by Bryan Perry

August 12, 2025

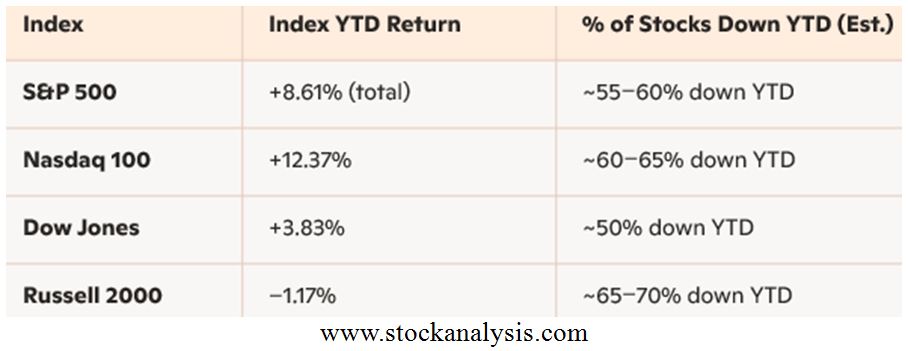

The financial media’s euphoria over a rising stock market seems a bit over the top, especially considering the fact that, despite headline gains in the major indexes, most individual stocks are actually down, year-to-date. As of Friday’s close, the Dow is up just 3.83% year-to-date and remains almost 2% below its all-time high of 45,073, set on December 4, 2024. The S&P 500 is doing better, up by 8.61% this year, while the NASDAQ 100 leads the way, up 12.37%. To say that this rally is top-heavy is a gross understatement.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

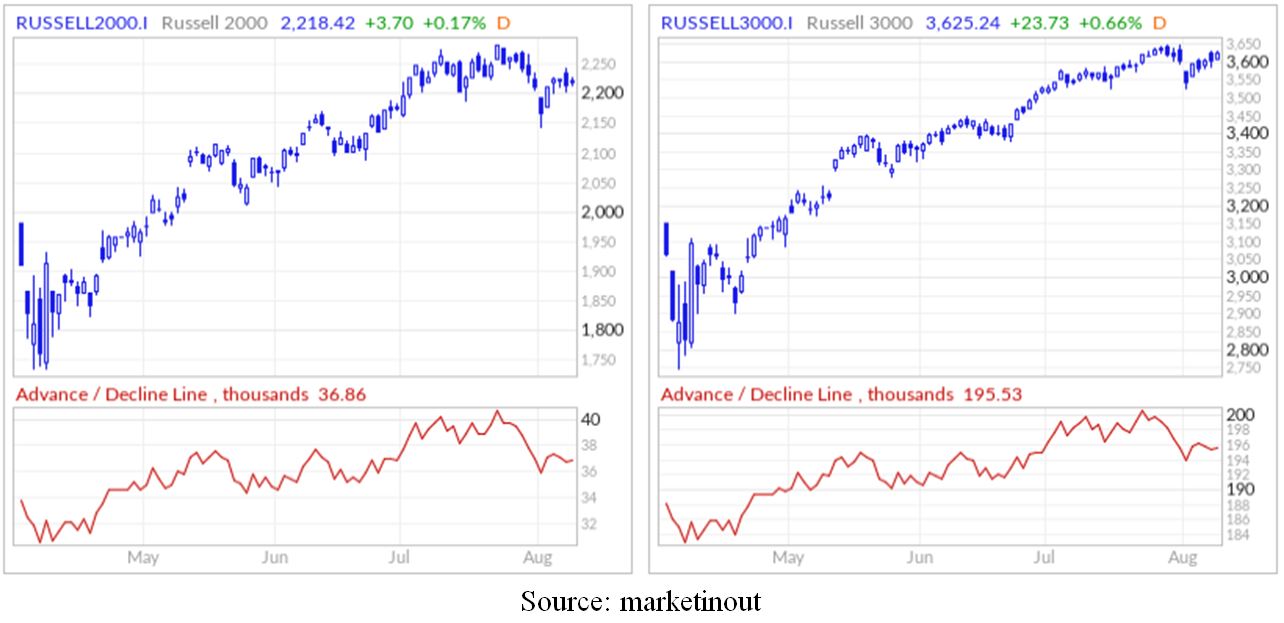

Only two in five stocks are participating in rallies, confirming that the market’s gains are concentrated in a narrow array of mega-tech stocks. Even as the Dow, S&P 500 and Nasdaq trade at, or near, their all-time highs, small stocks in the Russell 2000 are down in 2025, so investors should take note of fundamental market developments that could mark the beginning of a choppier time for the market over the near term.

