by Ivan Martchev

August 26, 2025

We closed last Friday just a few points from the all-time high in the S&P 500 of 6,481. The violence of that move that day shows that few were prepared for the Fed’s pivot, when the Fed Chairman basically said he will cut interest rates to protect the job market. To me, it sounds like there will be more than one rate cut in 2025, perhaps up to three. The Fed Chairman is between a rock and a hard place as job growth has been weak and there are some signs of tariffs bleeding into the CPI index, though not in a major way.

To make matters worse, President Trump had been pressuring the Fed Chairman to cut interest rates. We have had Presidents unhappy with Fed Chairmen before, but not on social media, and not so bluntly.

To see how unprepared investors were for the Fed’s Friday pivot, consider that we had four down days in a row before Friday, some of them large declines, and then, on the last day of the week, we wiped out all four days of losses and ended the week 0.3% higher. After seeing those aggressive rotations into more defensive sectors of the market last week (prior to Friday), my gut feelings tell me that many institutional investors assumed that a 6,481 high in the S&P 500 would stick for a while and negative seasonality was likely to take hold. Because of that wrong-way positioning, I believe the chances of a stampede higher are considerable now, as many fund managers have generally under-performed in the rally off the April lows.

I would rate the chance of a fresh all-time high this week on the S&P 500 at better than even, with the caveat that we already may be at a fresh all-time high by the time most of you see this post on Tuesday.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

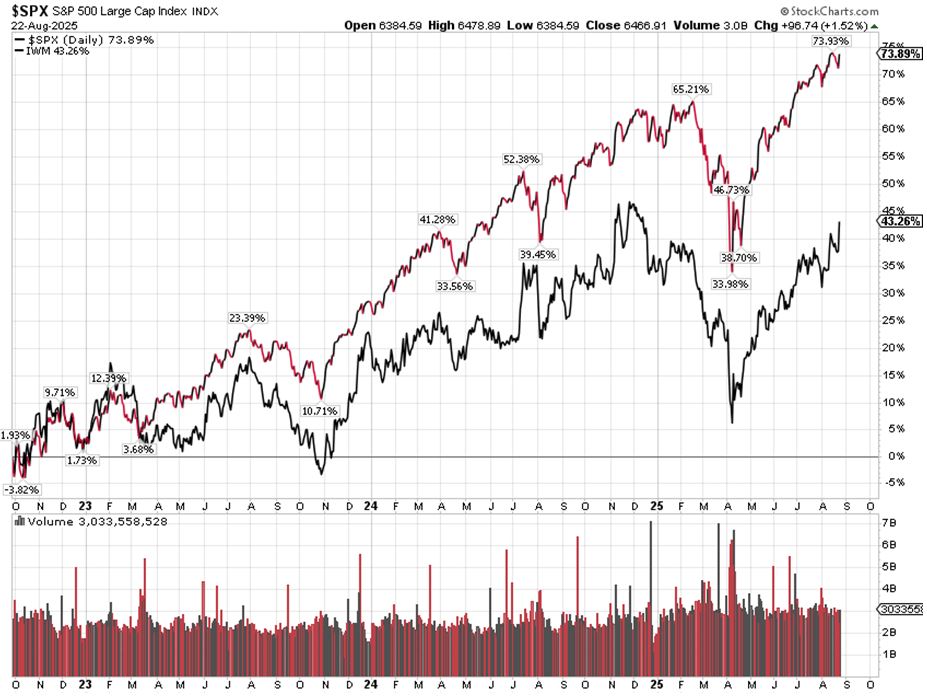

Investors are again buying the small-cap Russell 2000 Index aggressively, as it was up 3.92% on Friday alone – more than double the gain of the other three major indexes. Previously, the Russell dramatically under-performed in the rally off the October 2022 lows, simply because interest rates have remained in restrictive territory. Russell 2000 companies carry much higher debt loads than those in the S&P 500, so interest rates matter more to them. They are also less profitable than those of the S&P 500. The total value of all 1972 companies in the Russell 2000 Index (yes, they are less than 2000) is a tad over $3-trillion.

