

The most prominent themes driving investor attention now continue to be AI infrastructure and productivity, with the continued announcement of eye-watering capital commitments that cross the tape on an almost daily basis. While hype surrounding various AI applications is wide-ranging, I tend to focus mostly on semiconductors, data centers, and cloud platforms, where demand remains strong.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

It seems like every day we can read new stories about how the financial media equates the AI revolution with the bubble of the 1999 “dot-com era,” where hundreds of companies that that adopted a “.com” domain and a good sales pitch went bankrupt in sudden fashion in the year 2000 and thereafter, but I want to make it clear to investors that the AI transformation differs from the dot-com era because it’s built on mature infrastructure, real-world usage and proven demand, whereas the dot-com boom was largely speculative, on zero earnings, with many companies lacking viable products or business models.

In the late 1990s, the internet was new, and infrastructure (broadband, cloud, mobile) was still primitive. Many startups were built on hype, not capability. AI is built on decades of research, with robust cloud platforms, GPUs, and data pipelines already in place. Tools like ChatGPT, Copilot, Gemini and enterprise AI platforms are already deployed at scale, fueled by capital from the mightiest companies in the world.

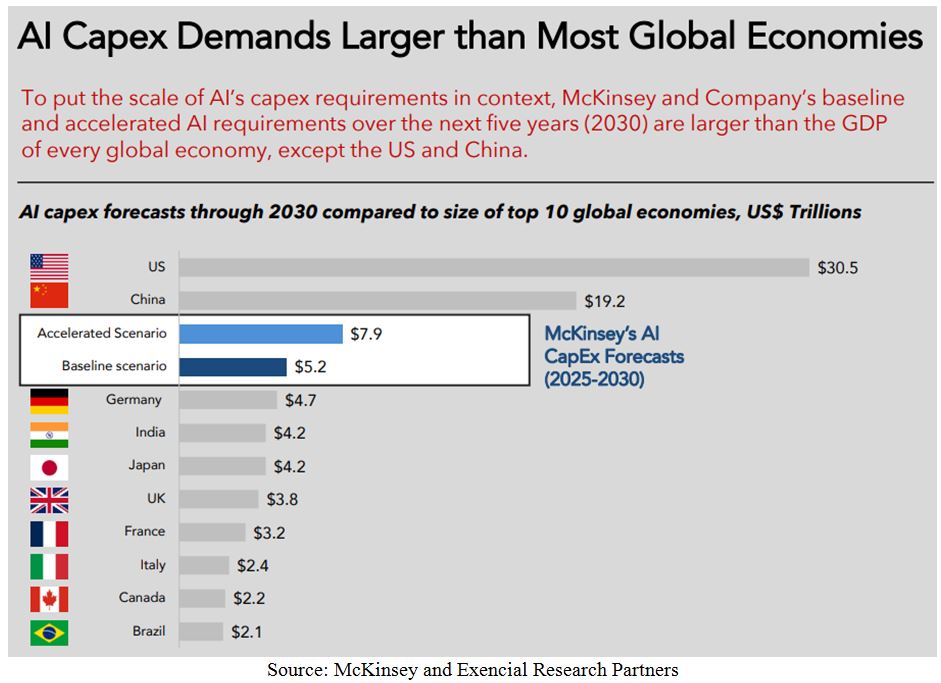

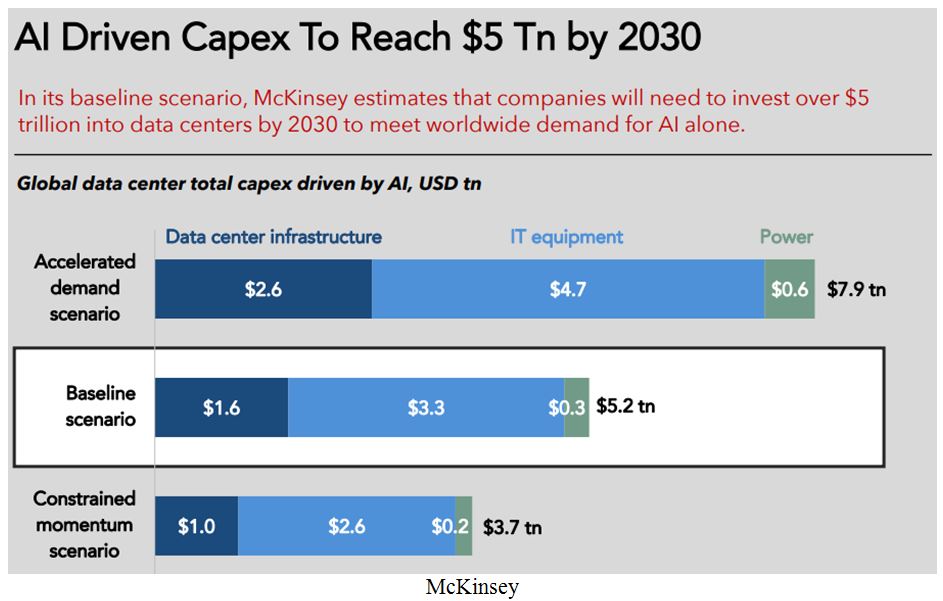

By 2030, the U.S. is expected to host thousands of data centers, with hyper-scale and colocation facilities driving exponential growth, though no single source can yet provide an exact count. McKinsey has put out some forecasts, stating that global investment in data center infrastructure is projected to reach $7-trillion by 2030, with over 40% of that total allocated to the U.S., or roughly $2.8-trillion.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

Grandview Research reports that the U.S. data center market is forecast to reach $164.7-billion in revenue by 2030, up from $89.9-billion in 2024, yielding a Compounded Annual Growth Rate (CAGR) of 10.6%. Using the baseball timeline, so constantly being thrown around, the AI infrastructure build-out appears to be in the 3rd or 4th inning of a 9-inning game, when capital deployment is accelerating but foundational systems are still being scaled and optimized to provide ample computer power and higher throughput.

