by Bryan Perry

September 3, 2025

When the Federal Reserve starts lowering interest rates, convertible bonds are an attractive investment, because they offer a unique hybrid profile that benefits from two key market dynamics: (1) declining interest rates, and (2) a potentially stronger equity market. Convertibles combine the defensive nature of a bond with the growth potential of a stock, in that convertible bonds have terms that allow the owner to convert the bond into the underlying common stock, depending on the conversion features.

When the Fed lowers interest rates, it is often a sign of potential economic stimulus, which can lead to a further rally in the stock market. Because convertible bonds provide investors with the option to convert the bond into a predetermined number of common shares, they can benefit from rising stock prices.

This “equity kicker” gives convertible bonds an advantage over traditional bonds, which only provide fixed income payments and no exposure to stock appreciation. This year, through July 31, convertibles (blue bar, below) are outpacing all other bond categories, including the U.S. Aggregate Bond Index.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

The main appeal of a convertible bond in a falling-rate environment is its asymmetric return profile. If the underlying company’s stock price soars, the bond’s value will increase, behaving more like an equity, as the owner can convert the bond into stock and book a big profit from selling the common shares.

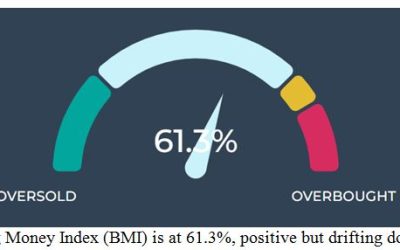

If the stock price stagnates or falls – as in a lower-rate environment – the bond’s value is supported by its bond floor and regular interest payments, protecting it from significant losses. This creates a powerful combination of downside protection with significant upside potential, a compelling value proposition in a period of economic transition, where inflation is holding steady at 2.6% and the Fed poised to start lowering rates at the next Federal Open Market Committee (FOMC) meeting scheduled for September 17.

As an asset class totaling $374-billion globally (as of 2024), the convertible market has grown substantially coming out of CoVID. “Historically, U.S. growth-oriented small and mid-sized companies have been especially well represented among convertible issuers, but we’re also seeing increased representation from larger bellwether, investment grade issuers, which is an exciting trend,” said Joe Wysocki, Senior Vice President and Senior Co-Portfolio Manager at Calamos Investments.

In recent years, most convertibles have been issued with five-year maturities, which means there’s a maturity on the horizon for securities issued in 2020 and 2021. Wysocki says, “We expect many of these issuers will replace their maturing securities with new ones and…refinancing with convertibles as well.”

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

Over the past two years, newly issued convertibles have offered higher yielding coupons than the existing market. The average yield of newly issued convertibles was 3.07%, as measured by the ICE BofA New Issue Convertible Index. In contrast, the average yield of the U.S. convertible market was 2.08%.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

The largest Convertibles fund traded is the SPDR Bloomberg Convertible Securities ETF (CWB) with $4.4 billion in assets sporting a yield of 1.84%. This is a summary of their portfolio contents:

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

This fund and other convertible funds and ETFs track the Bloomberg U.S. Convertibles Liquid Bond Index or the ICE BofA All U.S. Convertibles Index. Both are having solid 2025 YTD gains of 12.2% and trailing 12-month returns of 18.6%, making for a smooth and profitable ride even as the Fed stands pat.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

From a historical standpoint, the backdrop for accelerated total returns for convertible bonds is setting up in a manner that investors seeking a lower volatility approach to exposing investment capital to both the bond and the stock market in a favorable rate environment can do so with a higher degree of confidence.

Even if the stock market retreats, all bonds mature at par, which makes this asset class pretty special.

The post 9-3-25: It’s Prime Time for Considering Convertible Bonds appeared first on Navellier.