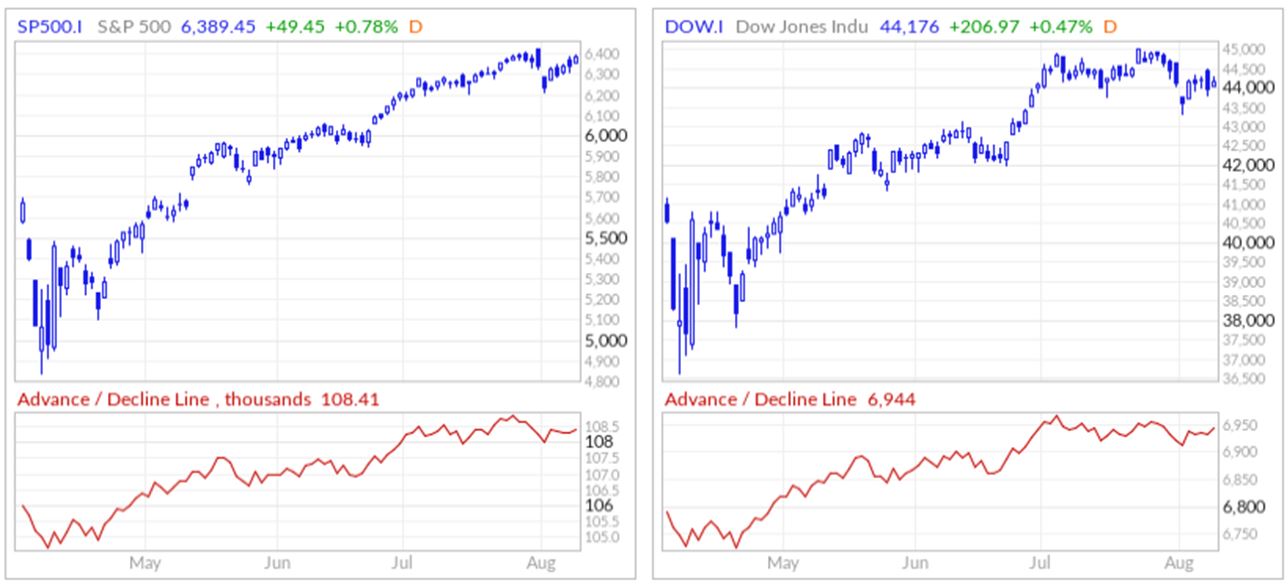

The Advance/Decline lines for each index show more distribution than accumulation, especially for the NASDAQ and Russell 2000, which look troubling. (The A/D line tracks the cumulative difference between advancing and declining stocks daily, and has diverged downward, indicating weakening market breadth.) Unless the big-cap tech leaders push higher, this rally could struggle to deliver further sustained upside.

Here is a quick look at the major market indexes since the April lows – rising almost without a pause.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

Those are the indexes, but the hidden story is that some stocks are still down for the year so far, so stock picking is at a premium, with more stocks falling through trapdoors on quarterly estimate misses and cautionary guidance. This is not an attempt to pour cold water on the rally – not at all. I believe it means that fewer stocks will continue to outperform, so investors may need to concentrate their stock exposure.

One area of concern for the technology sector is the sudden change in how the AI trade is playing out. AI isn’t just disrupting enterprises, it is redefining their entire Software as a Service (SaaS) business model. SaaS revenue is largely based on a per-seat or per-user basis, but AI can automate tasks that previously required human users. Hence, the reduction in headcount users leads to significant revenue contraction.

