by Louis Navellier

August 5, 2025

Last Wednesday, ADP reported that 104,000 net new private payroll jobs were created in July, a number substantially higher than the analysts’ consensus estimate of 76,000, but their June private payroll report was revised lower, to 23,000 jobs, down from 33,000 first reported, but the overall report was positive.

Then, on Friday, the Bureau of Labor Statistics (BLS) reported that only 73,000 payroll jobs were created in July, which was well below the economists’ consensus expectation of 104,000 – but a number that oddly matched the actual ADP job total of 104,000. The biggest bombshell in Friday’s BLS report was that May and June payrolls were revised lower by a cumulative 258,000 jobs, or nearly 90% below the first reports!

Specifically, June payrolls were revised down by over 90%, to 14,000 (down from 147,000) and May payrolls were revised down 87% to only 19,000 jobs (down from 144,000). Treasury yields declined sharply after this July payroll report came out, due to unemployment concerns after these huge revisions.

ADP sometimes revises their past totals, but they are seldom as seriously off the mark as the BLS report, since ADP works directly with the payroll data for private-sector jobs, so I trust the ADP numbers more than the BLS – the “gang that can’t count straight,” releasing seriously misleading numbers most months.

President Trump had two reactions after the Friday July payroll report. First, he fired Erika McEntarfer, the Biden appointee as Commissioner of the Bureau of Labor Statistics, accusing her, without evidence, of politicizing the payroll report. Instead of that, I would just say that the BLS simply can’t count well, or on a timely basis, but Trump said, “She will be replaced with someone much more competent and qualified. Important numbers like this must be fair and accurate. They can’t be manipulated for political purposes.”

Then, President Trump seemed to take the jobs report more seriously when he said on Truth Social Friday that, “Jerome ‘Too Late’ Powell, a stubborn MORON, must substantially lower interest rates, NOW,” and added that, “IF HE CONTINUES TO REFUSE, THE BOARD SHOULD ASSUME CONTROL, AND DO WHAT EVERYONE KNOWS HAS TO BE DONE!” In this post, he is clearly fomenting a Board mutiny at the Fed, so I think it is safe to conclude that President Trump is beyond upset at Mr. Powell.

I partly agree with the President, that Powell is way “Too Late” in most of his Board decisions. Like the President, I was grossly disappointed by the Federal Open Market Committee’s (FOMC) statement last Wednesday, which left key interest rates unchanged – yet again. The only good news is that two FOMC members, namely Christopher Waller and Michelle Bowman, voted for a rate cut, going against nine voters who opted to hold key interest rates steady. (One other voter, Governor Adriana Kugler, didn’t attend the FOMC meeting, due to a “personal matter.”) The FOMC statement said, “Although swings in net exports continue to affect the data, recent indicators suggest that growth of economic activity moderated in the first half of the year.” In a press conference following the FOMC announcement, Fed Chairman Powell said that the slowdown in growth “largely reflects a slowdown in consumer spending.” This last item was his only semi-dovish statement, so expectations of a September rate cut remain high – but not yet certain.

Other Economic Indicators Are More Positive than Friday’s Jobs Number

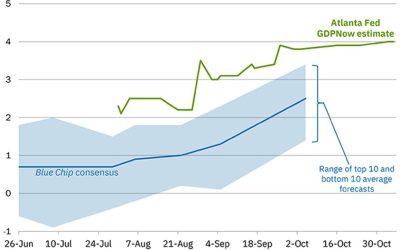

Last Tuesday, the Commerce Department announced that the U.S. trade deficit was much lower than the economists’ consensus expectation of $98 billion. The deficit fell 10.8% to $86 billion in June compared to $96.4 billion in May. A lower trade deficit will boost GDP growth, so I expect that economists will be revising their second-quarter GDP estimates a bit higher. For example, the Atlanta Fed on Tuesday raised its second-quarter GDP estimate to a 2.9% annual pace after the July trade data came in.

