by Ivan Martchev

September 23, 2025

In trading lingo, there are plenty of common sense sayings that need to be respected. “The trend is your friend” is one of the more common axioms. So, where is the trend of the market now? Up!

“Don’t fight the Fed” is another favorite saying, so what is the Fed doing now? Cutting interest rates, fueling all-time highs for the S&P 500. A third popular saying – born in the time when stock prices were transmitted via telegraph and ticker tape – is “Don’t fight the tape.” Translated, that meant “reading the tape,” with an eye toward figuring out how the market is acting, in order to position oneself accordingly.

Reading today’s digital “tape,” the stock market looks to be very extended, but there is a saying for that, too. British economist John Maynard Keynes put it this way: “The market can be irrational longer than you can be solvent.” With that saying in mind, here are some observations.

First, the chart below shows how the December S&P futures have performed for the whole of September.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

The September S&P futures expired last Friday on quadruple-witching expiration day, which is one reason why the stock market ran up going into Friday. Quad-witching expirations at the end of a big rally often mark a short-term top, or a “buying climax,” even though that has not yet become obvious. If Friday marked a top, that fact should become crystal clear in the next five trading days (by September 30).

If the December S&P futures start to trade below Friday’s lows – or better yet, close below that key level – they would be violating hourly support trend-lines that have held for the last 300 S&P points. That would probably mean that a sharp pullback has started. The biggest pullback in this surge was over 200 points in late July and early August. A great trader told me to “never lose sight of the hourlies.” If you go back and study hourly trend-lines over the summer, you will see sizable pullbacks – not hard to spot ahead of time.

Remember that a pullback is different from a correction, as a pullback tends to reverse very quickly as the stock market makes new all-time highs. We will know if a pullback has turned into a correction if the S&P 500 begins to trend lower, below 6400, as that level will be below several key moving averages.

The market is certainly due for a correction, but the stupidest thing one can do is to declare that the rally is either irrational or crazy and then bet on a pullback before it has started in earnest.

What Other World Markets Tell Us About America’s Market

I can spend all day talking about interest rates and credit spreads, but individual investors love charts and many readers of this missive are individual investors, so here are some more observations on the Nikkei 225, based on the fact that one famous investment strategist based in Asia used to say all the time that the Japanese are the ultimate momentum traders and that charts are not pure hocus-pocus.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

If you look closely, you will see beyond a beautiful uptrend and some very dramatic action last Friday.

Bear in mind that Nikkei cash trading runs from 8 pm Eastern Time on Thursday in America (which is morning in Japan), until 2 am Eastern Time. Because Nikkei futures trade 24-hours a day, both in Chicago and Singapore, the index can be more “gappy” from day to day as European markets and the U.S. markets can pull and push Nikkei stock index futures quite a bit before Nikkei cash trading has even started.

That said, late on Thursday night after Nikkei cash trading had already started, I saw some dramatic moves in the Nikkei as I was waiting for the Bank of Japan to come up with their version of an FOMC statement, which did not disappoint – if one was looking for drama. The chart shows only a 257-point decline in the Nikkei, but it also shows that it was up a lot at the open, so it had a 1350-point sell-off from the opening highs before rebounding. The reason for such aggressive selling at an all-time high was that the Bank of Japan statement implied they would begin selling some of their stock holdings.

Unlike the Fed, which officially does not buy U.S. stocks, the BOJ did buy a lot of Japanese stocks to support the Japanese stock market. From the Taipei Times, we read:

“The BOJ’s ETF holdings are worth about 3-trillion by book value and was about ¥74.5 trillion at market value at the end of March. It became the single biggest holder of Japanese stocks in 2020 during its massive monetary easing program, which ended last year. While the bank stopped its regular buying of ETFs some time ago, the value of its holdings has continued to rise as the stock market hit record highs earlier this week. The Nikkei 225 has gained about 26-percent since the start of this fiscal year.”

Book value is what they bought them at, market value is what they are worth now or $537-billion at current exchange rates. While the BOJ will be selling slowly over many years, this press statement from the BOJ for Japanese futures traders was like feeding red meat to hungry dogs.

