by Bryan Perry

September 30, 2025

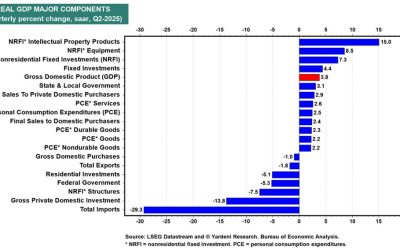

The U.S. is running multi-trillion-dollar deficits each year, with Treasury bond issuance ramping up to fund spending and interest payments. In the federal government’s fiscal year 2025, ending today, net issuance of marketable debt is projected to exceed $2.5-trillion, pressuring the long end of the curve.

This is a growing concern, in that there is diminishing demand from traditional buyers. Foreign central banks (notably those in China and Japan) have reduced their holdings, partly due to geopolitical tensions and reserve diversification. Primary dealers are absorbing more, but their balance sheet capacity is finite.

Top U.S. bond holders in 2025 include Japan ($1.13-trillion), United Kingdom ($808-billion) and China ($757-billion). The Cayman Islands, Belgium, Luxembourg and Canada also hold hundreds of billions in U.S. Treasuries. Collectively, the top 15-foreign holders own over $6-trillion in U.S. Treasury securities.

UK holdings have surged recently, rising 13% year-over-year. Japan remains the largest holder, despite some modest reductions, and China has steadily reduced its holdings in recent years and is now at their lowest level since 2009. Foreign ownership of Treasuries overall hit a record $9.16-trillion in July 2025.

Thankfully, Treasury yields are inching lower since the Fed cut its short-term lending rate by a quarter point, and the market is banking on two more quarter-point cuts by year end, based on recent inflation data and comments from Fed Chair Jerome Powell, who has noted that job openings have declined, and wage growth has moderated, suggesting reduced upward pressure on inflation. He emphasized that the Fed is now “more concerned about unemployment than inflation,” signaling a dovish policy pivot.

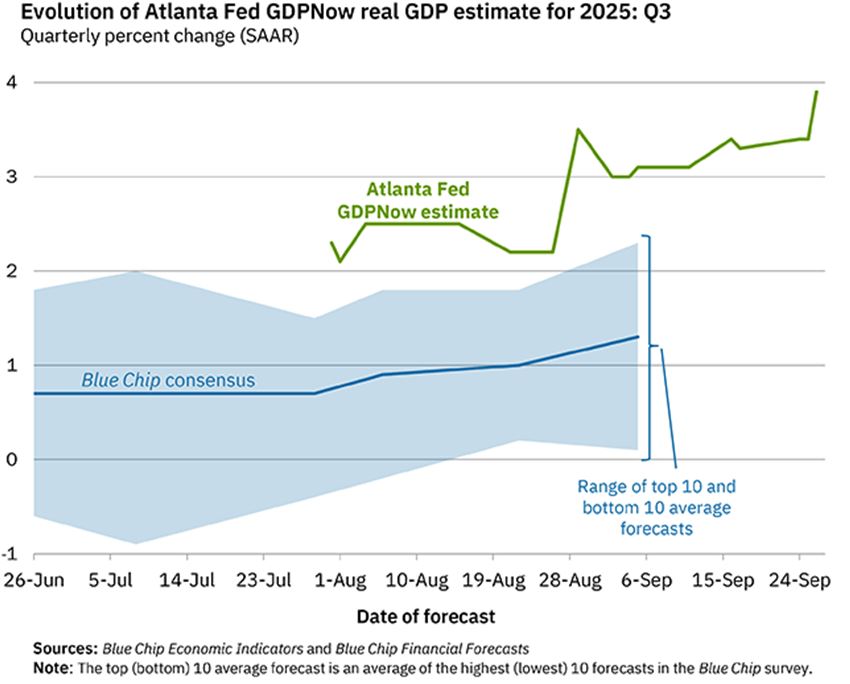

This Fed pivot comes at the same time as the latest GDP reading from the Atlanta Federal Reserve is being revised higher. Their GDPNow model estimate for real GDP growth from last Friday (seasonally adjusted annual rate) in the third quarter of 2025 is 3.9-percent, up sharply from 3.3-percent previously.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

Assuming this lower rate environment continues, and the economy remains healthy, income-oriented investors looking to lock in attractive fixed income yields that are not leveraged might consider shopping in the U.S. junk bond market. As of Q2 2025, the high-yield corporate bond market is estimated to cover about $1.4-trillion in outstanding debt vs. the $10-trillion market for investment grade corporate bonds.

In addition to potential price appreciation from lower short-term rates, high-yield bonds offer yields as high as 7.4%, which is far higher than Treasuries or investment grade bond yields, and they typically have shorter maturities, averaging 5 to 7 years. This feature tends to provide good visibility and price stability, where stocks that pay lofty yields can exhibit extreme volatility. In the event inflation returns, having shorter-term maturities lowers duration risk if Treasury yields begin to rise again.

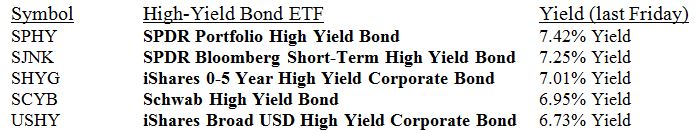

Rather than buying high-yield corporate bonds individually, using ETFs makes sense for a few reasons – diversification, institutional access to highly desirable issues, and monthly distributions. Expense ratios vary from 0.15% to 0.4% and yields average around 7%. The unlevered ETFs with the highest yields are:

The next Federal Reserve meeting is scheduled for October 28-29, and markets are heavily focused on whether the Fed will deliver a second rate cut this year. The final 2025 meeting will be held December 9-10, so it might prove prudent to see how S&P 500 companies report sales and earnings growth during the first two weeks of the Q3 reporting season kicking off in mid-October before buying junk bond ETFs.

Forward corporate guidance will be one big key to knowing if the economy is absorbing the impact of tariffs well and whether the labor market, business investment and consumer spending remain healthy. Most of the recent data indicates steady growth ahead for the U.S. economy, but hearing it from America’s C-suites firsthand is more reliable than government data that has been heavily scrutinized. When reaching for yield in “junk” debt markets, investors want to be sure the economy is on terra firma.

The post 9-30-25: Finding Good Yields in the Bond Junk Yard appeared first on Navellier.