by Ivan Martchev

September 30, 2025

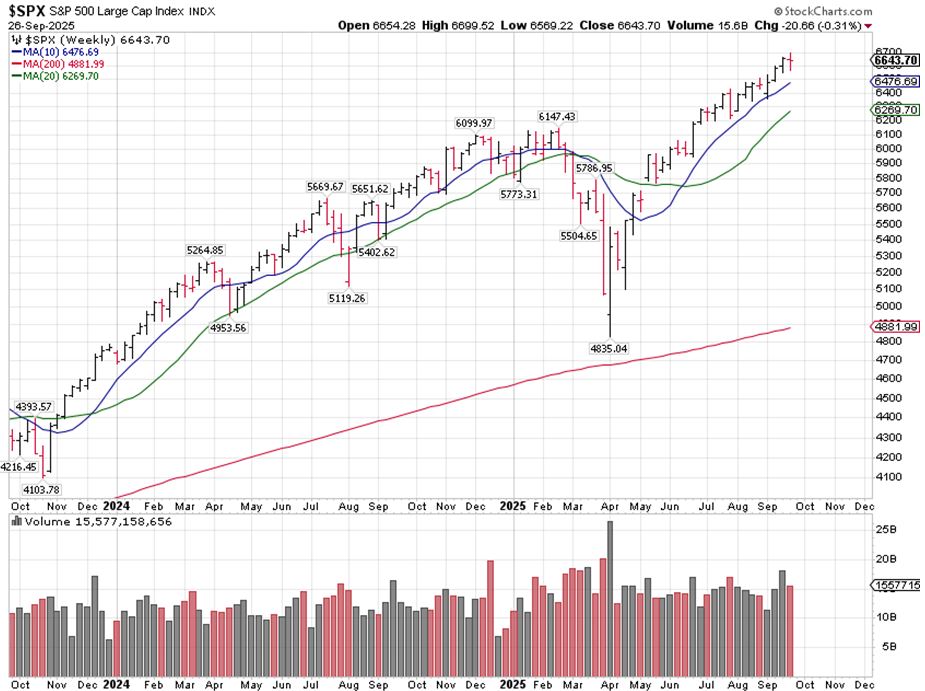

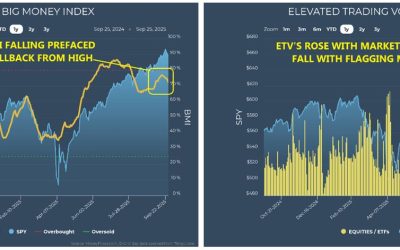

Today, September 30, is when the third quarter ends. Investors typically celebrate that event by pushing stock prices up at the end of the quarter. Just go back and see what happened at the end of June and you will see what I mean. Such furious buying was clearly related to quarter-end June positioning at the time, so unless we have adverse developments on the geopolitical front this week, I would expect the same.

Source: thinkorswim

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

Also, check out this December S&P futures chart, updated from last week, when we traded below hourly support and quickly declined by 130 S&P points, which is on the smallish side of all pullbacks in the last quarter (the biggest one was over 200 points in early August). I think of “corrections” as a trend that lasts more than a week or two – something we have not seen for a while, while I consider sharp one-to-three-day declines against the major trend as “pullbacks,” not real corrections, as far as I am concerned.

Since the rally started in earnest last April, we have had only two down weeks in a row – in June, in the middle of the Iran-Israel conflict. In other words, there have been no real corrections since early April.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

Escalation of the War in Ukraine Could Fuel a Fourth-Quarter Correction

It’s impossible to predict external events in advance, but the chances of an escalation in the Ukraine war increased over the past week. I hope the war does not escalate, as the downside of such an event would be impossible to estimate, as it is directly proportional to how big the escalation is, but the chances increased dramatically as President Trump declared that Ukraine can push the Russians to pre-invasion borders. That’s a major shift in his policy stance. Since it is clear that Ukraine cannot do that by their forces alone, it requires the entrance of third-party countries on behalf of Ukraine to deliver such an outcome. That basically means a declaration of World War III, which is an outcome we should strive to avoid.

