by Gary Alexander

August 12, 2025

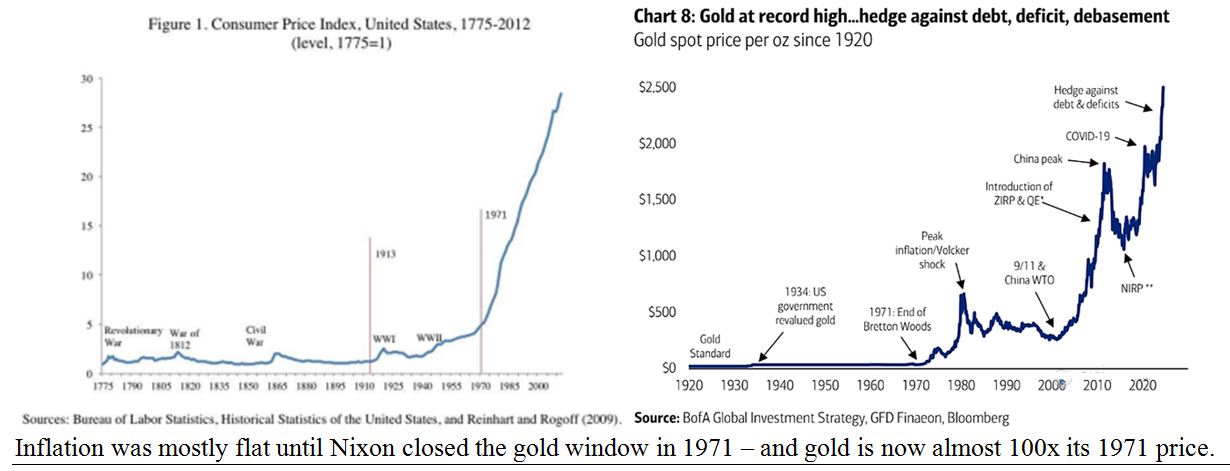

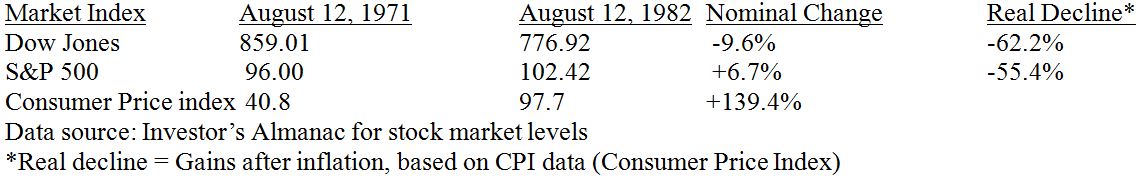

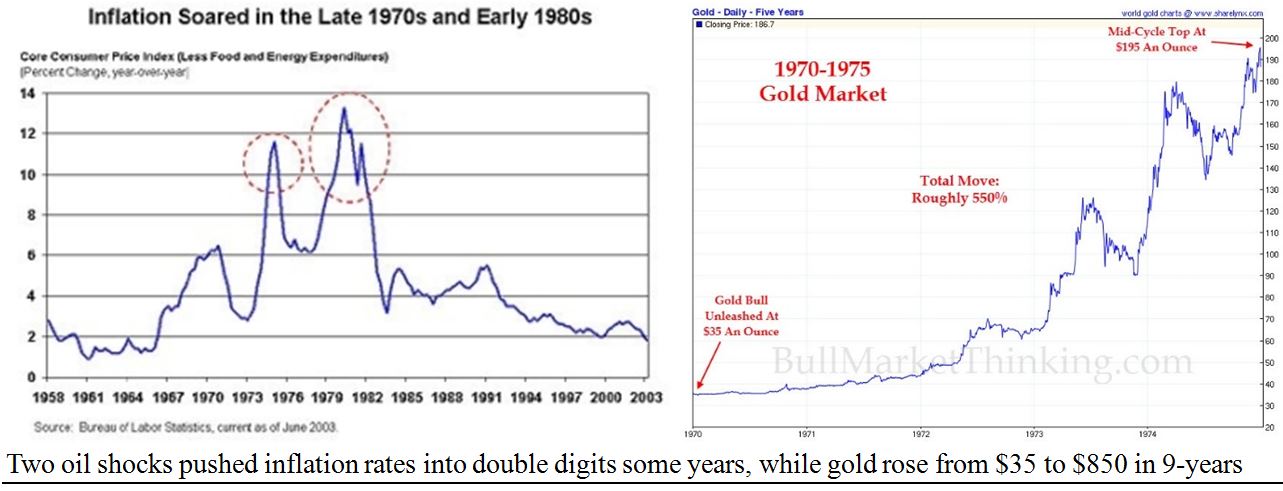

In the last two weeks, I’ve covered the positives and negatives of historical August market hurricanes, and how August went from being the market’s best month for over nearly a century, then became our worst month in recent decades. Today, I’d like to profile two mid-August market milestones from long ago, both falling on Friday, August 13: (1) Nixon’s Camp David meeting to close the gold window in 1971, and (2) The birth of the biggest bull market of our lifetimes on August 13, 1982. In between those two epic events, the stock market tanked in real (after-inflation) terms, as gold soared and the dollar sank.

The Nixon Gold Shock of August 13-15, 1971

Over the last few days, gold has set its most meaningful all-time high to date – at $3,500+ per ounce, 100 times its fixed $35 price from 1934 to 1971. So, in gold terms, a 2025 dollar is worth just a 1970 penny.

That story began on this date in history: On Thursday, August 12, 1971, President Nixon informed 15 key officials on his team to pack an overnight bag and be prepared to go away for the weekend – destination not disclosed – and they were forbidden from telling anyone, even their spouses, what it was all about.

On Friday the 13th, those 15 officials were ferried on two huge helicopters from the White House to Camp David, some 65 miles north. Top officials included Federal Reserve Chairman Arthur Burns, Treasury Secretary John Connally and Undersecretary for International Monetary Affairs Paul Volcker, along with key political aides John Ehrlichman and H.R Haldeman. Their