Matching the Atlanta Fed’s estimate, the Commerce Department announced last Wednesday that its preliminary estimate for second-quarter GDP rose to +3%. Imports plunged 30.3% in the second quarter, so stronger exports (over imports) boosted the second-quarter GDP calculation by a whopping 5%! Personal consumption rose 1.4% in the second quarter, while business investment slowed to a 1.9% annual pace.

The inventory glut caused by the first quarter dumping of goods to beat the tariffs persists and subtracted 3.17% from the second-quarter GDP calculation! Overall, it is imperative that most major tariff deals be finalized soon, since trade volatility is grossly distorting GDP calculations in the past two quarters.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

In other news, the Conference Board on Tuesday announced its consumer confidence index improved to 97.2 in July, up from a revised 95.2 in June. The “present situation” component declined to 131.5 in July, down from 130 in June. However, the “expectations” component surged to 74.4 in July, up from 69.9 in June. Overall, this report chronicling rising consumer optimism for the future is a very good sign.

In contrast to U.S. growth indicators, China’s National Bureau of Statistics announced on Thursday that its purchasing managers index (PMI) declined to 49.3 in July, down from 49.7 in June. Economists were estimating that China’s PMI would rise slightly to 49.8 in July, so this was a big disappointment. Since any reading below 50 signals a contraction, China’s slower growth and deflation woes are likely to persist.

Tariff Talks Continue Make Significant Progress

After six months of tariff negotiations, we’re starting to see a positive trend toward taking global trade into “fair trade” on all sides, with another plus – toward on-shoring manufacturing operations to the U.S.

Specifically, many European manufacturers, especially their leading automotive companies, are expected to onshore more of their manufacturing to the U.S. due to not only 15% tariffs, but their higher labor and power costs. Unlike the British trade deal that had a 100,000 per year limit on imported vehicles taxed at 10%, Germany did not agree to any quota, probably because they have U.S. plants and will likely boost their on-shoring efforts, including European leaders like German Chancellor Friedrich Merz and Italy’s Prime Minister Giorgia Meloni, who called the latest EU trade agreement with the U.S. “sustainable.”

Last Wednesday, while the Fed was delaying rate cuts, President Trump delayed the implementation of 50% tariffs on Brazil. (Interestingly, tariffs on orange juice and aircraft parts for Embraer (ERJ) will be exempt from any special tariffs.) Brazil’s President Lula de Silva has been largely defiant, especially by refusing to stop the prosecution of former President Jair Bolsonaro, so some further diplomatic meetings between Brazil and the U.S. may be necessary. President Lula said, “I treat everyone with great respect. But I want to be treated with respect.” So, apparently, Lula doesn’t feel respected by President Trump.

Last Wednesday, the White House also announced that South Korea had agreed to 15% tariffs plus a plan to invest $350 billion in the U.S. Similar to the trade deals with the EU and Japan, the South Korean deal will encourage auto manufacturers to onshore more of their operations to the U.S. to lessen the blow of a 15% tariff. So – just based on the commitments the EU, Japan and South Korea made last week – a cumulative $1.5 trillion of on-shoring has been promised. The Trump Administration has secured over $10 trillion in on-shoring, so 5% annual U.S. GDP growth is becoming more likely in the next few years!

This leaves Canada, Mexico and China as major U.S. trading partners that have not yet negotiated U.S. tariffs. President Trump gave Mexico a 90-day extension of their negotiations last Thursday, but the bottom line is that the August 1st deadline is being largely adhered to, thereby giving financial markets more certainty. However, a couple of surprises emerged, namely that tariffs on Swiss products rose to 39%, up from 31%, and Canada’s tariffs rose to 35%, from 25%. Obviously, trade negotiations need to persist.

Navellier & Associates; own Embraer S.A. Sponsored ADR (ERJ), in managed accounts. Louis Navellier and his family own Embraer S.A. Sponsored ADR (ERJ), via a Navellier managed account.

The post 8-5-25: Why Can’t the BLS Economists Count Jobs Accurately? appeared first on Navellier.