The policies of the Trump Administration, aimed at boosting domestic investment, can do a lot to make the Russell 2000 a top performer for the rest of 2025 and into 2026. The big performance gap between the Russell 2000 and the S&P 500 is likely to get narrower by the end of 2026 as these policy effects kick in.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

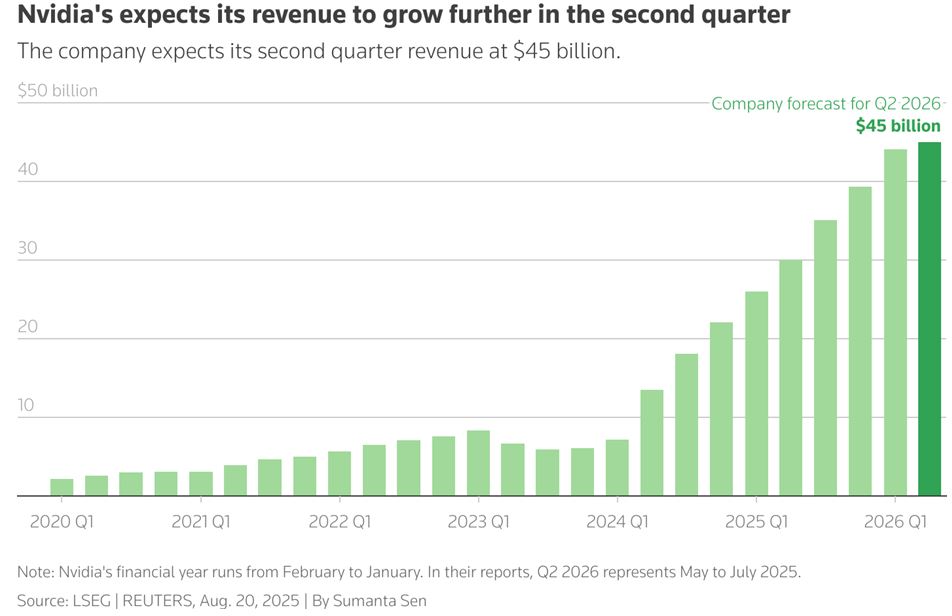

NVIDIA is Larger Than All 1,972 Stocks in the Russell 2000 Combined

The rise in the Russell 2000, as they say, is the good news. The bad news is that the market value of the whole of the Russell 2000 index, all 1972 companies, is smaller than just one company, Nvidia. The AI chip maker reports earnings on Wednesday and the chances of a “sell the news” after a better-than-expected earnings report are not insignificant. The problem with Nvidia is that it is a victim of its own success. The stock has more than doubled off its April low, reaching a market cap of $4.34-trillion on Friday. That’s over $2 trillion in appreciation since April 7, just 4.5 months, which is no chump change.

I have seen it happen more than once, where Nvidia reports great numbers, the stock is up a lot after hours and then opens higher the next day only to close lower. Such short-term tactical considerations should not be relevant to long-term holders of the stock, as the AI speeding boom is still ongoing, and they make the best GPU processors for data centers. Therefore, any type of “sell the news” reaction could turn out to be a one-day wonder – at least that is what I will be thinking about as Thursday trading starts, particularly if Nvidia is at fresh all-time highs and has reported great numbers the day before.

The fly in the ointment may be Chinese sales. The Trump administration did sign off on an export license demanding 15% of China revenues as the price for the license. Only then could Nvidia sell H20 graphics processing units (GPU), where the design and circuitry following parallel processing technology allows much faster chip-sets with much lower energy needs vs. Intel’s infamous and now less relevant CPUs.

H20 are not by far its most advanced GPUs, but Commerce Secretary Howard Lutnick made matters a lot worse by speaking off the cuff on live TV, suggesting that Nvidia’s 4th best chips are OK for the Chinese. There have been reports of Chinese authorities are actively urging Nvidia customers in China not to order as many H20s as they wanted and focus more on domestically produced GPUs, as inferior as they are.

Insulting the Chinese in the middle of a trade negotiation is a bad idea. Nvidia’s China business had shrunk so much that any China sales would be welcome, but the outlook is what counts for investors and as things stand right now it is hard to speculate what that outlook for China sales would be.

Navellier & Associates; own Nvidia Corp (NVDA), and Intel Corp (INTC), in managed accounts. Ivan Martchev does not personally own Nvidia Corp (NVDA), or Intel Corp (INTC).

The post 8-26-25: The S&P 500 Could Tag 6600 this Week appeared first on Navellier.