by Gary Alexander

April 15, 2025

It’s Tax Day today. I just sent a sizable check to my Aunt Iris and Uncle Sam, and I suppose many of you did, too. It seems like an appropriate (and sobering) day to shake you up with this reality: Some in the White House are misleading you, promising to abolish the income tax in the near future, to be replaced by a gushing torrent of tariff cash, since (they say) tariffs once supplied the majority of our federal income.

They ignore some very obvious reasons why such monetary alchemy is impossible in today’s economy.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

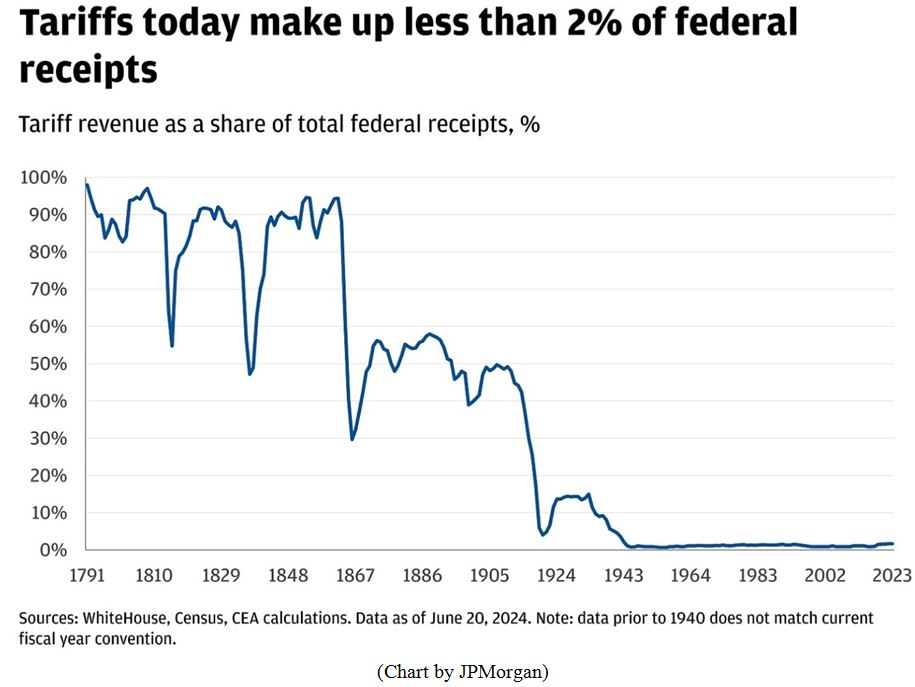

As this chart shows, tariffs dominated our federal income long ago, between 1790 and 1860. There are a few big dips in that period, for the War of 1812, Jackon’s land sales in the 1830s to “balance the budget,” and a Civil War income tax. In order to fund that huge war effort, the U.S. government imposed its first income tax on August 5, 1861, amounting to 3% on income over $600 and 5% on income over $10,000.

After the Civil War, tariffs supplied about half of federal income from 1870 to 1913, when income taxes took over, but tariffs almost disappeared as any meaningful source of income since World War II, and for at least three good reasons: (1) The 1947 General Agreement on Tariffs and Trade (GATT) lowered global tariff rates significantly, creating a postwar surge in global growth, and (2) the U.S. government budget soared to such lofty peaks that tariffs could not fund 10% of our needs, and (3) no nation in its right mind would pay 20% to 50% in tariffs on the “Liberation Day” chart. They would go on strike first.

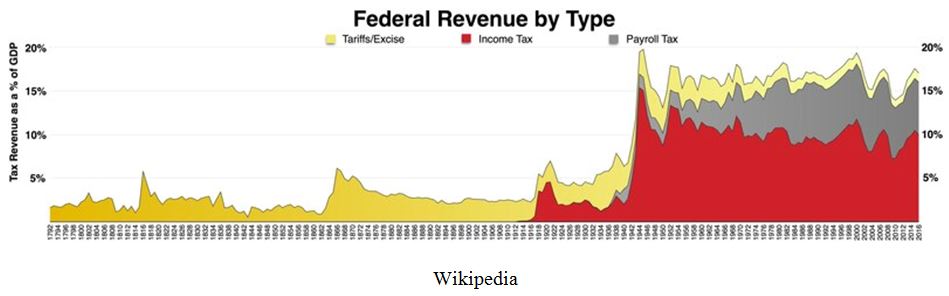

In 1913, the Federal Reserve and the Income Tax were born, 125 years after the Constitution was passed. For those first 125 years, our government was funded through excise taxes, tariffs, customs and public land sales. After 1913, income taxes took over, and spending skyrocketed, first through high World War I costs, and then in both war and welfare – guns and butter – in a rising crescendo of spending:

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

Our relatively tiny level of federal spending in 1912 – the year before the birth of income taxes and the Federal Reserve – was barely $3 billion ($3,026 million). Even adjusting for inflation (via the CPI), rising 31-fold since then, that would be $95 billion in today’s dollars. That’s just 1.36% of this year’s $7 trillion federal budget. America’s population was 95 million in 1912, so the federal government spent $1,000 per person in today’s dollars. With today’s U.S. population nearing 350 million, the federal government spends $20,000 per person – or 20 times as much, adjusted for inflation – for each one of its citizens.

This is why tariffs cannot possibly replace income tax. There is no way to raise 20 times as much money per capita as in 1912 from tariffs, especially since nations have other choices for exporting their products. They can sell products to nations that charge far less than 20% during a pointless trade war. This is the main reason why President Trump pulled back sharply from his Liberation Day threats, favoring a 90-day pause, giving each nation time to negotiate lower tariffs, which – if calmer minds prevail – will be zero.

When there are zero or near-zero tariffs, we raise far less money, hence tariffs can’t replace income taxes.

Raising prices (tariffs) doesn’t mean customers will pay those prices. That’s Economics 101. As I said last week, trading is between corporations in one country and people or corporations overseas. The tax burden should be no more than we charge customers in Louisiana buying produce grown in Texas.

Now, let’s celebrate our nation’s birth 250 years ago, resulting from another sort of economic revolution.

Happy 250th Birthday, America

“Listen my children, and you shall hear, of the midnight ride of Paul Revere.

On the 18th of April in Seventy-five, hardly a man is now alive,

Who remembers that famous day and year….

One if by land, and two if by sea; And I on the opposite shore will be,

Ready to ride and spread the alarm, Through every Middlesex village and farm.

For the country-fold to be up and to arm.”

…The fate of a nation was riding that night.”

— Henry Wadsworth Longfellow (1807-1882), writing in 1860

This coming weekend marks the 250th anniversary of the “shot heard ‘round the world” that launched the American Revolution in Lexington and Concord, Massachusetts, on the morning of April 19, 1775.

First, let us wish a happy birthday to Thomas Jefferson, born April 13, 1743, the author of our official birth certificate, the Declaration of Independence. April 13 is also the birthday of our first President – not George Washington, but John Hanson, first president (1781-82) of the American Confederation, formed under the Articles of Confederation. Oddly enough, April 13th was also the natal day of our main nemesis back then, Frederick Lord North, born April 13, 1732, Britain’s Prime Minister from 1770 to 1782.

Lord North was a chronic control freak. First, to salvage the East India Tea Company, he raised taxes on tea and was met with colonists in Indian garb throwing that tea into Boston harbor on December 16, 1773. Then came his Coercive Acts and Intolerable Acts (our titles). His last Act before war broke out, was a Conciliatory Act (his title), passed on February 20, 1775, reaching the colonies on April 13 (!), which forbade trade with any nation other than England, an edict backed up by a shipment of more British troops.

On April 18, 1775, British General Thomas Gage issued an order to march against the Patriot arsenal at Concord – and to capture John Adams and John Hancock, known to be hiding at Lexington. Forgive the NFL analogy, but two rookie defensive backs for the Boston Patriots, Paul Revere and William Dawes, went long and intercepted that pass on horseback. Before the British Anti-Terrorism Force (BATF) could confiscate the Patriot arsenal at Concord, the heady horsemen roused the Patriot Minutemen. At the end of that historic day, British losses totaled 73 killed and 200 wounded vs. 49 dead and 46 wounded for the colonists. Paul Revere’s horse was also commandeered by the British, so Paul had to walk (or jog?) home in perhaps the first “Boston Marathon,” which is still staged, 250 years later, on or near Patriot’s Day.

When it comes to “taxation without representation,” the colonists didn’t have much of a beef. In 1775, there were no income taxes, corporate taxes or payroll taxes. New Englanders paid something between 1% and 2% of their income in taxes, funded primarily by tariffs and excise taxes. I’d settle for that today, but it was really those Coercive and Intolerable Acts, plus Gun Control, that got under the patriots’ skin.

The post 4-15-25: Happy Tax Day and 250th Birthday, America appeared first on Navellier.