main goal was to stop the gold drain that had arisen from the “two tier” gold price of $35 per ounce for central banks and a market price of over $40 for private buyers (outside the U.S., where it was still illegal for U.S. citizens to own gold bullion).

Savvy governments were buying U.S. gold at $35, only to sell it for a quick 20% profit, the perfect crime. Many nations pledged not to take advantage of the U.S. Treasury’s gold drain, but some secretly bought as much gold as they could, so President Nixon needed to “close the gold window” for these arbitrageurs.

That weekend, on Sunday, August 15, 1971, President Nixon pre-empted the most popular TV show in America, Bonanza, to tell the nation via a special TV address that he not only closed the gold window, but effectively devalued the dollar 20% from its $35 fixed price, while engaging in a diversionary action by issuing wage and price controls for 90 days, despite low (3%) inflation rates, plus a 10% surtax (tariff) on imports. The American public and press loved these moves, for some odd reason, since the “candy” in the package was freezing out any price increases, plus an import tax, delaying any further dollar devaluations.

The Nixon team had not leaked any of this plan in advance. They also failed to warn any of our major trading partners or the IMF in advance, so it became known in history as “The Nixon Shock.” But the shock was positive at home. On Monday morning, the Dow Jones index enjoyed its largest one-day point gain in history, to that date, up 33 points, and rising over 5% in the first two days after the Nixon Shock. (Sources: “Three Days at Camp David,” by Jeffrey E. Garten, and “Currency Wars” by James Rickards).

