by Bryan Perry

September 16, 2025

There is a classic bifurcation in market dynamics underway: a divergence between capital-intensive tech optimism and consumer-driven economic fatigue. This split is becoming more pronounced of late, and it is reshaping sector performance, and the macro narrative. Investors chasing AI upside should consider hedging against a more cautious consumer in terms of portfolio allocation.

Current and future capex spending on AI infrastructure and applications is soaring with 2025 global AI capex outlays of $414-billion, with spending on AI in 2026 projected to be $432-billion. This is the greatest allocation of corporate capital in history toward what is massive transformational technology. The surge in AI-related capital expenditures is being driven by a convergence of technological, economic, and strategic imperatives.

Computer demand is going through the roof for all manner of applications. AI is being embedded into all industries at a record pace that foster autonomous systems, accelerated workflows, and smart factories. Estimates are for $5+ trillion in total spending over the next ten years. All this is beginning to impact the labor markets and sentiment regarding future job security, and it is showing up in the data.

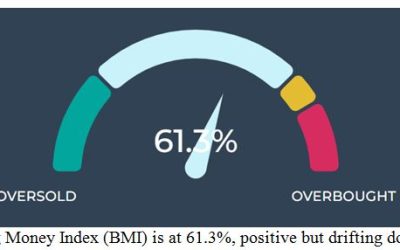

Friday’s University of Michigan preliminary consumer sentiment index for September 2025 dropped to 55.4, down from 58.2 in August, marking the lowest level since May and a 21% decline year-over-year. Consumer spending is showing signs of slowing momentum, especially among younger and middle-income households, according to the latest September 2025 data. Consumers are still spending, but more strategically and conservatively. The shift toward essentials, early deal-hunting, and gift cards suggests a value-driven mindset, not exuberance.

Within the UMich survey, both current and expected personal financial conditions fell roughly 8%, signaling growing concern about household budgets keeping up with the elevated cost of living incurred over the past four years. Prices are way up from 2020, but wages and salaries have not kept pace.

Source: sca.isr.umich.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

About 65% of consumers expect higher levels of unemployment in the next 12 months, a level not seen since the Great Recession. Initial jobless claims surged to 263,000 for the week ending September 6, marking the highest level since October 2021 and well above the consensus estimate of 235,000. Claims rose by 27,000 from the prior week, a sharp move that caught markets off guard.

Economists are calling this a “no hire, no fire” phase – where hiring slows dramatically, but layoffs are only now starting to rise. The labor market isn’t collapsing, but it’s clearly softening, and that’s feeding into weaker consumer sentiment and spending.

Roughly 60% of respondents mentioned tariffs unprompted, with many expecting price hikes and reduced spending on affected goods. While many companies initially absorbed the cost of new tariffs, recent data shows that tariff-related price hikes are now reaching consumers, especially imported goods and essentials. The Federal Reserve’s Beige Book for August showed businesses reported visible price increases tied to tariffs, especially in manufacturing-related goods like tools, auto parts, and electronics.

So, there is this wildly bullish spending spree by corporations and governments on AI with no slowing forecasted for anytime soon. At the same time, the latest data regarding consumer spending shows slower growth forecasts. Deloitte projects holiday retail sales to grow just 2.9% to 3.4%, down from 4.2% in 2024, marking the weakest increase since the pandemic. E-commerce is expected to grow 7–9%, but this is also slower than prior years.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

The most recent PwC survey expects average holiday spending to drop 5% YoY. Gen Z plans to cut spending by 23%, the sharpest generational decline and 84% of consumers expect to cut back over the next six months, citing inflation, tariffs, and cost of living pressure. The McKinsey ConsumerWise Survey shows that net sentiment is 35% lower than in 2024.

The latest CME FedWatch Tool has a quarter-point rate this week at 96.4% probability, 81% probability for a second quarter-point cut at the October 29 FOMC meeting and a 76.3% probability for a third quarter-point cut at the December 10 FOMC meeting. That December read was at 41.8% a month ago, so there is a major shift in sentiment among bond traders under way. Three cuts will take the Fed Funds Rate down to 3.50%-3.75%.

As an FYI, the CME FedWatch Tool probabilities are calculated by the Chicago Mercantile Exchange using real-time pricing data from 30-day Fed Funds futures contracts that are derivatives reflecting market expectations for the federal funds rate at specific future dates. The CME uses a proprietary algorithm to estimate the likelihood of each possible rate outcome at upcoming FOMC meetings. This past week saw the bond futures market move further to the notion of multiple rate cuts are in order to cushion the consumer and labor markets, both of which are growing more unsettled.

The Fed is late to the easing cycle based on backward-looking data but can help matters greatly by being aggressive with monetary policy in the months ahead. The markets will likely trade higher on looser Fed policy over the near term, but the labor market and holiday shopping season remain wild cards for now and will factor into the market’s year-end performance.

The post 9-16-25: A Widening Bifurcation of Spending Trends appeared first on Navellier.