by Bryan Perry

September 23, 2025

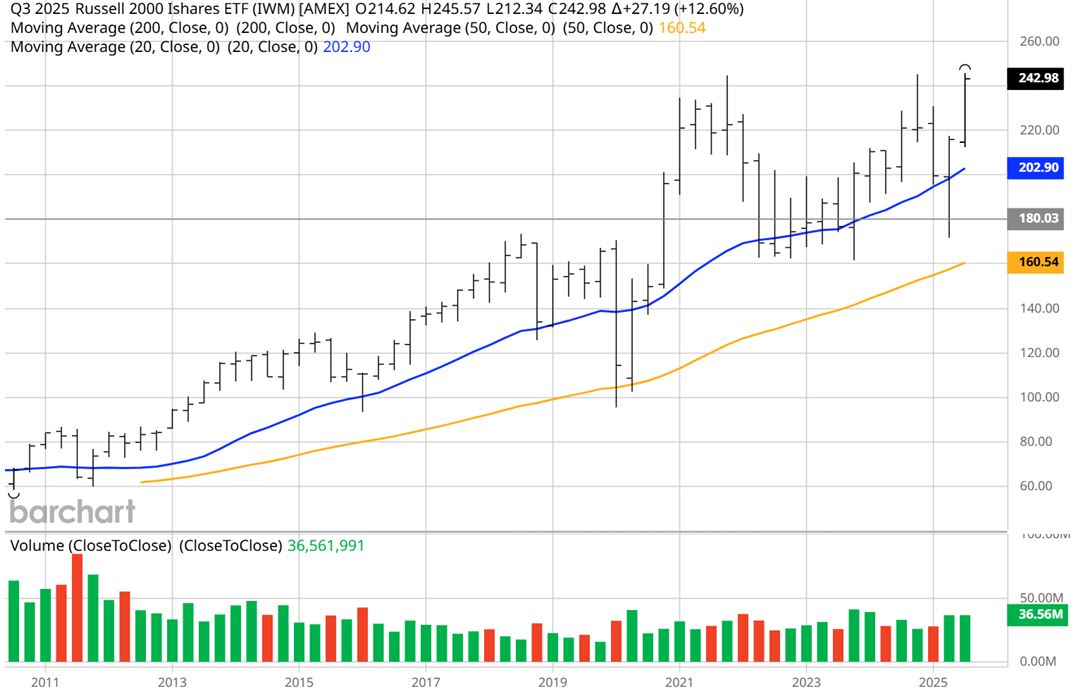

When the Russell 2000 index of small-cap stocks hits a new all-time high, it is generally considered to be a positive and expansive sign for the broader market and the economy. As of last Thursday, the Russell 2000 did just that, closing at record high of 2,467.70, signaling a fresh level of “risk on” sentiment.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

Historically, any new all-time high in the Russell 2000 – particularly one that breaks a long period of under-performance relative to large-cap stocks – has often been a precursor to further gains in the major indexes. It is often viewed as the final piece of the puzzle, confirming a sustained bull market.

This is a very special development for market bulls. For much of the past two years, large-cap indexes, like the S&P 500 or NASDAQ, have rallied to new highs, usually led by a few massive tech companies. With the Russell trading to a new high now, that suggests the rally is broadening out to smaller, more diverse companies, confirming the strength of the bull market across different segments of the economy.

This sudden Russell rally is a paradox of sorts in that a lot of recent economic data reflects slowing economic growth. The Bureau of Labor Statistics revised its payroll data downward by 1.2 million jobs for the 16 months leading up to March 2025, suggesting job growth is significantly weaker than believed.

Heather Long, chief economist at Navy Federal Credit Union and previously a Fed reporter for the Washington Post, said, “The U.S. economy barely has any jobs right now and it’s been that way for a long time,” adding, “The Federal Reserve needs to cut interest rates in September, October and December, and the White House needs to quickly finalize a trade deal with China. Businesses aren’t going to invest and hire more people again until there is more certainty.”

The Russell 2000 hitting new highs (while the labor market is softening) reflects investor expectations for Fed policy. The market, especially the interest rate-sensitive small-cap sector, is betting on a “bad news is good news” scenario. Small companies are highly sensitive to interest rates because they tend to carry more debt, often with floating rates, and they rely more heavily on external financing for growth.

Hence, the lower cost of capital has an immediate positive impact on profit margins, making their future growth prospects more reliable. That is a catalyst for higher stock prices. It also assumes that hiring will pick back up because the Fed’s dual mandate of price stability and maximum employment will now tilt more toward supporting job growth. This view of the Fed being more aggressive on future rate cuts to stimulate employment growth is fueling bullish sentiment for small-caps.

If you look at the top 10-holdings for the iShares Russell 2000 ETF (IWM), there are no financials, even though financial services companies comprise the largest weighting in the Russell 2000, at 17.66%:

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

As the Fed lowers rates, lending and refinancing volumes increase, so smaller regional and community banks will likely see their stock prices pick up speed to the upside, further boosting the Russell’s gains.

The bearish camp takes the position that this is a “head-fake” rally. If rate cuts fail to stimulate real job growth – or if earnings disappoint – small caps could retrace a good portion of the recent gains. The view that AI is rapidly replacing jobs has strong merit and just because the Fed lowers the cost of borrowing doesn’t guarantee job growth – not at all. (AI has become the greatest eliminator of jobs since CoVID).

A recent Stanford Study (source:digital-economy Stanford) found a 13% decline in employment for U.S. workers aged 22–25 in the occupations most exposed to AI, such as customer service, accounting, and software development, and a J.P. Morgan analysis shows rising unemployment among college graduates – especially in majors like computer engineering and design, where jobless rates have risen to 5.8%, the highest in over four years. This suggests that AI is already displacing knowledge workers.

Unlike COVID, which devastated service and manual labor sectors, AI is targeting white-collar, cognitive jobs. What is at work is a new set of market conditions: a possible rising trend in unemployment among higher-paid workers and a rising stock market led by the productivity and efficiency gains brought about by the implementation of artificial intelligence that generates higher corporate profits. Consumer sentiment is not just psychological, it is predictive. When people fear job loss, they delay major purchases, cut discretionary spending, and increase savings rates, which slows velocity of money.

The Bureau of Labor Statistics now incorporates AI’s impact into its employment forecasts, noting that while displacement tends to be gradual, the scale and speed of generative AI adoption are unprecedented. Unlike past tech shifts, generative AI tools like ChatGPT scaled to millions of users in months, not years.

It’s time to “enjoy the ride,” as the bullish sentiment has spilled over to small caps, thereby broadening the rally. But as a consumer-driven economy, AI brings uncertainty to numerous occupations that were once considered secure. Investors are well aware of this dichotomy between market optimism and labor market fragility – or between AI-driven productivity and human displacement – and at some point, it will matter to Mr. Market, too, but for now, the Russell 2000 is celebrating some future rate cuts.

The post 9-23-25: Russell 2000 Delivers Broad-Based Rally Confirmation appeared first on Navellier.