by Bryan Perry

August 5, 2025

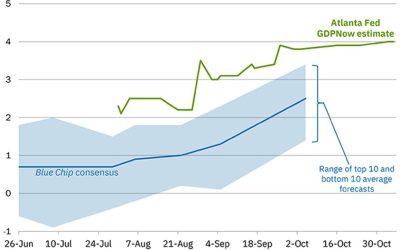

As the month of July bowed out last Thursday, it seemed as if the stock market could do no wrong. Trade deals were flowing in, the majority of companies reporting second-quarter results were beating estimates, GDP for Q2 came in at 3.0% versus a 2.5% forecast, Consumer Confidence for July was 97.2 versus a 95.5 forecast, PCE inflation was in line with forecasts, and the most recent Treasury auctions saw robust demand, especially on the longer-dated maturities, sending bond yields lower.

For instance, the bid-to-cover ratio for the recent $39-billion 10-year Treasury auction was 2.67, up from 2.59 in the prior auction. That means investors submitted $2.67 in bids for every $1 of debt offered. A ratio above 2.5 is generally considered healthy. The bid-to-cover on the $22-billon 30-year Treasury auction was at 2.43, a modest improvement, and the $44-billion 7-year Treasury auction came in at 2.55.

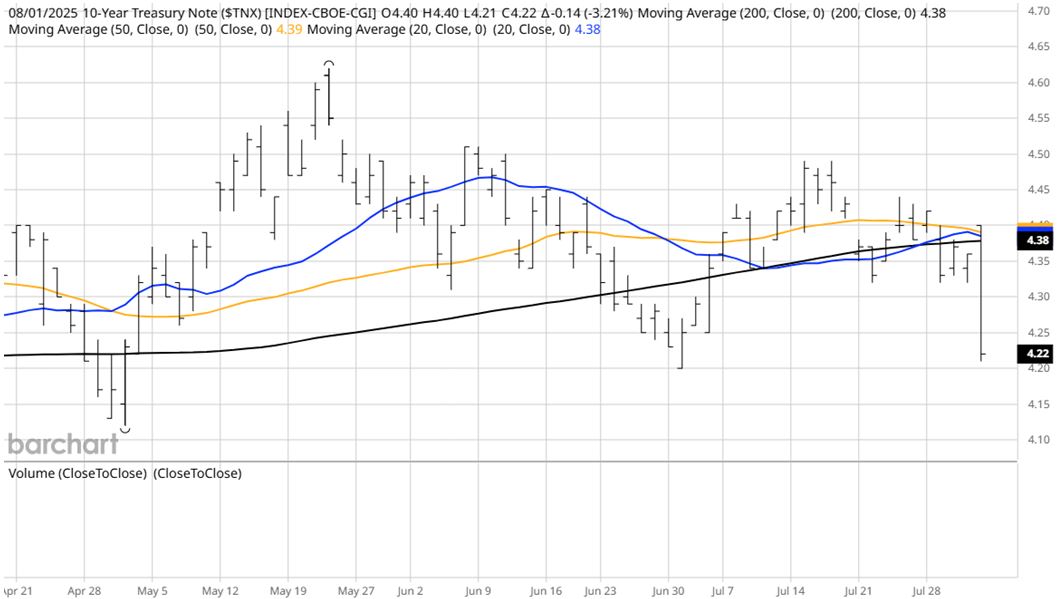

The yield on the benchmark 10-year Treasury knifed lower, closing the week at 4.22% after the FOMC left rates unchanged at Wednesday’s FOMC meeting, but the big reason for the drop in rates was that May’s job total was cut by a whopping 87%, from 144,000 to 19,000, and June’s total was further off the mark, shrinking 90% from 147,000 to just 14,000, resulting in a combined two-month job cut of 258,000.

