by Louis Navellier

July 29, 2025

Earnings will continue to help or hurt specific stocks. For instance, Google (GOOG) beat the analysts’ estimates by 5%, but some analysts were shocked by its higher spending. Nonetheless, I expect Google to meander higher and help shore up the Magnificent 7 stocks, which were dragged down by Tesla (TSLA), which laid another egg last week by missing analysts’ earnings estimates for the third quarter in a row.

In addition, the emission credits that Tesla has sold to other automakers are scheduled to expire in the U.S. (while persisting in Europe), so that is posing an additional risk to its bottom line. I will admit that the Tesla Diner, which opened in Santa Monica, is a big hit and is getting great reviews, but until Optimus robots do all the cooking and serving, I suspect that Tesla fans may become disenchanted with the Diner.

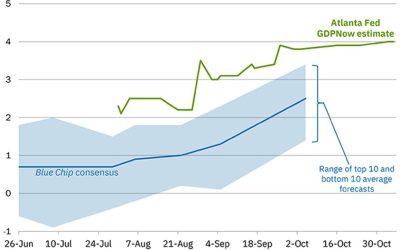

I am proud that President Trump re-posted on Truth Social my recent appearance on Fox Business during the June CPI announcement as mounting evidence of why the Fed should resume cutting key interest rates. President Trump’s aggressive tariffs threats are actually forcing our trading partners to reduce their trade barriers, so freer worldwide trade is now unfolding. The on-shoring now underway is incredible, which is why I expect the U.S. to achieve 5% annual GDP growth sometime in the upcoming years.

The global interest rate collapse will increasingly put downward pressure on Treasury yields and the Fed, especially as the U.S. dollar rallies and gets its “mojo” back. While President Trump’s domestic and international opponents are increasingly trying to humiliate him with endless Jeffery Epstein allegations, some media outlets might beware of going too far: The Wall Street Journal has been hit with a $10 billion defamation lawsuit by President Trump. I feel they would be wise to settle with him, like other media outlets have done. Furthermore, the WSJ was removed from the press pool covering President Trump’s upcoming trip to Scotland, but these distractions have no capacity for derailing the U.S. economy.

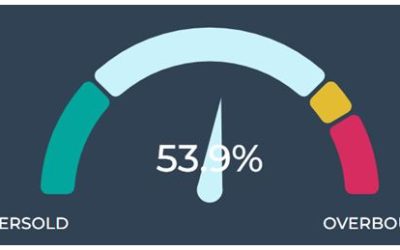

I’d say that the only thing that can derail the stock market’s resurgence are seasonal shenanigans. August is a seasonally weak month, but a dovish FOMC statement may help to squelch this August’s negative sentiment. As interest rates collapse, the Fed will be forced to follow other central banks and cut interest rates multiple times, causing a “turbo boost” that will be a stimulus to help our economic nirvana persist.

Real Estate is Hurt by High Interest Rates

Last Wednesday, the National Association of Realtors announced that existing home sales declined 2.7% in June to an annual pace of 3.93-million. Economists were expecting a 0.7% decline, so existing home sales came in much worse than expected. In the past 12 months, existing home sales were unchanged.

The supply of unsold homes is now 1.53-million, representing a 4.7-month supply. Median home prices rose 2% in June to $435,200, but as the supply of homes increases, median home prices are expected to moderate. If you go to Zillow, you will see that home prices are being discounted nationally as inventory builds. However, it is imperative that the Fed cuts key interest rates SOON to stimulate home sales.

Despite a weak housing sector, we are truly in a special environment, an economic renaissance for the U.S. While Asia and much of Europe are in the midst of a demographic collapse, the U.S. is better positioned with household formation and better assimilates immigrants. Furthermore, the U.S. is food and energy independent, plus the U.S. is benefiting from surging exports as well as on-shoring.

The Commerce Department on Friday announced that durable goods orders declined 9.3% in June, due largely to a 51.8% decline in commercial plane orders, but excluding a 22.4% decline in transportation orders, durable goods orders rose 0.2%. Economists were expecting an 11.1% decline in June durable goods orders due to Boeing’s woes, so the June durable goods orders were really better than expected.

