by Ivan Martchev

April 8, 2025

When I noted last week that the quickest way for President Trump to push the stock market lower, on par with what Jerome Powell did in December 2018, is by over-tariffing, I didn’t think that he was going to actually do it. The difference is stark, though. For Jerome Powell, it took some time to figure out he was over-tightening, and some people had to talk sense into him. All in all, the Powell decline in the final quarter of 2018 took about three months to turn around. In this case, the decline is similar in magnitude but is coming a lot faster. In the case of Jerome Powell, he made a mistake by raising rates. In the case of Donald Trump, I don’t know yet if he has made a mistake by raising so many tariffs. I hope he hasn’t, as the execution of the tariff policy comes with the support of some of the smartest people on Wall Street as part of his cabinet, namely Commerce Secretary Howard Lutnick and Treasury Secretary Scott Bessent.

I do not believe that the President’s objective was to intentionally crash the stock market, but to force his trade deals, for which he believes this gambit of over-tariffing puts him in a better position to get faster results. I sure hope he is right, as the unintended consequences can be gargantuan.

The stock market is trading as if this is the onset of COVID all over again, as in March 2020. The onset of COVID was not intentional. In this case, the issuance of high tariffs is 100% intentional, as Trump intends to begin rebalancing the economy which has had bad policy decisions made by former leaders over 40 years. Since it is not humanly possible to rebalance it in a month or two, it stands to reason that President Trump wants to put trade deals in place to rebalance it over time and then the tariffs will start coming off.

When Powell backed off, the stock market completely recovered in three months or so. When President Trump gets a few trade wins and starts removing tariffs, I think we will see the same. In theory, the recovery could be quicker, but that cannot be ascertained ahead of time, as it depends on the timing of the tariff removals and trade wins, which have not happened yet. The results of his highly unorthodox policy are expected now, by billions of people all over the world – as that is how many it is impacting.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

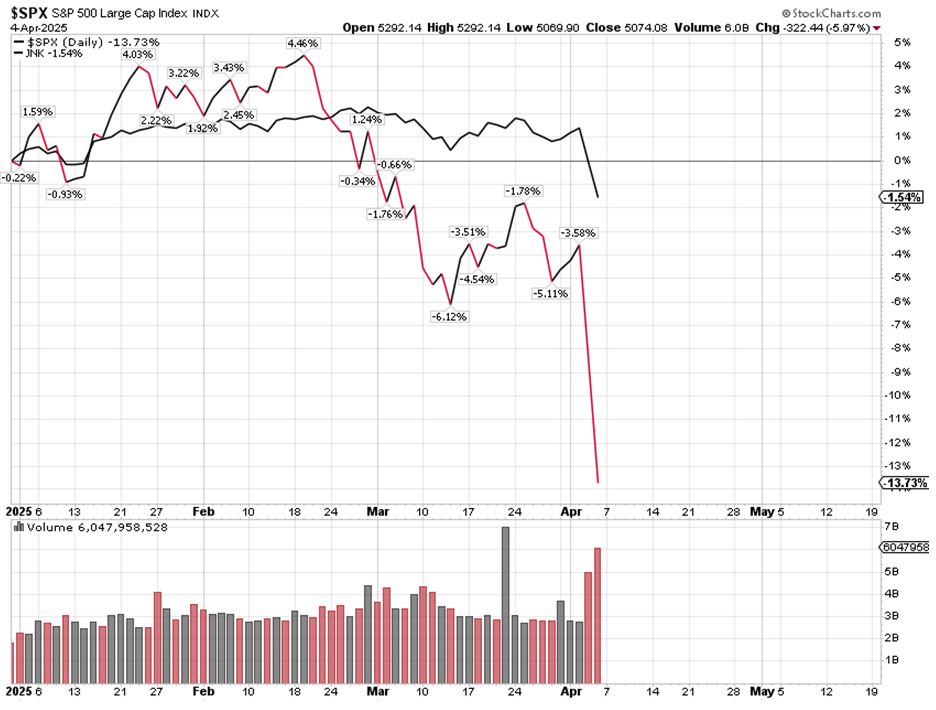

During this tariff game of “chicken,” which the president is sure he can win, the real economy has not suffered yet. Junk bonds – which tend to deteriorate before the stock market tops out, if the economy is headed into a recession – are down just 1.54% based on the total return of one of the most liquid ETFs that holds such securities, whereas the S&P 500 is down 13.73% as of last Friday.

When there is an economic problem, typically the junk bond market tops out before the stock market, and when the economy begins to improve, it is the same in reverse: The junk bond market begins to improve before the stock market, sometimes six months or more in advance, so all I can say is that this is a man-made crisis with the goal to avert a bigger crisis down the road, which hasn’t hit the economy yet.

I don’t know when the President thinks we will reach peak uncertainty, but I sure hope it was last week.

The post 4-8-25: A High-Stakes Game of Tariff Chicken appeared first on Navellier.