by Ivan Martchev

March 11, 2025

I don’t believe that the recent three weeks of selling in the S&P 500, after an all-time high in February, is due to interest rates, economic statistics or even the trade war. At least those are not the major drivers of the sell-off. I don’t see the economic numbers causing the weakness we have seen in the S&P 500. The bond market has calmed down and the trade war is coming along, arguably with Mr. Trump being less predictable than one would think, which is probably intentional on his part.

I think the recent weakness is a major institutional trade out of U.S. stocks into European stocks and some emerging market equities, which had previously lagged U.S. stocks for a long time.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

Sure, Mr. Trump’s negotiating style is adding fuel to the fire, but I would think that the Europeans and many other countries have at least as much to lose, if not more, in a trade war as they have taken advantage of the U.S. for decades. When President Trump says, “I like free trade, but I want fair trade,” he has a very valid point when putting tariff barriers on the same scale, as hard as it may be to deliver his reciprocal tariff demands. Keep in mind that those imbalances took 30 years to create, so I doubt they can be turned around in one or two years, but he sure does want to put them on a different trajectory, ASAP.

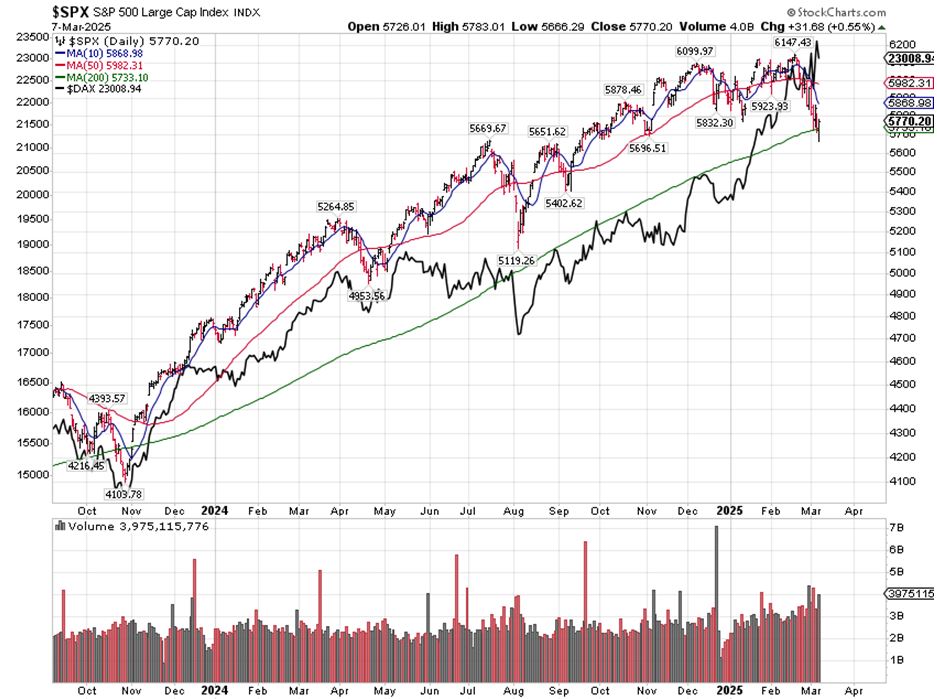

My case for an institutional switch to Europe is that the German DAX index has gone vertical, advancing as much as 16% in 2025 before backing off a little. Germany was a lot more correlated with the U.S. last year, but with a new election just completed, and Germany about to deliver a more competent government, a massive economic stimulus plan in the works and possible peace in Ukraine, the German stock market is on fire. It feels that the selling of the U.S. is very mechanical, regardless of the daily economic releases. This U.S. money is going towards global markets, like the DAX.