Changes in Auto Regulations Encourage Lower Tariffs and Onshoring

Among other hidden gems in the “Big Beautiful” tax bill, it eliminated federal penalties for Corporate Average Fuel Economy (CAFE) standards, which means automakers no longer have to comply with mileage mandates. That means Tesla’s windfall for selling emission credits is now over in the U.S, which may explain why Elon Musk seems so mad at President Trump. In addition, Stellantis may still have to pay the European Union (EU) a $2.95 billion fine for its emission violations, so it is in the company’s best interest to divert as much of its vehicle production to America, to avoid the EU’s oppressive rules.

Speaking of the EU, that 27-nation union is facing up to 30% tariffs on August 1st if their negotiations with the U.S. do not start going well. Commerce Secretary Howard Lutnick on CBS’s Face the Nation, said, “I am confident we’ll get a deal done.” Lutnick added, “these key countries will figure out it is better to open their markets to the United States of America than to pay a significant tariff.”

In addition, Treasury Secretary Scott Bessent said the EU “got out of the blocks in a slow pace” on trade talks before becoming more engaged. He said that given the “gigantic” trade deficit the U.S. has with the EU, and their level of tariffs, “I would imagine that they would want to negotiate faster.” If they do, the Trump Administration’s threat of reciprocal tariffs (above 10%) should result in freer trade in the end.

Last Tuesday, President Trump announced trade deals with the Philippines, Indonesia and Japan, with Indonesia and the Philippines now subject to a 19% U.S. tariff. The U.S. products heading to Indonesia generally will not face tariffs. According to a joint statement, Indonesia will drop its tariff rate to zero for 99% of its trade with the U.S. On Truth Social, President Trump said the Philippines will lift all tariffs on imported U.S. goods and added, “It was a beautiful visit, and we concluded our Trade Deal, whereby The Philippines is going OPEN MARKET with the United States, and ZERO Tariffs.”

President Trump also announced that he had made the “largest deal ever” with Japan, including reciprocal tariffs of 15% on the country’s exports to the U.S. On Truth Social, President Trump also said that Japan will invest $550 billion into the U.S., adding that the U.S. will “receive 90% of the Profits.” Japan’s public broadcaster NHK reported that auto tariffs will be lowered to 15% from the current 25%. That’s a big concession, since auto exports to the U.S. accounted for 28.3% of all 2024 Japan’s exports to the U.S.

In conclusion, it is now clear that President Trump is sticking to his August 1st tariff deadline and that he is in a “let’s make a deal” mode. The EU is expected to be difficult, since the EU represents 27 nations, all with their own trade barriers, so they face 30% tariffs on August 1st, if they cannot make a deal. I suspect that Germany will tell the EU what to do and possibly pledge to invest more in the U.S. like Japan did, in exchange for a lower tariff. France remains defiant and remains a bottleneck in the tariff negotiations. Italy has a great relationship with President Trump, thanks to Prime Minister Giorgia Meloni, so I also suspect that Italy may get a special deal, so the EU negotiations will be fascinating in the upcoming days!

I should add that after VW Group announced that the Trump tariffs have cost them $1.5 billion, VW is offering to move its Audi production to the U.S. in exchange for concessions on tariffs. VW Group Chief Executive, Oliver Blume, on Friday said that a deal with the Trump administration could follow an EU agreement, centered on factory and other investments that the automaker could make in the U.S.

Blume said, “What we can offer is clear to the U.S. government. It’s a scalable package, which in the end of course will depend on what we get in return.” VW has already invested $2 billion in a new Scout Motors plant in South Carolina. VW also has a manufacturing plant in Chattanooga and is committed to invest $5 billion in U.S.-based Rivian. This “on-shoring” is real and should help boost GDP growth!

Navellier & Associates; own Alphabet Inc. Class A & C (GOOG), in a few managed accounts. A few accounts own Tesla (TSLA), per client request only in managed accounts. We do not own Volkswagen (VWAGY), Stellantis (STLA) or Rivian (RIVN), in managed accounts. Louis Navellier and his family own Alphabet Inc. Class A & C (GOOG), via a Navellier managed account. He does not personally own Tesla (TSLA), Volkswagen (VWAGY), Stellantis (STLA) or Rivian (RIVN).

The post 7-29-25: Beware Any “Seasonal Shenanigans” in August appeared first on Navellier.