by Jason Bodner

August 26, 2025

Ever since the Kansas City Federal Reserve began holding its annual Jackson Hole symposium in 1982, markets have often used the central bankers’ words there as a turning point in the markets. The remote setting in Wyoming has become a global stage, where a few carefully chosen phrases can move trillions of dollars across stocks, bonds, currencies, and commodities, including gold. Friday was no exception.

As I sat down to write this column, Jerome Powell delivered his final speech from Jackson Hole, and his words cracked open the door to a September rate cut. Markets responded instantly. The S&P 500 surged by 1.5%, the NASDAQ rose 1.9%, and the small-cap Russell 2000 exploded up by 3%. Oil, gold, silver, and even Bitcoin all rallied. Bond yields understandably fell, from 4.30% to 4.25% on the 10-year Treasuries.

Friday’s immediate reaction was a sign of just how much investors have been craving clarity. For years, equity markets have been navigating a turbulent August, traditionally one of the bumpiest months of the year. Now, Powell’s comments have provided some reassurance and a spark of positive momentum.

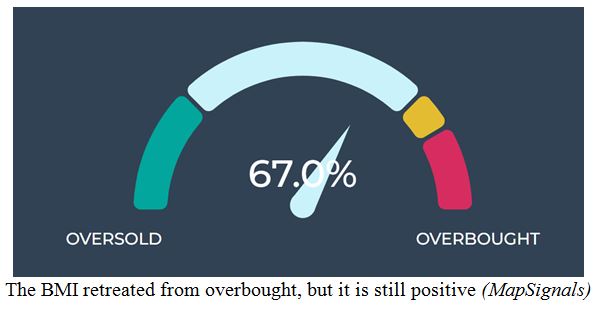

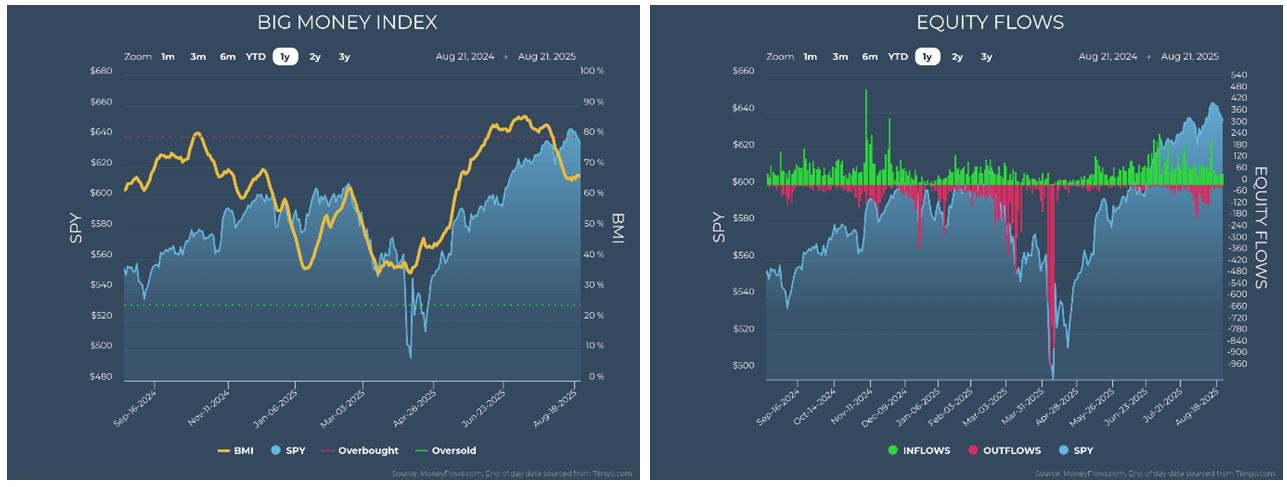

The Big Money Index (BMI), a measure of institutional buying, currently sits at 67%: a comfortable zone, well below the overheated 80% level that often signals exhaustion. History shows that being overbought rarely lasts long: The 35-year average is just 22-trading days. This summer, however, the index remained overbought for 35-consecutive sessions, a streak that ended in early August with predictable turbulence.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

The post 8-26-25: The Market Finds Its Voice at Jackson Hole appeared first on Navellier.