Note (from the DAX, in the sharp line, above) that in sharp corrections like we had in August 2024 or in October 2023, the DAX was under pressure, but not this time. The recent sell-off in U.S. stocks cannot be seen even in a high beta market like the Hong Kong Hang Seng Index, which is also benefiting from the Chinese government loosening its grip on their technology sector. When the U.S. market, which is almost 68% of global market cap (as measured by the MSCI indexes), was at an all-time high at the end of 2024, it is no wonder that institutional investors are looking for catalysts to put money elsewhere, like the DAX.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

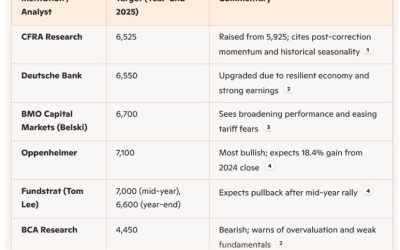

I don’t believe that this massive under-performance of the U.S. market at the start of 2025 will continue ad infinitum. It needs a catalyst to reverse. What that might be probably depends on the President’s tweets, and events that have not happened yet, which by definition cannot be accurately foreseen.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

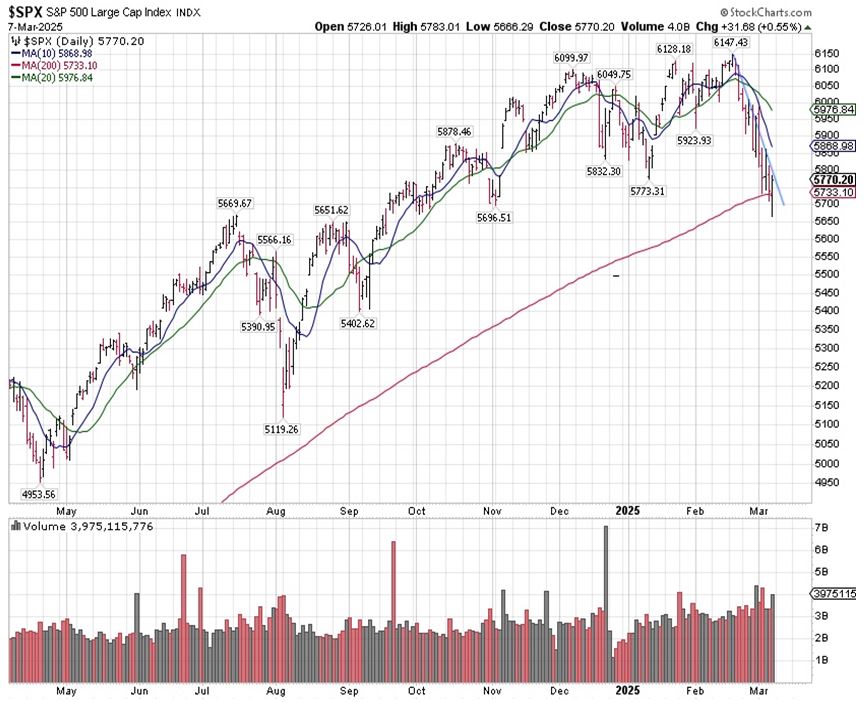

If one were to zoom in on this S&P 500 chart, one would see that this decline is very meticulous and very different from what we experienced in August 2024. It is keeping a near-perfect downtrend over three weeks, with lower lows on most days. Only computerized sell programs can be that precise.

Typically, when an index spends 16 months above a rising 200-day moving average and finally tags it, as we did last week for the S&P 500, it tends to be a strong area of support. The number itself is not a support level but the area around that number (say 1% to 2% around it) tends to provide support. When the Nasdaq 100 tagged its 200-day moving average in August last year (the S&P 500 went close but didn’t, as shown in the chart above) and then went straight up, close to the all-time high, that is an abnormal way to rebound and make a bottom. A more normal way would be to rebound, come down again, perhaps taking out the initial low, like we did in October and November of 2023, and then rebound.

I don’t know which of these bottoming patterns we will see in March, but the odds are better than even that it will be one of them. All we need is President Trump to make major progress on Ukraine, or in the trade war, or both…and a tweet.

The post 3-11-25: U.S. Stocks Are Ripe for a Rebound appeared first on Navellier.