by Bryan Perry

March 18, 2025

A heavy rotation out of growth stocks over the past few weeks has weighed heavily on the major averages that are now in correction territory. Some of the fears surrounding a more cautious consumer were confirmed a week ago Monday by downside guidance for Q1 by a major airline company, noting that its outlook has been impacted by the recent reduction in consumer and corporate confidence being caused by increased uncertainty driving softness in domestic demand, plus premium and international air travel.

The market seems to be buying more and more into the recession risk narrative. At this point, there is no recession risk in the hard data, but there is in the soft data, meaning subjective measures based on surveys, sentiment indicators, and expectations. Examples include consumer confidence surveys, business outlook surveys, and the Purchasing Managers Index (PMI). These data points have been sliding lower, signaling slower economic activity, which can change on a dime based on market changing headlines.

The hard economic data has been holding up well. Last week’s inflation data, though backward looking, was tame, as both the CPI and PPI numbers come in at or below Wall Street expectations. Prior to these reports, the ISM Manufacturing Index, ISM Services, Factory Orders, Initial Jobless Claims and Non-Farm Payrolls came in at or better than forecast. But again, these are backward-looking numbers.

The University of Michigan Consumer Sentiment Survey came in at 59.9 versus a consensus of 65.6, but critics of this survey claim the numbers are politically polluted. There is conflicting data. The NFIB Small Business Optimism index for February came in at 100.7, above its 51-year average of 98, but down from its recent peak of 105.1 in December, following the November election and red wave win in Washington.

However, Bill Dunkelberg, NFIB’s chief economist, said in a release, that, “Uncertainty is high and rising on Main Street, and for many reasons,” citing the fact that the number of respondents in the NFIB survey who believe that it is a good time to expand saw its biggest monthly decline since April 2020.

The White House has frequently pointed to this NFIB survey as an indication of economic strength: The November survey following Trump’s election showed small business optimism rose by the most in any month in history. But, since then, optimism has steadily declined. Tariffs and the potential re-emergence of inflation are confounding a large portion of small businesses, according to the NFIB’s latest survey.

Small businesses are a significant source of hiring, employing 45% of the workforce. They also account for 99.9% of all firms, so a shift toward more cautious hiring could put a damper on wage inflation.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

The annual rate of wage growth has come down from 6.7% in mid-2022, when the inflation rate peaked at 9.1%, to 4.3% now, meaning wage growth is well above annual household inflation running at 2.8% (total CPI) or 3.1% (core CPI). This is a constructive development, but tariffs loom large if they are activated and undo some of the progress made in this important metric to the health of the domestic economy.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

The dramatic shift in sentiment has been swift, with the price/earnings multiple compression for stocks occurring in most market sectors, save for consumer staples, utilities, and some healthcare stocks.

When volatility is spiking, investors care about the here and now. Any talk of lower tax rates and de-regulation in some uncertain future will not provide the catalysts for the market to rebound significantly.

The market rallied on Friday as a Continuing Resolution was passed on that day by a 54-46 vote in the Senate. This allows the government to operate through September, when Congress will have to contend with another CR all over again. An even better piece of news happened after the market closed on Friday – reports of a highly constructive meeting between U.S. and Canadian trade officials. It did not produce any immediate results, but it laid the groundwork for some more substantive negotiations this week.

This week also features a Federal Open Market Committee (FOMC) meeting, in which the bond futures market is all but certain that the Fed will keep the Fed funds rate unchanged. Like most investors, they too are waiting to see what impact tariffs will have on inflation, the labor market and future economic growth.

After this FOMC meeting ends, it is likely that Fed Chair Jerome Powell will voice a Fed policy statement that is decidedly dovish, confirming to markets that further rate cuts are forthcoming.

Against this highly fluid backdrop of uncertain but improving odds of lower interest rates and bond yields, investors can find defensive dividend stocks of U.S. and foreign blue-chip companies that are paying upwards of 5% yields in industries that have all-weather profiles. In addition to consumer staples and utilities, telecommunications, life and casualty insurance, energy pipelines, healthcare REITs, and some ETFs offer excellent choices to complement portfolios where growth stocks are consolidating.

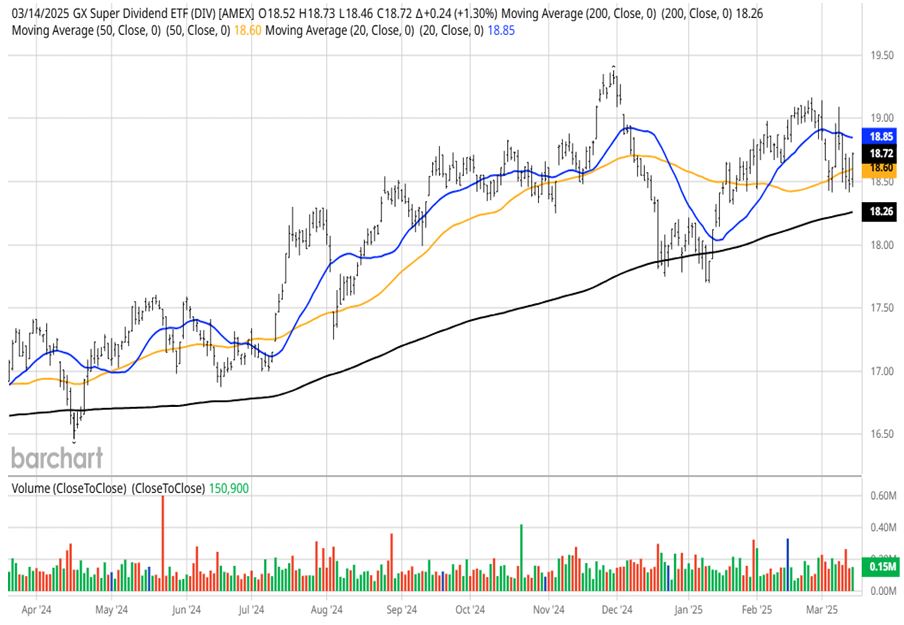

Shares of Global X SuperDividend U.S. ETF (DIV) is one place to cast a net over many of the premier U.S. high-yield dividend stocks. Paying a 5.5% current dividend yield and receiving a monthly distribution with a constructive chart, this is one place to consider staying long the market in an environment where defensive stocks are being rewarded.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

Until there are some genuine breakthrough events on negotiated trade pacts – and the prospect of more Fed rate cuts based on inflation not rearing back up – the market will very likely remain in a state of flux.

Fund flows into defensive dividend stocks could continue for the intermediate term. While growth stocks are clearly where the greatest amount of wealth is created over the long term, having some balance of dividend paying stocks in one’s portfolio during these chaotic times is prudent.

The post 3-18-25: Rotation Into Defensive Dividend Stocks Warranted appeared first on Navellier.