That means the average job gain over the past three months was just 35,000 – a major blow to the narrative of a strong job market being touted by the Trump Administration – assuming the numbers aren’t as rigged as President Trump implied, saying the Bureau of Labor Statistics had created “fake” statistics.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

This downbeat job revision really caught the market flatfooted, opening the door for a possible 50-basis point cut in the Fed Funds Rate when the Fed meets again on September 17. If the weekly Initial Claims and Continuing Claims numbers gap higher over the near term, a rare between-meeting rate cut becomes a possibility, especially if August’s employment data, set to be released September 5th, shows a sharp rise in unemployment. Reciprocal tariffs that kicked in on August 1st will also start to register in the economic data released for August. It’s now six weeks until the next FOMC meeting, which feels like a lifetime.

Global markets traded lower after President Trump signed an executive order that increased tariff rates for several key partners, including increases to 50% for Brazil, 35% for Canada (up from 25%), 25% for India, 20% for Taiwan, and a 40% tariff on all “transshipped” goods (via lower-tariff countries), regardless of origin. The deadline for any U.S./China deal is now August 12, with negotiations ongoing.

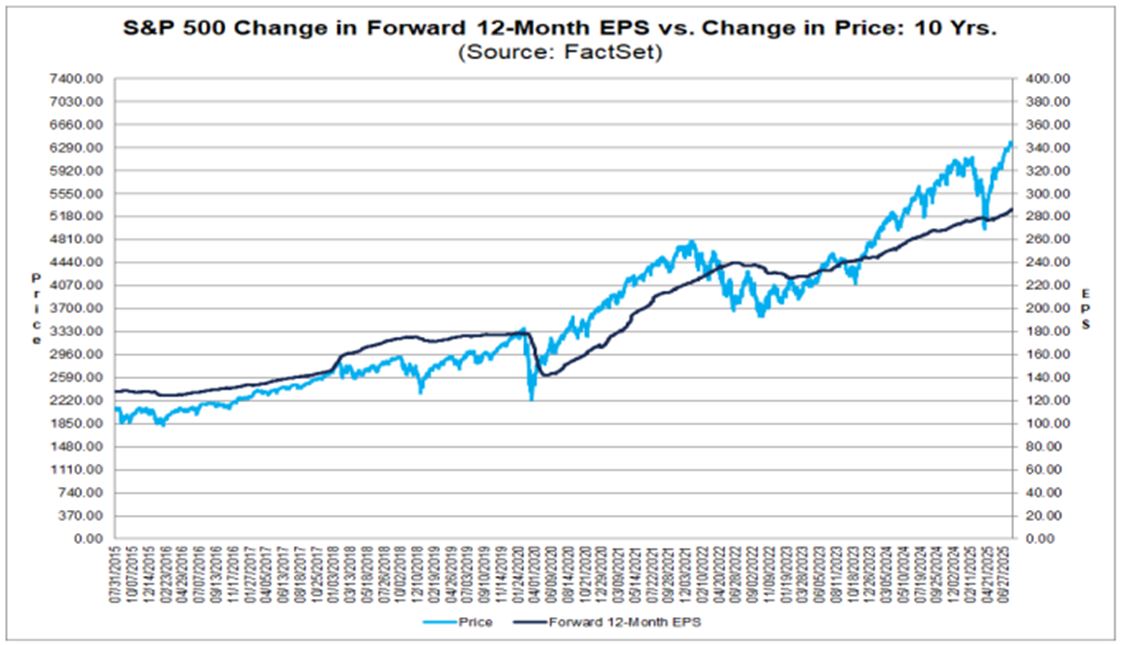

Aside from the latest negative employment data and tariff increases, second-quarter sales and earnings for the S&P 500 are downright impressive. According to FactSet, as of August 1, for Q2 2025 (with 66% of S&P 500 companies reporting actual results), 82% of S&P 500 companies have reported a positive EPS surprise and 79% of S&P 500 companies have reported a positive revenue surprise. For Q2 2025, the blended (year-over-year) earnings growth rate for the S&P 500 is +10.3%. If that is the final actual growth rate for the quarter, it will mark the third consecutive quarter of double-digit earnings growth for the index – and over twice the June 30 estimate of just 4.9% growth for second-quarter earnings.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

Is it Time to Switch from Sideline Cash to Bonds and other Fixed-Income Investments?

So, with new uncertainties entering the stock market, one asset class where the direction of pricing is more certain is that of fixed income. Whether it be Treasuries, agencies, corporates, municipal bonds or preferred shares, the bond market is done wondering about what the next move is for interest rates.