The escalation could take place due to a seemingly minor event. The Russians have been violating NATO airspace with their drones and jets of late. All it takes is for one NATO country to take down a Russian jet in some marginal violation of airspace – like Turkey did in 2015 during the Syrian conflict. The Russians let it go back then, but I don’t believe they will be so forgiving this time around. In other words, the potential for the Ukraine war to turn into a multi-country conflict in that scenario increases exponentially.

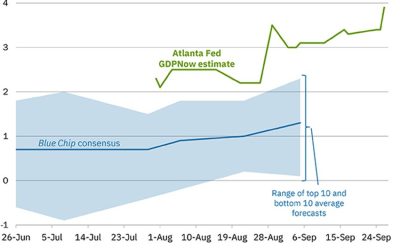

I hope that we have no escalation in Ukraine so that we can focus on economic issues, which are easier to forecast. I think the glass remains half full when it comes to the stock market, even though the market did not produce any downside seasonality in September, despite last week’s pullback. The key catalysts for any correction would be employment and inflation indicators that have now increased their importance due to a trade war and the huge downside revisions in job growth that cost the BLS commissioner her job.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

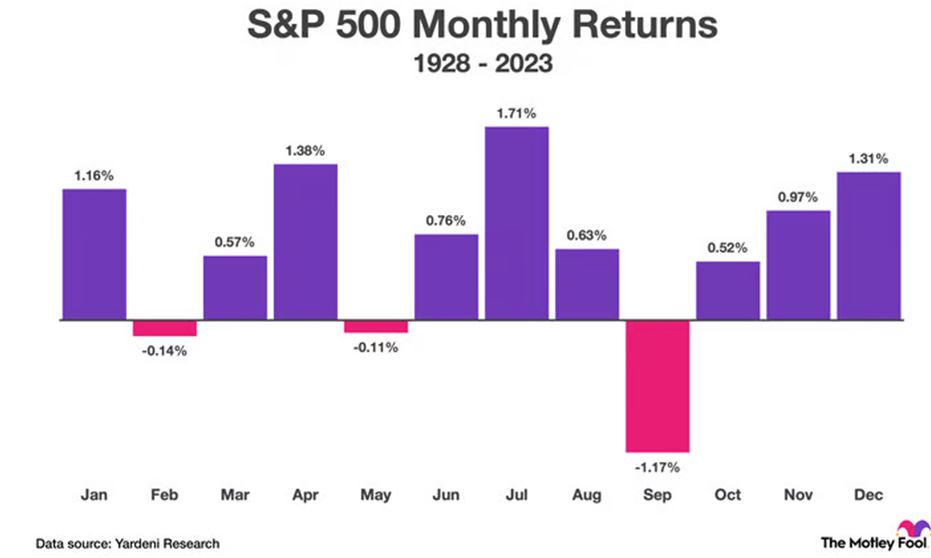

Despite September being the worst month over long periods of time, this year (like last), September has been positive this time. As I have stated previously, seasonality is a guideline but not a guarantee.

One of the worst periods that went against positive seasonality was the 2018 over-tightening by Jerome Powell’s Federal Reserve, when the stock market declined by 19% from September to December, without any bad economic news. The catalyst was the Fed’s misguided quantitative tightening in late 2018.

Another period that went against positive seasonality was last March and April – two-positive months in market history – but this year the imposition of cost-prohibitive tariffs as a negotiating tactic by the Trump administration actually pushed the S&P 500 down more than 20% if one were to look at intra-day extremes. Keep that in mind as we enter the seasonally most positive part of the year.

I think the S&P 500 will make it to 7,000 by year end, but I also think it is unrealistic for this to happen without a correction. Institutional investors have gotten so fixated with slicing and dicing the market that they now go by weekly seasonality, which in any given year may be a crap shoot. For example, looking forward to October, bear in mind that the first part of October tends to be a lot weaker than the second part of October. It remains to be seen if this year’s October seasonality will live up to its expectations.

The post 9-30-25: A Quarter-Ending Ramp-Up Is Likely appeared first on Navellier.