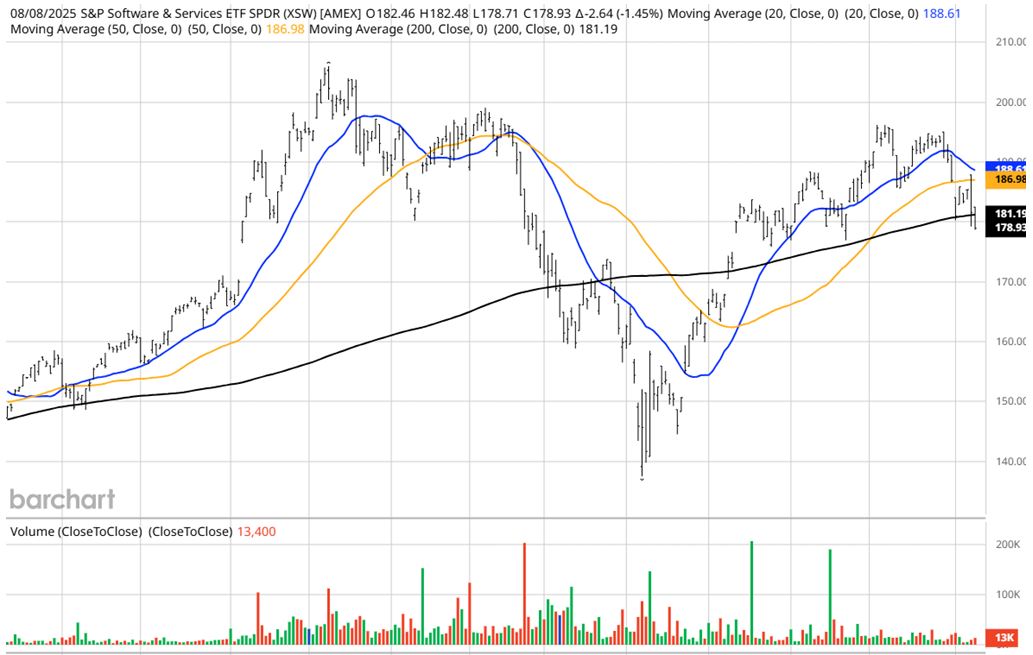

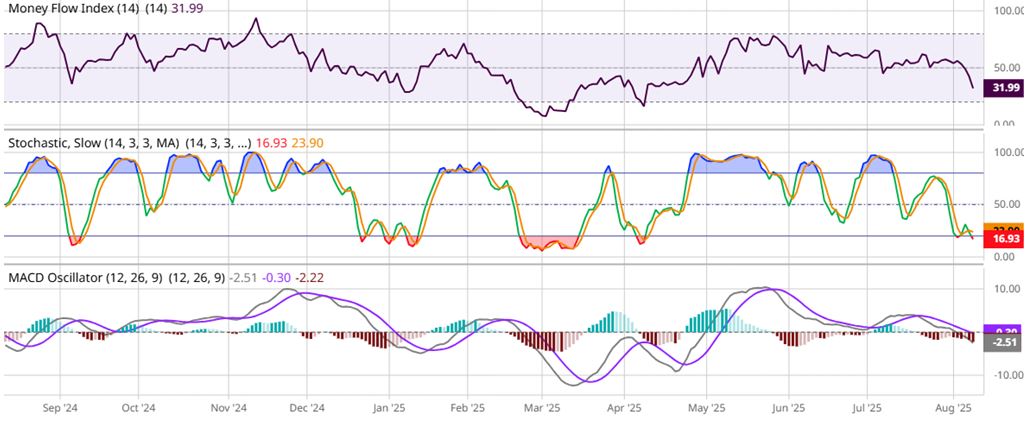

Microsoft CEO Satya Nadella recently confirmed that around 30% of Microsoft’s code is now written by AI tools, and that figure is trending upward. This reshapes developer roles, turning engineers into orchestrators of AI agents rather than manual coders, resulting in a reduction in high-salaried employees. This can be seen in charts like S&P Software & Services ETF SPDR (XSW), down 5% YTD (below).

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

This is a very recent development – and a negative “AHA” moment for a plethora of software companies that built their fortunes on the SaaS business model. There is now a sudden comprehension of this AI breakthrough condition in the stock market that is having a ripple effect over the past two weeks in some of the biggest CRM and software enterprise companies in the sector. Of the top 10 software companies in the world, only five have bullish charts, led by MSFT, Mr. Softie. The other five are breaking down badly.

Bottom line, AI will cut both ways. While rapidly advancing productivity gains, the reshaping of certain businesses also means that investors cannot be complacent during this massive technological change, on in which AI can turn a once thriving business into a dinosaur in a matter of weeks or months.

Treasury Demand is Weaker, Threatening Higher Future Rates

One other area of concern is the most recent lack of appetite for long-term U.S. government debt. The 30-year Treasury auction held last Thursday, August 7, did not go so well. The higher yield of 4.813%, above pre-auction levels, signaled weak demand, and the “Tail Spread” of +2.1 basis points is the widest since August 2024, indicating pricing pressure. On top of that, the bid-to-cover ratio of 2.26 was the lowest since November 2023. At 59.5%, indirect bidders (foreign buyers) came in at their second lowest level since 2021, and the dealer take-down of 17.5% is the highest since August 2024, meaning primary dealers had to step in heavily. In Japan, primary dealers have taken up to 40% of the total auction issuance.

Fiscal concerns amid soaring deficits and “Big Beautiful Bill” spending plans are spooking buyers of long-term U.S. debt. The Treasury will likely have to scale back on future 30-year issuances as aversion to longer duration rises. The benchmark 10-year U.S. Treasury pays one of the highest rates for developed nations, but U.S. debt-to-GDP now stands at 121%, as of Q1 2025, versus 81.6% for the European Union.

Comparative 10-Year Government Bond Yields – And Trends

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

As the month of August unfolds, earnings season will culminate with the release of Nvidia’s Q2 numbers on August 27. After that, there will be fewer catalysts to drive stocks higher in September, so more attention will likely be placed on fundamental topics – like those addressed in this column.

Navellier & Associates; own Nvidia Corp (NVDA), and Microsoft Corp (MSFT), in managed accounts. Bryan Perry owns Nvidia Corp (NVDA), personally. He does not own Microsoft (MSFT), personally.

The post 8-12-25: Mining the Fundamentals of the Key Market Trends appeared first on Navellier.