by Bryan Perry

April 15, 2025

The tit-for-tat tariff war between President Trump and China hit a deep nerve in the Treasury market last week as trade war tensions were peaking, thereby sparking fears of inflation and economic instability following reports of overseas investors offloading U.S. Treasuries due to ongoing concerns about the economy and a sharp sell-off in the U.S. dollar that hit its lowest level against the Swiss franc in a decade.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

The greenback has shed 10% in the last three months, with nearly 5% of the loss coming in the past two weeks. In the currency world, this is a dramatic decline. The $28.6-trillion of the U.S. Treasury market is the lifeblood of the global financial system, and the dollar is the world’s reserve currency. Seeing the yield on the benchmark 10-year Treasury spike from 3.97% on last Monday’s opening to 4.49% at Friday’s close is just as dramatic, and not in a good way. The 30-year T-bond approached 5% before closing at 4.87%.

There were reports of forced selling from large institutional investors that had to unwind their leveraged positions, especially on the longer-dated maturities. The situation became so severe that President Trump paused the steepest tariffs for 90-days, hoping to stabilize markets. He used the term “yippy” to describe investor reactions, even as stock investors and nervous bond investors added more volatility to markets.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

To call the fire sale selling in Treasuries a “yippy” moment is disingenuous and dangerous. There was a real risk in triggering systemic selling pressure. To add further angst to the President’s casual reaction, Treasury Secretary Scott Bessent publicly claimed that the 90-day pause on tariffs was part of Trump’s negotiation strategy from the beginning. Critics argued that the sudden reversal seemed more like damage control after market turmoil and public backlash as bond spreads gapped wider – not a “yippy” reaction.

Bond spreads – the cost to borrow – widened significantly, marking the biggest one-week increase since the 2023 regional banking crisis. This volatility was largely driven by uncertainty in the corporate bond market that led to rising borrowing costs on top of Chinese and other Asian funds offloading Treasuries in high volume. The takeaway is that Trump and Bessent have lost some credibility in bond trading pits.

Both the bond and stock markets have become trigger-happy in this highly fluid and unpredictable environment. It would only take a new headline, or headlines, of aggression from Trump, or a major trading partner fighting back hard, to cause the bond market and the dollar to resume losing value. Even though bond prices have paused in their downward spiral, fund flows remain largely negative. After the recent panic sales, bond investors remain very unsure about all that has transpired in the Treasury market.

The Federal Reserve is closely monitoring the bond market turmoil of last week, as concerns about liquidity and financial stability can lead to large, rapid shifts in prices that can suddenly clog up market plumbing and inhibit its functioning, requiring the Fed to step in to provide liquidity. Although the Fed did not officially intervene this time, officials signaled they were “absolutely ready” to step in if needed.

Wall Street banks and investors have reported a decline in liquidity – the ease with which traders can buy or sell assets without affecting prices – as volatility in the Treasury market has intensified. During the 2020 coronavirus crisis, for instance, the central bank stepped in amid severe market dysfunction, when key funding markets froze due to concerns over the pandemic’s impact on the global economy. The same fears of a major slowing in global growth from tariffs has now emerged, and – who knows? Maybe the Fed did conduct some open market purchases in recent days, interventions they have not yet reported.

It also stands to reason that the passage of President Trump’s “Big Beautiful Bill” by the House on April 10 contributed to bond market anxiety. The bill is a budget framework that paves the way for tax cuts, military spending, border security investments and energy policy. The vote was delayed due to some Republican holdouts who refused to advance trillions of dollars in tax breaks without deeper spending cuts.

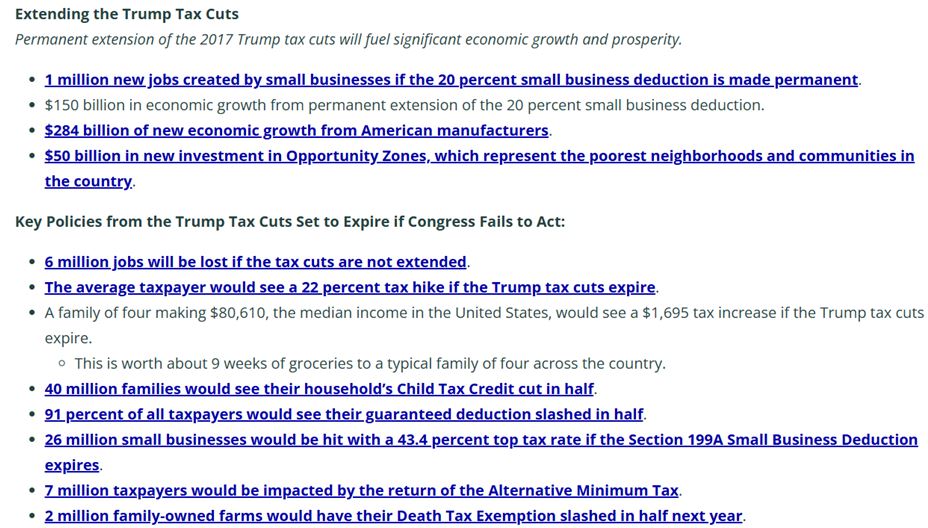

During debate on the bill, House Ways and Means Committee Chairman Jason Smith put out his list of pros and cons if the bill was passed, or not passed.

Source: House Ways and Means Committee

A final bill could raise the nation’s debt ceiling by as much as $5-trillion while extending President Trump’s 2017 tax-cuts and adding hundreds of billions of dollars in defense and border security spending. Then, the hard work begins: Where the spending cuts and revenues will come from to pay for this massive increase. America voted for a balanced budget and a reduction of the federal debt that now stands at $36.7-trillion.

So far, halfway into fiscal year 2025 (which began October 1st), the federal government has run up over $1.3-trillion in deficits in the first half of fiscal 2025, a 23% increase over the first half of fiscal 2024. We have paid out $396-billion in interest payments, compared to $350-billion at the same point in fiscal year 2024, due to higher borrowing and higher interest rates. There’s nothing “yippy” about these reactions, either.

I believe President Trump is banking on economic prosperity to pay for these rising costs and to reduce the federal deficit. This is a tall order, and history is not on his side. When the government brings in more revenue, historically Congress tends to increase spending. Changing this behavior may be an even taller order.

A big reason the Red Wave happened last November was because voters were told that fiscal discipline will shape the new administration and the new Congress. Citizens vote every two years for a new Congress, but the bond, currency, and equity markets vote every day, and these votes have not been positive – not at all.

It is vital that Trump & Company restore confidence in the markets. Sleeping with one eye open is not how investors want to function. For the vast majority of investors, volatility is incredibly stressful and mentally exhausting to manage. Some real progress on trade and government spending must be accomplished, near term, to stem the outgoing tide of bond and stock assets flowing into money markets, and that time is now.

The post 4-15-25: A Bond Market Sell-Off is Anything But a “Yippy” Reaction appeared first on Navellier.