by Bryan Perry

August 26, 2025

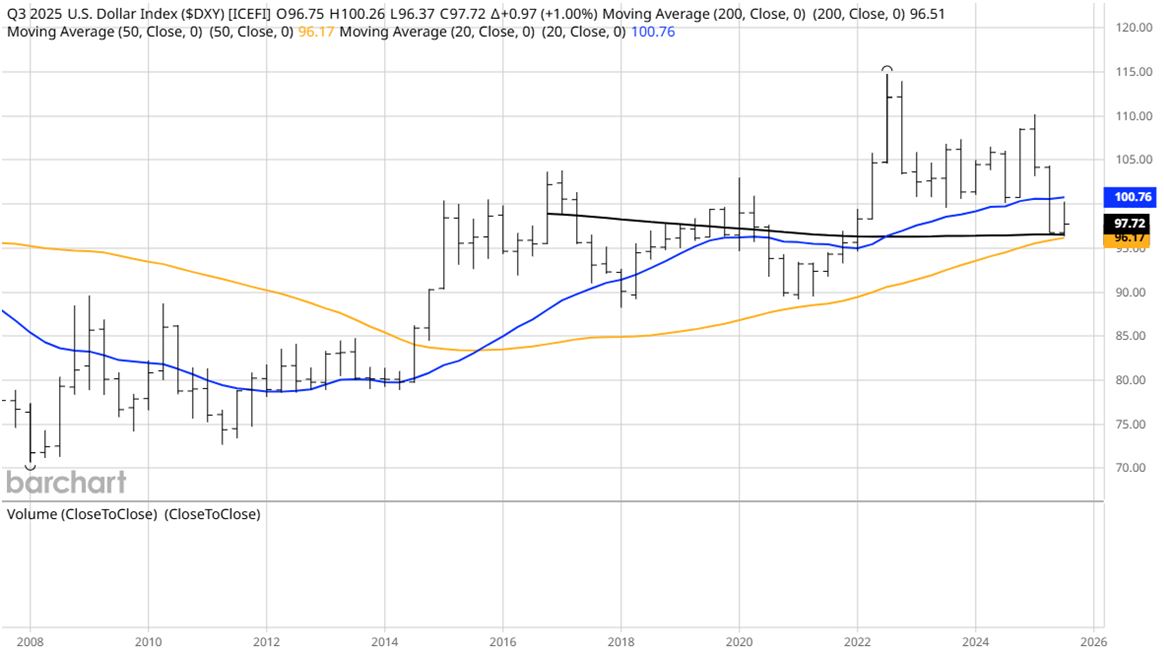

From looking at a long-term chart of the U.S. Dollar Index (DXY), going back to the Great Recession of 2007-2008, one can see that it is well above 2008 levels but has dropped since 2022 and sharply in 2025.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

However, from a much longer timeline perspective – 50 years – the dollar looks to be in relatively decent shape. The dollar’s dramatic rally between 1982 and 1985 wasn’t just a market fluke, it was the result of a perfect storm of monetary policy, macroeconomic shifts, and global capital flows. But as one can see from this chart, the dollar has appreciated since 2008, despite record deficit spending during that span.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

Paul Volcker’s Fed aggressively raised interest rates, starting in 1979, to crush double-digit inflation, pushing the federal funds rate above 20% by 1981. In similar fashion, but not nearly as dramatic, Jerome Powell’s Fed raised the Fed Funds rate 11 times from March 2022 to July 2023 to beat back 9% inflation.

Though rates began easing in mid-1982 as inflation fell below 4%, the U.S. still offered relatively high yields compared to other economies, attracting foreign capital. Sound familiar? This is similar to today’s situation, when comparing 10-year sovereign yields from other developed nations. Only the UK, Australia and New Zealand offer 10-year yields fractionally higher than that of the U.S., but with far less liquidity.

So, what’s up with the current rally in gold if the dollar isn’t truly breaking down? Gold’s surge to record highs approaching $3,500 isn’t just about inflation or dollar weakness anymore. What’s remarkable is that this rally is happening despite the dollar holding firm within a long-term range and long-date Treasury yields having risen for the better part of 2025.

Demand for gold as a safe haven against soaring government debt is incredible. Central banks have purchased over 1,000 metric tons of gold each year for three straight years (2023–2025), diversifying away from dollars and Treasuries. China’s gold purchases rose 34% in early 2025 compared to 2023.

Gold demand is strategic, driven by geopolitical hedging and sanction resilience, especially among emerging markets and has elevated gold’s appeal as a politically neutral reserve asset. Gold’s rally isn’t defying logic so much as it is responding to a new gravitational center – geopolitical hedging, fiscal anxiety, and strategic reserve rebalancing. The dollar may be stable, but the world around it isn’t. Following a sharp run up earlier this year, gold prices have traded laterally for nearly six-months now.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

Investor anxiety about long-term U.S. fiscal sustainability is a large and consistent part of the macro-economic dialogue as the potential for future dollar debasement grows with every $1-trillion added to the federal debt. Even as the Fed is gradually seeing core inflation rachet down towards its 2% target, there is a deep-seated anxiety about fiscal-driven inflation that could emerge like a roman candle.

As of August 2025, the gross national debt has surpassed $37-trillion, a historic and surreal milestone. The U.S. is adding about $1-trillion every 160-days, which is more than twice as fast as the average over the past 25-years. This acceleration is primarily driven by two factors that are proving hugely difficult to corral – massive federal budget deficits and exploding interest payments at higher average interest rates.

The fiscal year 2025 deficit is projected at $1.9-trillion, with $1.63-trillion already recorded in the first 10 months and annual interest on the debt is nearing $1-trillion, making it the second-largest federal expense, surpassing defense, and Medicare, trailing only Social Security. As a result, Treasury auctions have scaled up dramatically, with $125-billion in notes and bonds issued in August alone, plus the shorter-term bills.

Trump’s Big Beautiful Bill raised the debt ceiling by $5-trillion. The jury is still out as to how lower top income tax rates, higher tariffs, inflation and economic growth will impact any further growth of the federal debt and whether there is real potential for deficit reduction – as is being voiced by Treasury Secretary Scott Bessent, who has repeatedly emphasized that the Trump administration is “laser-focused” on using rising tariff revenues to pay down the national debt. Bessent projected over $300 billion in tariff revenue this year and stated that this would be prioritized for debt reduction. He’s committed to lowering the deficit-to-GDP ratio at around 100% of GDP, which he considers a “manageable, responsible” level.

A “3-3-3” Plan (aiming for 3% GDP growth, 3% inflation and 3% interest rates on federal debt) is Scott Bessent’s goal. This trifecta set of goals is designed to create conditions where the debt burden becomes more sustainable, relative to economic output. What is missing in this formula is dramatic restraint on Congressional spending – something that has proven to be wildly unpopular with our elected officials.

It’s too early to tell if this plan and other strategic efforts will produce meaningful results to combat the debt crisis because, quite simply, the political will seems to be lacking, at least as long as the market keeps absorbing U.S. debt at these record Treasury auctions. In the meantime, this sideways price action in gold for the past six months looks like it will culminate in a solid move higher, sooner than later.

The post 8-26-25: Gold is Set for More Gains, Based on “Weak Dollar” Misconceptions appeared first on Navellier.