As an economics reporter for a major magazine in 1971, I had expected such a move, after reading Harry Browne’s 1970 book, “How You Can Profit from the Coming Devaluation,” so I stayed up late that Sunday night in our closet filled with three news ticker-tapes by AP (Associated Press), UPI (United Press International) and our newest tape, from Reuters. I was monitoring global reaction for a quick article in the magazine, due the next day. After the buoyant market reaction on Monday, I knew the real story was a future decline in the dollar, along with higher inflation and a gold market, but most pundits didn’t see that.

As I summarized the public reaction back then: “A poll of 220 households by Albert E. Sindlinger & Co., on Monday revealed 75% of Americans favored the president’s proposals, while most of those who dissented did so on the grounds that Mr. Nixon’s actions should have come sooner. Albert Sindlinger’s amazed reaction was, ‘In all the years I’ve been doing this business – more than 15 – I’ve never seen anything this unanimous, unless maybe it was Pearl Harbor” (from “Initial Reaction to Nixon’s Economic Plan,” by Gary Alexander, Plain Truth Magazine, September 1971). A month later, in the October issue, I wrote a longer article, on “America’s Dollar Crisis,” spelling out the negative long-term implications.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

In 1971, I quickly learned that at least three other men were outraged by Nixon’s moves – listed below – not counting the writers, actors and advertisers of “Bonanza,” the TV show pre-empted by the speech.

In that show, “Pa” (Lorne Greene) and his three sons Adam (Pernell Roberts) “Hoss” (Dan Blocker) and “Little Joe” (Michael Landon) would not understand a revaluation of the gold dollars in their pockets.

In addition, here are some brave gents – whom I later worked with – who reacted with an action plan.

- Robert D. Kephart (1935-2004), publisher of Human Events, launched the Inflation Survival Letter in late 1971 to help investors profit from the inflation to come. (In 1981, I worked for Kephart).

- James U. Blanchard III (1943-1999), a high school American History teacher in New Orleans, was so outraged that he quit his teaching job to form the National Committee to Legalize Gold, launching “Gold Newsletter” that fall, mostly born from a mailing list of the Gold Club my dad attended in Seattle. (I also later worked for Blanchard’s company, editing Gold Newsletter from 1983 to 1989).

- Libertarian activist David Nolan (1943-2010) was so outraged by Nixon’s move that he created the Libertarian Party in his home in late 1971. (I later worked with LP candidate Harry Browne (1933-2006) in his Presidential candidacy of 1996, and I ran for office on the LP banner myself in 1997).

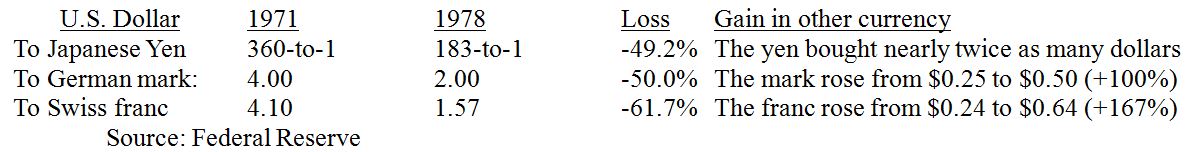

These brave dissenters saw the 1970s challenges clearly, in advance, with inflation eroding any meager stock market gains, while “real things” (like metals, commodities or real estate) beat stocks and bonds.

The dollar also fell sharply in the rest of the 1970s:

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

Friday, August 13, 1982 – Birth of the Greatest Bull Market of Our Lifetime

After the incoming Reagan team endured two deep back-to-back recessions and a market swoon, August 12, 1982, marked a major market low, 43 years ago today. After that, from a Las Vegas-style lucky low of Dow “777,” the bull market grew 15-fold in less than 18 years. Yes, that mega bull market was born on a Friday the 13th, in the 13th consecutive quarter of negative growth. Our 11-year market swoon was over.

(This is already too long, so I’ll continue this second dramatic Friday, August the 13th saga next week).

The post 8-12-25: Two Freaky Friday the 13th Markets Changed America appeared first on Navellier.