by Bryan Perry

August 19, 2025

Of all the discussions, agreements and questions surrounding the virtues and evils of artificial intelligence (AI), few will debate the positive contribution AI is having on health care in its many forms. If there were ever an industry or segment of society that needs a top-to-bottom overhaul – it is the business of health and the burgeoning costs of operating what is a highly fragmented and poorly executed system.

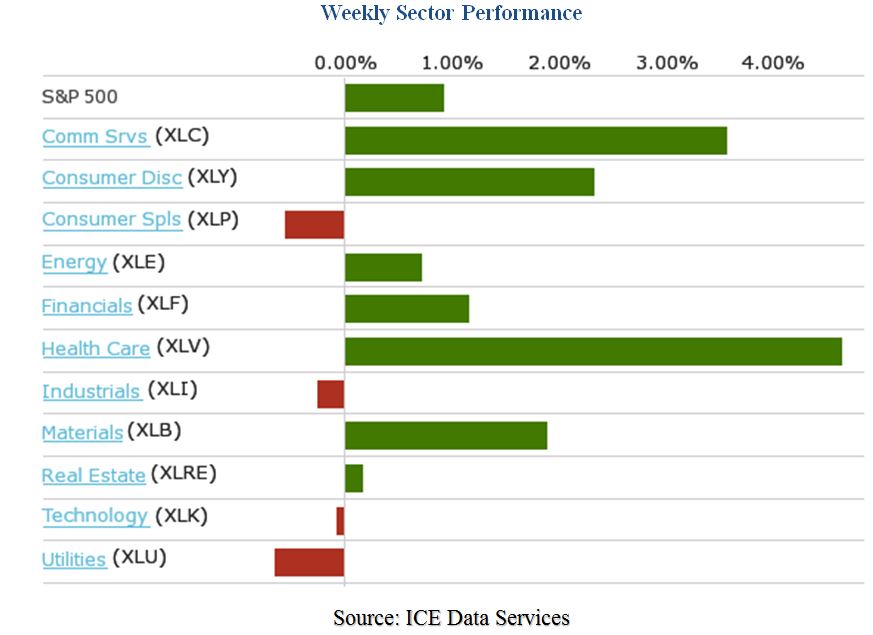

Last week, we saw some notable rotation into health care, led by a rebound in Dow component United HealthGroup Inc. (UNH) after it was reported that Berkshire Hathaway bought 5.04 million shares valued at roughly $1.57 billion. With UNH down 40% in Q2, Buffett’s team saw value.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

As to whether this specific play works out, only time will tell, but this purchase did wake up a sector that has sorely lagged most of the other 10 S&P market sectors for over a year. Knowing full well the intentions of the Trump administration to drive down pharmaceutical costs, one would expect that sub-sector to continue to be on the receiving end of bearish sentiment, but there are several other areas of health care that are rapidly adopting and applying AI to enhance research, products and services.

Some of the positive transformations underway include improved diagnostics, where AI algorithms can detect diseases like cancer, stroke, and fractures with high accuracy. In radiology, AI often outperforms humans in interpreting MRIs and X-rays. AI models streamline drug discovery by analyzing vast datasets, reducing time and cost. AI also enables remote diagnostics and tele-health, helping under-served populations receive care. Machine learning tailors therapies based on patient data, improving outcomes and reducing trial-and-error. AI-powered scheduling tools predict staffing needs, improve retention and AI supports early screenings and risk assessments, such as cardiovascular disease prediction.

The Global Industry Classification Standard (GICS) organizes health care into two major industry groups:

- Health care Equipment & Services

- Equipment & Supplies

- Providers & Services

- Health care Technology

- Pharmaceutical, Biotechnology & Life Sciences

- Pharmaceuticals

- Biotechnology

- Life Sciences Tools & Services

There are now several AI-driven stocks of leading companies that are quickly monetizing AI in pursuit of their corporate goals and objectives:

- AI in surgical video analytics, cardiac diagnostics are making significant strides.

- AI in imaging and device optimization is also seeing tremendous advancements.

- AI in diagnostics and lab automation is boosting R&D efforts while driving down costs and radically shortening timelines. And:

- AI in imaging and patient monitoring and processing genomic data is bringing new meaning to the phrase “precision medicine.”

So, while the war on big drug companies and high-priced pharmaceuticals gets most of the media’s attention – mostly due to political and PAC money influence – AI is reshaping medicine and health care in numerous ways that are having an immediate impact on patient care and the top and bottom lines of companies that have taken the necessary steps to make the greatest use of AI in their business models.

I think the investment community is starting to weigh in now, seeing where AI is having a seriously bullish impact on various stocks, so it might be worth our time to explore the holdings of a few health care ex-pharmaceutical ETFs whose top holdings are invested in the most cutting-edge AI-driven medical products and services. They include iShares U.S. Medical Devices ETF (IHI), SPDR S&P Health Care Equipment ETF (XHE) and First Trust Health Care AlphaDEX Fund (FXH), among others.

Sector rotation is vital to positioning one’s portfolio to profit from bullish fund flows. Rising volume drives stocks and ETFs higher. Getting in on a rising tide of positive money flow is one of the most consistent ways to generate profits and limit losses. It’s called “respecting the tape.” The right kind of health care exposure has a place in growth portfolios, especially when the sector is defensive in nature.

As long as investors seek to grow within the health care space in companies that are not in the crosshairs of Trump and RFK, Jr., then opportunities abound. It is one way to effectively broaden one’s AI exposure to portfolios without have to be concentrated in only big-cap tech stocks – and last week’s price action for health care might just be the beginning of a fresh new uptrend that deserves some immediate attention.

Navellier & Associates; own United HealthGroup Inc. (UNH) in a few accounts but does not own Berkshire Hathaway (BRK.B) in managed accounts. Bryan Perry does not own United HealthGroup Inc. (UNH), or Berkshire Hathaway (BRK.B) personally.

The post 8-19-25: High-Tech Health Care is Rapidly Monetizing AI appeared first on Navellier.