by Bryan Perry

October 7, 2025

As the fourth-quarter gets underway, market sentiment has shifted to a decidedly positive outlook for lower interest rates and bond yields. Recent economic data – like ADP private payrolls, a weaker labor differential reported by the Conference Board, and manufacturing and services ISM reports for September 2025 – showed signs of economic weakness, with contraction in key areas and stagnation in services.

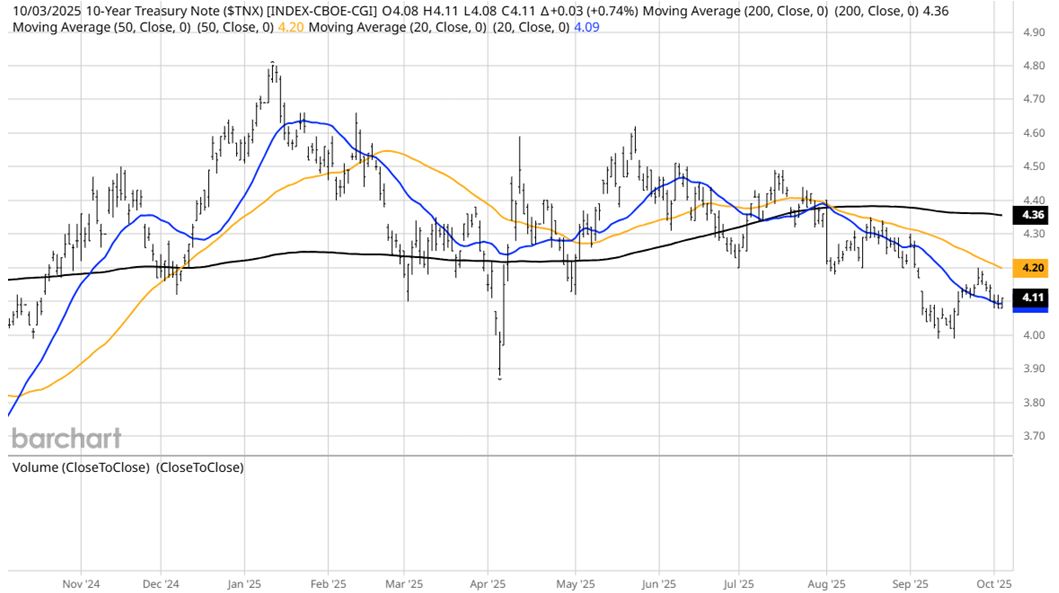

The benchmark 10-year Treasury tested the 4% level twice in September, then briefly backed off. As of Friday’s close, the rate was 4.11%. Any move below 4% will provide further bullish conviction for U.S. financial markets and pave the way for lower mortgage lending rates for businesses and consumers.

While falling rates are bullish for equities and bond prices, income investors will face lower interest income streams in a declining rate market, making it more challenging to meet their household budgets.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

There are, however, some alternative forms of income outside the bond market that offer some lofty rates of annual distributions that are linked to the major stock market indexes.

The first ETF selling covered calls on major stock indexes debuted in the mid-2000s, with the Invesco S&P 500 BuyWrite ETF (PBP) launching in December 2007. The ETF format made these strategies accessible to retail investors without needing to manage options directly.

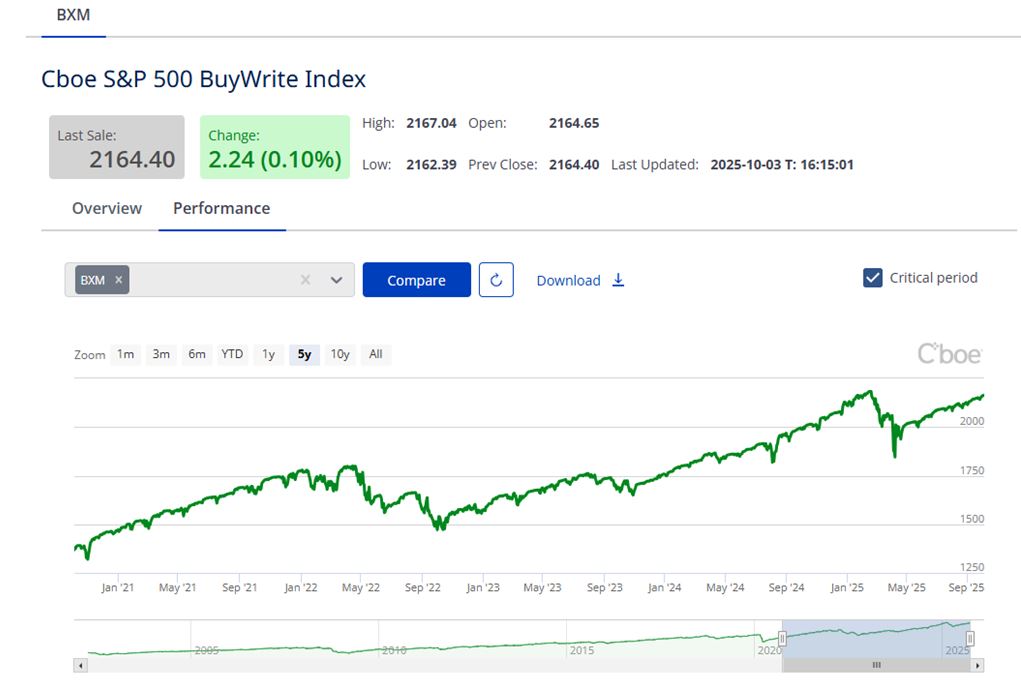

These ETFs were designed to replicate the performance of buy-write indexes like the CBOE S&P 500 BuyWrite Index (BXM), which itself was introduced in 2002. Post-dot.com, and again post-2008, volatility created demand for income-generating strategies that had shown resilience in choppy markets, generate monthly income via option premiums received, and provide a measure of downside cushion.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

The ETF format made these strategies accessible to retail investors without needing to manage options directly, and their popularity has only grown over the years, both in the number of available ETFs to choose from and their assets under management (AUM). The five-year annualized return for the CBOE S&P 500 BuyWrite Index (BXM) has been approximately 9.52% as of October 1, 2025.

Bear in mind that this figure reflects total return, including dividends and option premiums, consistent with the index’s methodology. A 9.52% five-year return under-performs the five-year annualized return for the S&P 500 as of August 31, 2025, at approximately 13.0%, but the CBOE S&P 500 BuyWrite Index (BXM) has historically exhibited about 30% lower volatility than the S&P 500 Index (SPX).

Investing in buy/write strategies doesn’t come without market equity risks, but the market is entering what is shaping up to be an extended period of declining bond yields that should extend the market’s rally, even as the S&P 500 trades at historically high P/E ratios, based on optimism about future earnings.

Taking a look at this sector and the available choices, I see a couple of candidates to consider for superior distribution rates – both are from the NEOS family of ETFs, which have grown rapidly:

- NEOS NASDAQ 100 High Income ETF (QQQI): 14.28% Distribution Rate. AUM $5.2-billion

(YTD Performance 15.30% versus NASDAQ 100’s 18.10%)

- NEOS S&P 500 High Income ETF (SPYI):16% Distribution Rate. AUM $5.6-billion

(YTD Performance 12.77% versus S&P YTD, at 14.83%)

As with any investment noted in this column, and past columns, investors and/or their advisors should conduct their own due diligence before investing. There are several other buy/write ETFs and closed-end funds pursuing similar strategies, but these two ETFs pay out some generous monthly distributions, coupled with stable to higher share price action.

The post 10-7-25: Finding Juicy Yields from Option Income Funds appeared first on Navellier.