Friday’s pivot by bond traders to “back up the truck and load up” on Treasuries signaled to me an “all-clear” sign for income investors seeking to secure current higher yields and benefit from price appreciation in the coming weeks and months. The CME FedWatch Tool has quickly adjusted to the notion of the Fed Funds Rate moving 75 basis points lower by year-end, equivalent to three 0.25% cuts in three meetings.

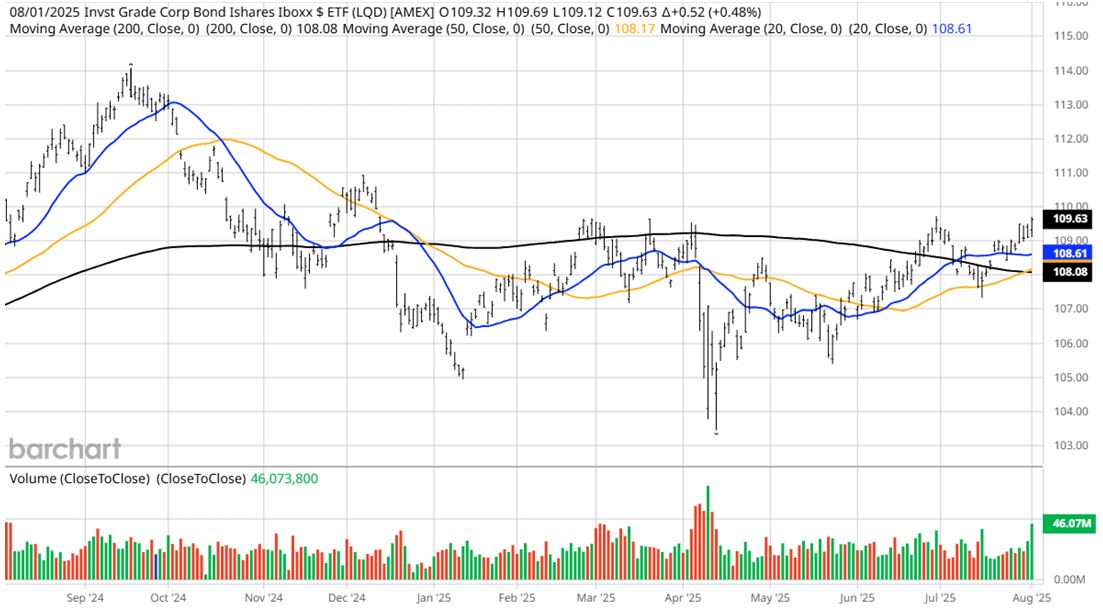

The largest investment-grade corporate bond fund by assets under management is the iShares iBoxx $ Investment Grade Corporate Bond ETF (LQD), with over $30-billion in assets. It tracks the Markit iBoxx USD Liquid Investment Grade Index, tracking U.S. dollar-denominated, investment-grade corporate bonds from a broad range of issuers. The current yield is 4.42% with an average duration of 8.6 years.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

From the chart above, shares of LQD are about to put in a “golden cross,” where the 20-day and 50-day moving averages move up through the 200-day moving average (black line).

Could bonds outperform stocks by year-end? Probably not, as stock prices are also supported by higher bond prices and lower yields. But the odds of LQD and other fixed income assets gaining by Christmas have greatly improved since last Friday.

Dividend stocks are also back in fashion, with utilities topping the list for decent yields from qualified dividends while also embarking on the greatest capex spending spree to fund the power grid upgrade of all time. This is driven largely by surging demand from data centers, crypto operations and new manufacturing across their 11-state footprint.

It was just three weeks ago, in the week of July 14-18, that the 30-year Treasury traded above 5.0% with 10-year rates near 4.5%. Now they trade at 4.8% and 4.22%, respectively, and appear to be headed lower. I believe this a good time to shift some funds out of money markets, where lower future yields appear likely, and move into fixed income and dividend stocks.

The post 8-5-25: Time to Buy U.S.-Based Dividend Stocks and Fixed Income Investments? appeared first on Navellier.