by Gary Alexander

July 29, 2025

August begins this Friday, so today might be a good time to warn you that August is the start of Hurricane Season in the Atlantic and Caribbean, and it is also the start of market hurricane season on Wall Street. September and August are the worst two market months, by far, over the last 35-years, as shown here:

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

However, it may come as a surprise that August was not always such a bummer. August was the #1 month for the bulk of the last century, from 1900 to the mid-1980s. Why? Farming was a big market driver in the early 1900s: “Harvesting made August the best stock market month, 1901-1951. Now that only about 2% farm, August is the second-worst Dow and S&P month since 1987” (Stock Trader’s Almanac, 2010).

The major reason why August was strong in those golden days was that most of America either worked on a farm or in rural businesses before World War II, and agricultural crop sales started rolling in during August and September. A secondary bonus was that Christmas started turning commercial in the 1930s, and most Christmas products had to be manufactured in August and shipped to warehouses by October.

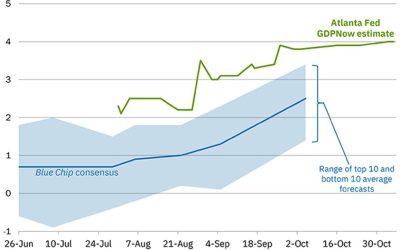

The noted newsletter rating guru Mark Hulbert wrote about this trend two years ago (“August used to be the best month for the stock market. Then it became the worst,” Marketwatch, July 29, 2023). He showed that in the 90 years after the Dow Jones Industrial Index was launched in 1896, August was the top-performing month. From 1896 until 1986, Hulbert wrote, “August on average was far ahead of the other months – more than four times larger, as you can see from the table below. August outperformed the other months’ average by 1.4 percentage points” but, “In the years since then, in contrast, August has been the worst month for the stock market, on average, lagging the other months’ average by 1.7 percentage points. Since 1986, in fact, August has been a worse month for the stock market than even September.”

Taking the monthly performance up to 1972, August was up even more, +2.0% on average, 1896 to 1972:

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

What changed? In addition to the obvious – the shrinkage in agricultural production, as a percentage of GDP – Louis Navellier and I have some alternative explanations. First, few Americans took long August vacations before the 1970s, but now nearly everyone does. As Louis said last week, nearly all of Europe and much of Wall Street goes on extended August vacations, so the “B” team is running August markets. The resulting low volume encourages unscrupulous short sellers to circulate rumors that certain stocks are in trouble. Then, all of a sudden, investors unload a big-name stock, which generates market-wide panic.

My added theory is that October was once thought to be the worst market month, due to scars from 1929 (exacerbated by October 1987 and 2008), so investors began selling in September to avoid the dreaded Halloween massacres. Alas, that made September the worst month in modern times, with massive double-digit Dow declines in September 1974 (-10,4%), 2001 (-11.1%) and 2002 (-12.4%), so after 2002, smart market timers decided to move one month back and sell in August, to avoid future September slaughters.

Whatever the reason, August and the first half of September are a lousy time to be in the market, or to own property below sea level in New Orleans or Florida, when hurricanes hit. NOAA says hurricane season runs six months (June 1 to November 30), but as this chart clearly shows, the two worst stock market months (August and September) have the most hurricanes, peaking around September 10:

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

This doesn’t mean you should “sell all stocks” or even sell a large portion of your portfolio positions in fear. I usually ride out these storms, but this year I sold 50% of a high-riding tech stock in order to raise funds for future bargains. More risk-averse investors could consider trimming a few positions in order to have cash on the sidelines to buy some emerging bargains that may be attractively priced in October. But even if you don’t sell any stocks, history says the market will shoot back to new all-time higher later on.