This analysis coincides with the need for rapid expansion of the electric grid and the wealth-building opportunities within the engineering/construction sector, where backlogs, sales and earnings are booming.

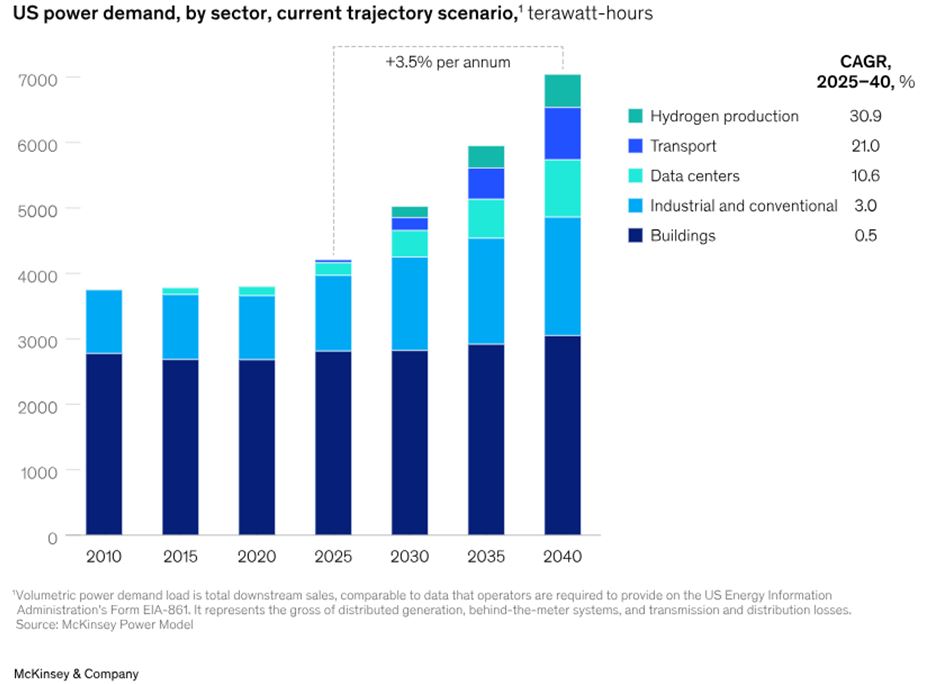

Much of the U.S. electric grid was built in the 1960s and 1970s, so the grid is undergoing a much-needed generational overhaul. Upgrading 70% of aging infrastructure is essential not just for reliability, but to enable the AI build-out, electrification and clean energy transition. The vast majority of transmission lines are approaching the end of their typical 50-to-80-year lifecycle, and McKinsey projects that U.S. power demand will grow by over 3% annually through 2040, requiring massive capacity expansion.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

Natural gas is still the largest source of electricity today (~40% of U.S. generation), providing reliable baseload and peaking power. Modern combined-cycle plants are efficient and relatively quick to build. Gas is abundant domestically, making it a stabilizing “bridge fuel” for the grid through at least the 2030s.

However, the greatest future fuel for U.S. grid expansion will likely be solar energy, complemented by wind and backed by natural gas for reliability, with nuclear SMRs and green hydrogen emerging as long-term strategic additions. Solar power is by far the fastest-growing source of new capacity. Utility-scale solar costs have dropped by over 80% in the past decade. The U.S. Energy Information Administration (EIA) expects solar to account for over 50% of new generating capacity added through 2030.

The price action for the solar sector has picked up after a steep multi-year decline, as charted below:

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

What seems clear throughout this whole AI experience is that the biggest players in this space are widening their “moats” (well-protected competitive advantages). AI is wildly expensive to deploy at scale. Using market pullbacks to accumulate shares of the top Who’s Who among the AI infrastructure and applications companies is the way forward to continued capital appreciation of portfolios.

Aside from AI, the power grid, gold, autonomous driving, robotics, quantum computing, nuclear power and cryptocurrencies all represent highly desirable areas of capital concentration for diversification in a market that is broadening out. The innovation coming from AI and these future technologies, along with Fed easing, are structural tailwinds that won’t be stopped by a geopolitical dispute over rare earth metals.

We are at the start of an exciting fourth quarter, which is shaping up to be a contrast of headline-driven selling pressures with buying opportunities, offering long-term investors an opportunity to partake in one of the most compelling generational wealth-building growth cycles in stock market history.

The post 10-14-25: A Chance to Buy “Wide Moat’ AI Leaders after a Market Flush appeared first on Navellier.