What the Nikkei exhibited on Friday is what Japanese traders call a bearish engulfing pattern, or a high-volume big range reversal that comes at a high. Such messy trading often signifies a trend change from up to down. Because the Japanese are the ultimate momentum traders, I think they will run with the ball they have been given by the BOJ and press the Nikkei lower about 3-5%.

At a minimum, I see very high chances of a sharp pullback in the Nikkei index.

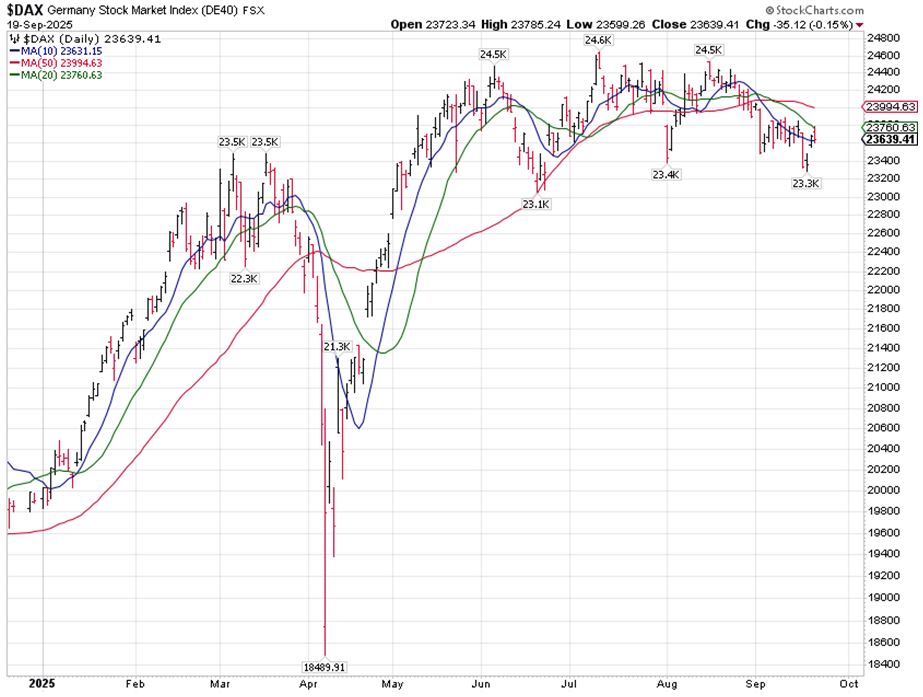

But what about the German DAX Index?

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

The German DAX outperformed the S&P dramatically in January and February, but since June it has been as flat as a pancake, while the S&P 500 has begun to outperform dramatically. The reason why the S&P 500 outperformed so dramatically over the past 15-years is mostly the tech sector in the U.S. About 40% of the value of the S&P 500 Index is in its top 10 components, only two of which are non-technology. The eight tech giants are the Mag 7 plus a famous electric car company, which is a technology company as far as I am concerned. Those companies are about 70% of the value of the NASDAQ 100.

It appears that the EU, and Germany in particular, completely missed the boat on digital transformation of the world economy. They are falling behind as the digital business is dominated by U.S. companies (and increasingly Chinese ones). Still, the DAX Index does have some indication of where the winds in investor sentiment are blowing in Europe, and those investors do not feel very bullish. All key short-term moving averages in the DAX (10, 20 and 50-day) are pointing lower. This index is sending bearish vibes and the most likely thing one would expect here is a deeper sell-off. Some deep pocketed investors have been selling into strength for a while, and they may tip the market into a further sell-off.

To recap, the Nikkei had a highly potent bearish reversal Friday, and the DAX looks outright miserable. If they are sending any signals as to where the S&P 500 is headed next, it is at a minimum a sharp pullback.

The post 9-23-25: We’re In “Thin-Air” Territory in the U.S. Stock Market appeared first on Navellier.