Now, let’s enjoy some market history, this time from 1890 in the newly-minted State of Washington…

Port Townsend – Where Dashed Railroad Dreams

Froze a Victorian Town Into an 1890s Time Capsule

This past weekend, my wife and I stayed at the Palace Hotel in Port Townsend, one of many Victorian-style hostelries we could select while attending the Port Townsend Jazz Festival, the best of its kind in this region (that’s a veteran jazz DJ’s biased opinion, admittedly). I chose the Palace since my last (2023) stage role was to play an aging sea captain modelled on Henry Tibbals, a major founding father of that town. Among other entrepreneurial efforts, he built and ran this hotel in the former “Tibbals Building.”

The Palace Hotel, built in 1889 by Tibbals, has a sign upon entering: “A step back in time.” Each room has been renovated into a Victorian motif, with 16 rooms named for the ladies of the night who once attracted male visitors to what locals called “the House of Sweets.” (We stayed in the Tibbals Room).

Tibbals was very active in local business and politics. After building his first hotel in 1858 (he operated it until 1871), he then built a long wharf as agent for the Pacific Mail Steamship Company. He soon became the richest man (largest taxpayer) in the county by in 1889, the time of our play’s drama. He also became sheriff of Jefferson county, president of the board of county commissioners, postmaster and a member of the city council, while holding down top spots in the Masonic lodge. Even at age 70, he was building a 1-mile racecourse and park just above the head of his own wharf, calling it “one of the fastest in the world.”

In 1889, when Washington gained statehood, railroad fever dominated many towns up and down Puget Sound. Seattle, Tacoma, Everett and Port Townsend each vied to be the terminus of James Hill’s Northern Pacific line, running from the Heartland (Minneapolis/St. Paul) over two mountain ranges to the coast.

Port Townsend was the first city inbound ships would see, after navigating the Straits of June de Fuca. It had deep ports, a ready customer base and the potential for feeder lines running south to Oregon and up the Sound to Tacoma and Seattle. PT’s city fathers had high hopes, but my character, Captain Tibbals (below) knew better. One key line in the play, written by a direct descendant of Tibbals, told his family:

“There’s somethin’ you should know. The railroad won’t be comin’ to Port Townsend. I spoke with some lads in San Francisco, some lads who know. They won’t be layin’ the tracks out here. It’s a dead end. There’s nowhere for a train to go.” Ships would sail “right past Port Townsend.” – Gary as Henry Tibbals.

In 1893, Hill’s St. Paul, Minneapolis, & Manitoba reached Puget Sound, first at Everett, Washington. However, during that year, a panic put the Northern Pacific, as well as the Santa Fe and Union Pacific, into receivership. The Northern Pacific became part of the Great Northern in 1896. With multiple ports by then, in Everett, Seattle and Tacoma, Hill’s lines supplied Japan with cotton from the south and shipped New England cotton goods to China. He also shipped northern goods such as Minnesota flour and Colorado metals to Asia. On the return trip, his train’s main “crop” was mostly Northwestern lumber.

Below is an excellent biography of James J. Hill, which I read last year, all about how he decided which sea terminals to feed his rail lines. Also, see the chapter on Hill in “Myth of the Robber Barons,” which covers Hill’s free-market efforts vs. the government-aided monopolies which used “eminent domain” to claim land. Folsom says Hill built his railways by “wise investments, quality construction, and no federal subsidies. Meanwhile, his rivals at the Central Pacific and Union Pacific received free land, subsidies, tax breaks—and still managed to go bankrupt and be embroiled in bribery and embezzlement scandals.”

The first Dow index, assembled by Charles Dow in 1884, contained nine railroads and only two other stocks, both of them industrials. In 1886, another index became the germ of today’s Dow Transportation index, with 12 railroad stocks, even though railroad stocks were over-extended and trending down then.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

The lesson, of course, is that “bubbles” still happen, and technology can change at warp speed, so savvy investors need to overlook the hype of daily news, read more history and notice when it may be repeating.

The post 7-29-25: How August Went from “First to Worst” Among Market Months appeared first on Navellier.