by Ivan Martchev

August 19, 2025

Some variation of market rotation – in this case, out of growth and into value – has begun, as over the last week the S&P 500 Equal Weight Index (+1.52%) outperformed the S&P 500 Index (+0.98%), while the S&P 500 Index outperformed the growth-heavy NASDAQ 100 Index (+0.48%).

The S&P 500 Equal-Weight index covers the same stocks as the S&P 500 Index with one big difference, in that all components have the same index weight. The market-cap-based S&P 500 Index – the one that we see on a daily basis – heavily weighted with eight holdings, all in the tech sector, carrying an index weight of 36.5%. These eight stocks (the Magnificent 7 plus Tesla, which is also a technology company, as far as I am concerned, not a car company) carry a weight of over 70% in the NASDAQ 100 index.

In other words, the “sell technology, buy value” trade does not work very well, as it pulls the index lower if it goes into turbo-drive. We have seen occasions of under-performance in the tech sector in 2024, but tech’s revenue and earnings growth were much stronger, so any type of rotation did not last very long.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

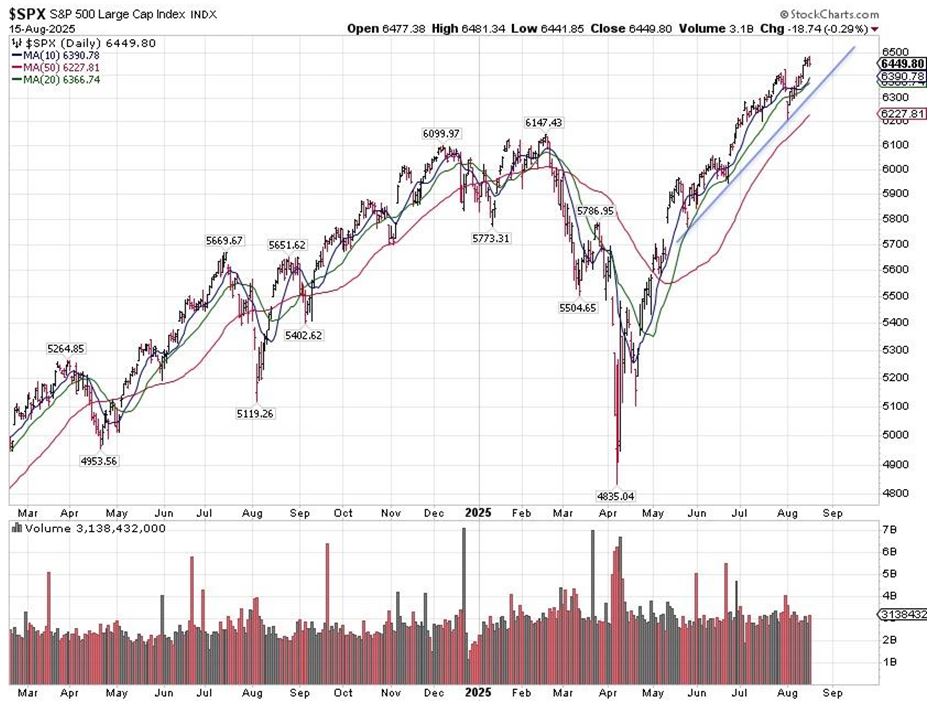

When technology has under-performed notably for more than a week or two, it has typically been in times of corrections for the broad market, as tech is considered the high-beta part of the market. So far, the S&P 500 shows a series of higher lows off the April bottom and, unless the August bottom (6212) is violated, we have not topped out. The low of the month is your red flag. The yellow flag, a less severe warning, is last week’s low, at 6364. Any type of trading below last week’s lows should be viewed with suspicion.

The vast majority of the rally off the April lows – other than a day or two in early August – has happened above a 20-day moving average, which is to say it is a very aggressive rally with two shallow corrections. As long as the 20-day moving average is below the market’s current level, we may glide higher, but I fear there are a lot of short-term gains built up and many short-term traders may lose out due to stop loss sales.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

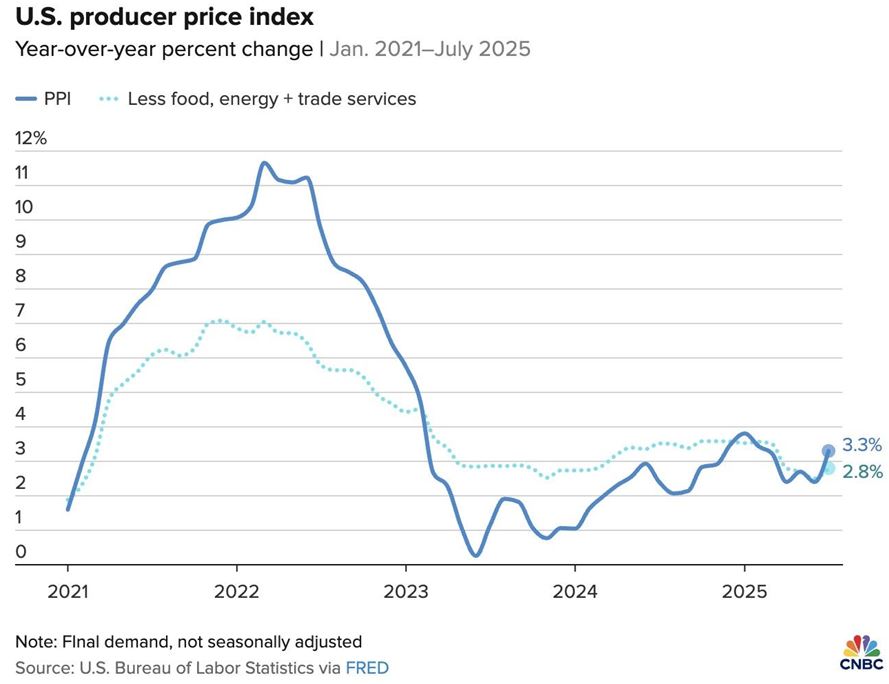

Although we got a decent CPI report, which was celebrated by stocks, we then got bad PPI data, which caused investors to question the magnitude of the coming Fed rate cuts. The key to this rotation into value is for the Federal Reserve to cut rates two to three times this year, which would be problematic if we keep getting a whiff of inflation in future CPI and PPI reports. When you throw in a few weaker jobs reports, the Fed’s policy could remain stuck in place by relying on its employment and price stability mandates.

The problem for the Fed is that companies will take some time to adjust prices because of tariffs, and that tariffs are “floating,” in that they have not been set completely yet, as the trade deals have not all been concluded. Plus, as the Administration negotiates and changes tariff rates, the idea that tariffs are a one-time bump in price levels will not hold. I don’t think we will have a long-term inflation problem because of tariffs, as the levels are manageable, compared to those announced in April, but I think we could have lingering issues with CPI and PPI reports over a 3-6-month period, which complicates things for the Fed.

From a longer-term perspective, if the Trump administration begins to rebalance the horrific U.S. trade imbalance, it would have all been worth it. The trade situation had been neglected for over 30-years – by both Republican and Democratic administrations. It should have been addressed many years ago.

In this case, it’s better late than never to address trade imbalances – as it is definitely the right approach.

Navellier & Associates; a few accounts own Tesla (TSLA), per client request in managed accounts. Ivan Martchev does not own Tesla (TSLA), personally.

The post 8-19-25: The S&P 500 Hits New All-Time Highs, Now What? appeared first on Navellier.