by Ivan Martchev

October 7, 2025

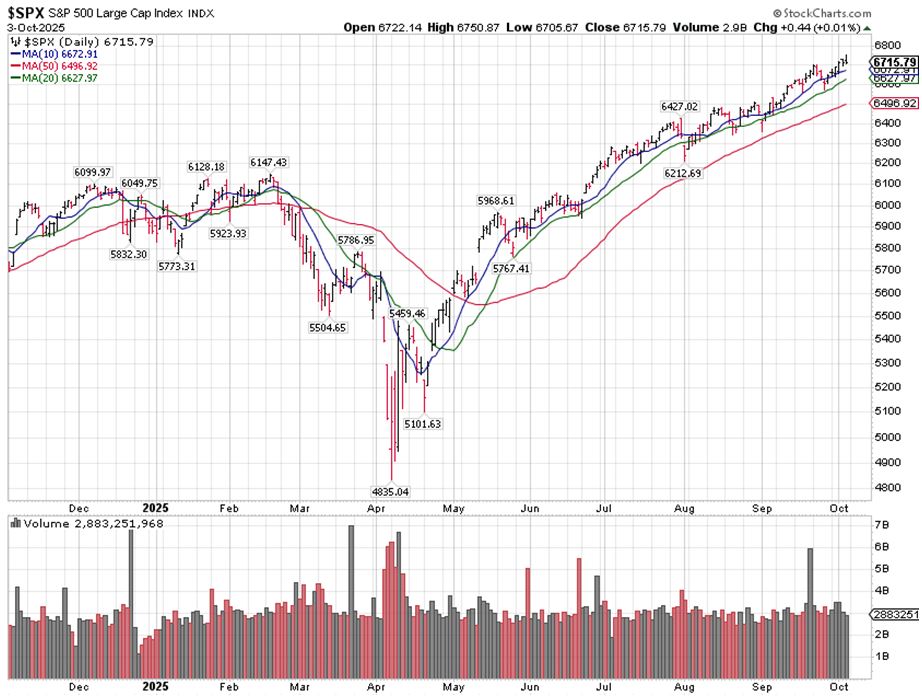

On both Thursday and Friday, October 2-3, the S&P 500 set fresh all-time highs, and on both days the index closed below where it opened. This is what is called “selling into strength.” Big money investors are booking gains and rotating into the value part of the market. This rotation was more evident on Friday when the NASDAQ 100 was notably down after a fresh all-time high. The S&P 500 was more-or-less flat, while both the Dow and Russell 2000 were notably up, even though they cut their gains by more than half as the multi-trillion-dollar mega-caps in the S&P 500 and NASDAQ 100 indexes pulled the market lower.

Such rotations can make for a very confusing trading environment. One part of the market (value) is going up while another part of the market (technology) is providing the funds for that rally by selling off. Such rotations have lasted more than a day before but, in many cases, they have been “one-day wonders.”

If this rotation turns out to be a multi-day event, we will likely get a correction, as it is not mathematically possible for investors to sell the NASDAQ 100 and buy the Russell 2000 without seeing a market decline – as several single companies in the NASDAQ 100 index are bigger than the entirety of the Russell 2000.

In fact, the largest company in the U.S. stock market – the one that makes the world’s best AI chips – is bigger than all but four of the world’s stock markets (Japan, China, India and, of course, the U.S.). That means that all stocks in France, Germany or the UK are less valuable than one single U.S. company.

As with the Russell 2000, we have more than one U.S. company that is bigger than many global stock markets. We call these behemoths the Magnificent 7 (or 8, if you include Elon Musk’s Electric-Vehicle company, which tends to trade in more erratic fashion, given the unconventional manner, to put it mildly, of Musk).

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

On Friday, the NASDAQ 100 Index (charted above) printed a “bearish engulfing pattern,” which typically comes at an intermediate-term high for an index of individual stocks. It may indicate a trend change from up to down. (I say it “may” indicate, because one day a trend does not make).

At the end of July, we also printed a bearish engulfing pattern, not only on the NASDAQ but on all major indexes, and the following sell-off lasted one more day. This two-day sell-off was very impressive, as the major indexes lost all their July gains in two-days, then reversed immediately in five-days in early August.

I am writing this on Sunday, so I have no idea ahead of time how Monday’s or Tuesday’s trading will end, but we are due for a correction, and early October is known for corrections. If we get a couple of bigger down days early this week, the chances that we have started a correction will increase quite a bit.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

We have seen no corrections since late April. Instead, we have seen sharp pullbacks that have led to fresh all-time highs. The S&P 500, which is less volatile than the NASDAQ 100 (and is better diversified) has made only three closes below its 20-day moving average – one in late July, one in mid-August and one on the first trading day in September. The S&P 500 is up 39.8% from intraday low to intraday high off the April lows. Rising that much without any meaningful giveback is extraordinary. It would be unlikely for us to keep ramping up like that into December, but as Yogi Berra put it, “It ain’t over till it’s over.”

What I think happened here is that many money managers sold with conviction in April, thinking we were going into a recession. Then they missed the bottom and began chasing the market higher, which explains the lack of corrections. Some investors sold (or shorted) the market in late July because of the sharp rally and kept getting squeezed, so I’d say this sharp rally is a function of under-performing money managers hit with rolling short squeezes. Typically, such rallies continue until the last bear throws in the towel.

We’ll know more this week, but the potential for a pullback is not insignificant.

The post 10-7-25: We’re Seeing “Toppy” Action Without Conviction appeared first on Navellier.