by Gary Alexander

March 11, 2025

In August 1997, I first began working with Louis Navellier, launching one of his successful growth stock newsletters. At the time, I was also in the midst of a political campaign, running for a seat on the Virginia State House of Delegates as an independent challenger against a 10-time Democratic Party incumbent and a Republican challenger. Why did I do that? In the previous year, I served on the Finance Committee for Libertarian Presidential candidate Harry Browne, and he was a lot like me – a bookish introvert, music lover (opera in his case), but his wife got tired of him complaining about corrupt politicians, so she said, “Why don’t YOU run for office?!” He did, and then he posed the same question to me in 1996!

At the time, I was working with a more extroverted career Republican, the “bleeding heart conservative” Jack Kemp. I was editing his newsletter promoting free market principles for Eagle Publishing, but we had to end that letter when Jack ran for President in 1996, eventually settling for the VP slot to Bob Dole.

So, I went through the hazing ritual of getting hundreds of voter signatures in supermarket parking lots to qualify to get on the ballot. I debated the other two candidates on local TV stations and in high school forums. I loved sharing my Constitutional ideas with Virginia newspapers, where many of our greatest ideas were born 250 years ago, in the Washington Post, and in door-to-door visits with neighbors.

There’s no way I can claim President Clinton and Congress saw my ideas and drafted the most amazing tax bill of my lifetime on August 5, 1997, but that one Act clearly set the stage for the only four balanced budgets of the last 55 years – all four years of Clinton’s second term – something we need to do again.

A year earlier, in his State of the Union speech of January 23, 1996, Clinton did not recite the politician’s normal laundry list of more goodies if re-elected. No, he began by saying, “The era of big government is over.” Wow! A Democrat incumbent clearly listened to voters in the Republican Revolution of 1994, where Newt Gingrich and his “Contract with America” won back the House for the first time in 40 years.President Clinton went on to say, in his January 1996 SOTU speech, “For too long our welfare system has undermined the values of family and work, instead of supporting them. The Congress and I are near agreement on sweeping welfare reform…. I challenge people on welfare to make the most of this opportunity for independence,” and so Clinton and Congress passed welfare reform later that same year.

Clinton went on to say, in January 1996, “Here, in this place, our responsibility begins with balancing the budget in a way that is fair to all Americans. There is now broad bipartisan agreement that permanent deficit spending must come to an end. I compliment the Republican leadership and the membership for the energy and determination you have brought to this task of balancing the budget.” Praising the other side! I wonder when we’ll ever hear something like that again – and he won re-election with such heresy.

That brings us to the 1997 Balance the Budget Act and Tax Reform Act passed on August 7, 1997, which reflected this bipartisan love, as voting for the 1997 Tax Reform Act was 90% positive, across party lines:

- House votes for 1997 Tax Reform: 389-43 (90%): Republicans, 225-1; Democrats, 164-41 (80%).

- Senate votes for 1997 Tax Reform: 92-8 (92%): Republicans, 55-0, Democrats, 37-8 (82%).

In summary, the Taxpayer Act of 1997:

* Reduced capital gains tax rates from 28% and 15% to 20% to 10%, sparking a stock market boom.

* Exempted most housing sales from capital gains, exempting the first $500,000 (per couple) in real estate profits from capital gains taxes in homes lived in for two of the last five years.

* Established the ROTH IRA, a retirement account in which earnings are exempt from future taxation.

* Created a $400 tax credit for each child under 17 in 1998, increased to $500 in 1999.

* Increased the $600,000 estate tax exemption to $1 million by 2006, and:

* Family farms and small businesses could qualify for a $1.3 million exemption, effective 1998.

Far from being “tax cuts for the rich,” Investopedia says, “Most of the tax breaks in the 1997 act went to middle- and low-income taxpayers,” citing housing breaks, child tax credits and education savings accounts. As a result of these measures, budget surpluses began right away, starting October 1, 1997:

Source: Congressional Budget Office (budget surplus); White House Office of Management and Budget (Debt/GDP)

These were our ONLY budget surpluses since fiscal year 1969 – and 1969 was only a $0.3 billion surplus.

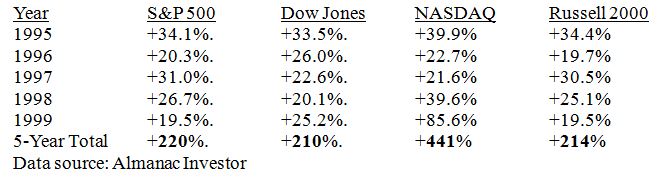

This package of benefits also supercharged an already-surging U.S. stock market, the best in our lifetime:

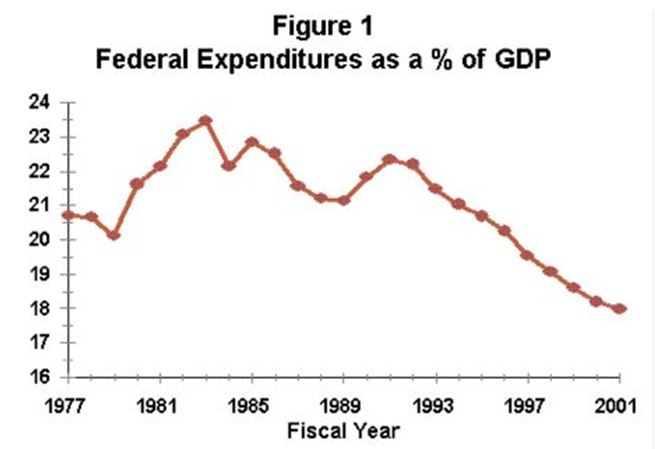

The co-incident Balanced Budget Act of 1997 fueled reduced spending to match rising tax revenues:

* Large personnel cuts (about 377,000 total job positions cut during Clinton’s eight years in office)

* The end of welfare by requiring welfare recipients to quickly find work.

* Changing benefits so as not to discourage two-parent families.

These and other cost cutting programs resulted in a decline in total federal outlays (spending) from over 20% of GDP in 1995 to a low of 17.6% of GDP in 2000, the lowest federal spending rate since 1966.

Federal spending fell from 23% of GDP (1983) to 18% in 2000 (Center on Budget and Policy Priorities, 2001)

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

In addition, in his final year, Clinton and Congress eliminated the earnings test for Social Security, allowing retirees to work without facing tax penalties. Combined with the 1997 Tax Act, all these acts removed tax burdens off the backs of most Americans, encouraging more work, and more taxes paid.

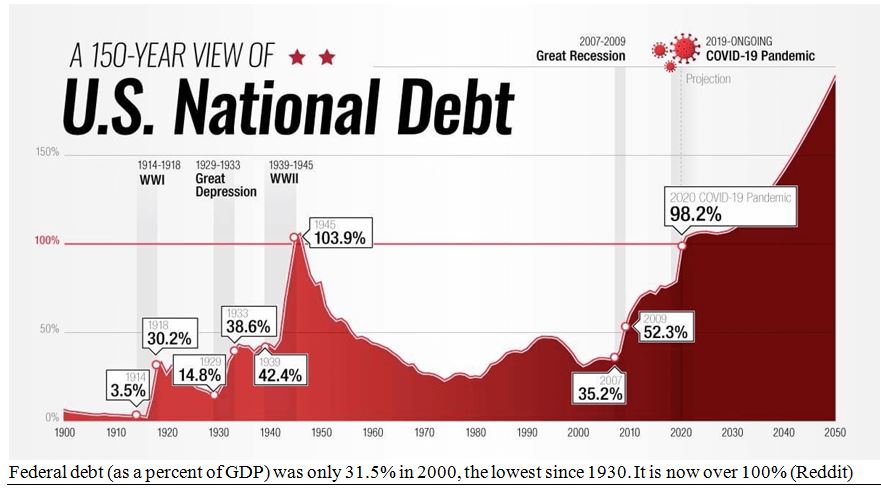

What happened next? In simplistic terms, 9/11 happened, and then President George W. Bush and his all-Republican Congress (until the 2006 election) overspent on two prolonged wars, plus added social programs, ballooning the federal budget deficits all over again. Then Obama doubled those deficits, with our first trillion-dollar deficits – one in each year in his first term. We have since run up over $30 trillion in added deficits in the last 24 fiscal years, under 12 Congresses and four Presidents (two in each party).

Our accumulated federal debt was $5.6 trillion in 2001. It is now $36.5 trillion, for a gain of $31 trillion.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

In the 1990s, President Clinton listened to angry 1994 voters and changed his course. Why don’t today’s Democrats in Congress listen to 2024 voters? If they had better ideas, why didn’t the Biden-Harris team introduce some of those better ideas over the last four years? Why can’t Democrats and Republicans cooperate across party lines, like President Clinton did with the cost-cutting Republicans, led by Majority Leader Dick Armey, an economics professor from Texas, and Newt Gingrich, a historian from Georgia?

In the last 40+ years at the New Orleans Investment Conference, I’ve interviewed these gentlemen and many others in the front tiers of our country’s financial history. Perhaps the most important and telling moment came when I interviewed George W. Bush’s mentor, Karl Rove, around 2010 and cited the fact that Republicans controlled the White House and both Houses of Congress for six years, 2001 to 2006, giving us cost-cutters great hope, yet his Republican monopoly added many new social programs (like “No Child Left Behind” and more Medicare benefits) and started two expensive wars, so I paused for a moment and said, “Karl, you broke our hearts.” I remained silent for about 10 seconds, as did Mr. Rove.

He had no answer, until his political blather machine kicked back in, and he began to justify all those acts.

And that’s where we stand in 2025 – both political parties are still justifying more spending, resisting most spending cuts – like injured swamp creatures biting back – so it’s time to recall the summer of 1997, when Parties talked to each other, creating big budget surpluses – and the biggest bull market of our lives.

The post 3-11-25: The Magic Formula for Creating Budget Surpluses (Let’s Do It Again!) appeared first on Navellier.