by Bryan Perry

July 15, 2025

This past weekend was chock full of tough tariff news coming from the Trump Administration, with an August 1 implementation deadline looming that might prove to be a hard stop for the President after a series of pauses and extensions. Trump declared a 30% tariff on the European Union and Mexico effective August 1, and this current narrative has the look and feel that, this time around, Trump is not bluffing.

The market has proven incredibly resilient, buying into the notion that Trump will always delay and soften his threatened levies on imports, but being labeled a TACO (Trump Always Chickens Out) must rub his ego the wrong way, in a big way, so it is my view he will not allow this acronym to live much longer.

Trump is using this August 1 deadline to maximize leverage, signaling that countries must either strike deals or accept the consequences. This hardline stance is part of his “America First” trade strategy, and August 1 is now positioned as a turning point for his “No More Mr. Nice Guy” politics. If this is in fact the case, what does that mean for the market now, as the second-quarter reporting season begins?

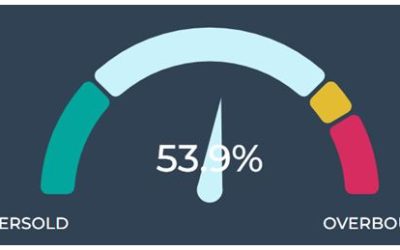

There are significant discussions among Wall Streeters about whether the S&P 500 is overbought and/or overvalued. Some indicators would suggest it is. The CAPE (Cyclically Adjusted Price-to-Earnings) ratio is at 37.8, a 52% premium to its long-term average of 24.8, indicating a high historical valuation.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

While the stock market has demonstrated strong performance lately, with the S&P and NASDAQ reaching new all-time highs, the CBOE Volatility Index (VIX) closed at 16.40 on Friday, testing the 2025 low, reflecting a high level of complacency, implying the market has largely adjusted to tariff uncertainties.

However, the recent “Mother of all V-shaped Rebounds” shows little sign of giving back much, so one has to wonder how much good news regarding projected earnings, future rate cuts by the Fed, the broader economic outlook (benefitting from the passage of the Big Beautiful Bill), and geopolitics is “priced in.”

Here are a few other technical indicators reflecting a possibly overbought market:

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

The months of August and September are also historically (and recently) tough months for stock market performance, and 2025 is setting up for more risks of an overdue consolidation or modest correction. Friday’s price action showed both stocks and bonds selling off, the catalyst being a revival of trade wars.

The yield on the 30-year Treasury is touching up against 5%, a level not seen since last May, stoked by fears of tariff-related inflation and the soaring federal deficit. Treasuries used to be the go-to safe haven, but this past week, Gold and, to some degree, Bitcoin, were the pre-eminent global safe-haven assets.

I noted recently that fewer than 50% of the stocks in the S&P are trending upward, suggesting hidden fragility beneath the surface. Fund managers were severely under-allocated in stocks in May but have amped up their exposure to U.S. equities significantly since then. Add a high level of institutional and retail “FOMO” coupled with sizeable shorts being squeezed and the recipe for new highs was in place.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

Similar to 2020 and 2019, the index gets taken back up to all-time highs because of all that forced buying. But, while the index itself has powered through, the average stock in the S&P 500 has not performed well.

V-shaped recoveries can also be violent. The AI trade is powerful because of the robust level of capex investment and how the leading companies that dominate the top holdings for the S&P have propelled the market to new highs. There is little reason to question rising capital spending by the dominant companies.

Based on recent reports and surveys, it appears most CIOs in S&P 500 companies expect to raise spending on tech investments in the coming year (2026), with a strong emphasis on Artificial Intelligence (AI) and cybersecurity. A Piper Sandler CIO survey (July 2025) indicates that IT spending is on solid footing, with growth estimates of 3.4% in 2025 and 4.8% in 2026. This survey found 85% of CIOs expect IT budgets to keep rising, “pointing to budget durability and potentially a slight acceleration.”

Morgan Stanley’s 3Q’24 CIO Survey projected a +3.6% year-over-year increase in IT budgets for 2025, accelerating from +3.4% in 2024. S&P Global forecasts global IT spending to grow 9% in 2025, up from 8% in 2024, supported by continued AI infrastructure build-out and improvements in non-AI hardware.

To sum up, the latest market rally was fueled by a generational spending boom on AI that shows no signs of letting up. This alone will keep investors buying the dips until the rug is pulled out of the Treasury market, the dollar, or evidence of significant lower consumer spending emerges due to tariff pressures.

For the next two weeks, the market will shift its focus to what should be a strong earnings season, a series of high-profile trade deals and a change in Fed policy that points to a more dovish path forward – all of these positive for market bulls. But if the charts don’t lie, the chances are rising that when August 1 rolls around, an overbought market will simply look to “seasonality” and a vacuum of fresh catalysts to book some profits, digest gains and endure a garden variety pullback of around 5% to 7% over the course of a few weeks – but that would provide us with an excellent level to initiate and add to positions.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

The post 7-15-25: Trump’s Tariff Bluffs Could Cause an August Slump appeared first on Navellier.